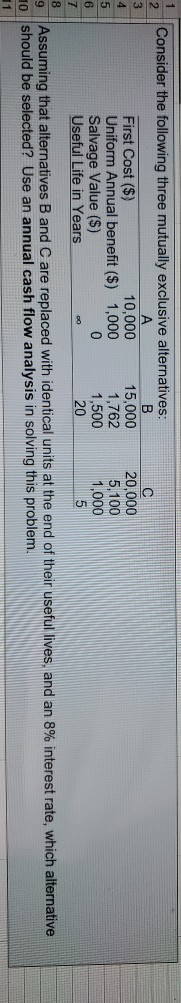

Question: 1 Consider the following three mutually exclusive alternatives: 3 B c 4 First Cost ($) 10,000 15,000 20,000 5 Uniform Annual benefit ($) 1,000 1,762

1 Consider the following three mutually exclusive alternatives: 3 B c 4 First Cost ($) 10,000 15,000 20,000 5 Uniform Annual benefit ($) 1,000 1,762 5.100 6 Salvage Value ($) 0 1,500 1,000 7 Useful Life in Years 20 5 8 Assuming that alternatives B and C are replaced with identical units at the end of their useful lives, and an 8% interest rate, which alternative 10 should be selected? Use an annual cash flow analysis in solving this problem. 9

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock