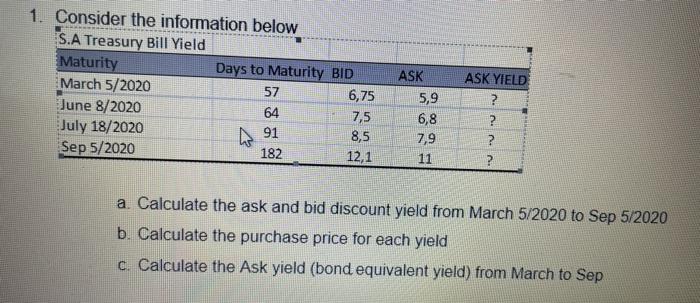

Question: 1. Consider the information below S.A Treasury Bill Yield Maturity Days to Maturity BID March 5/2020 57 6,75 June 8/2020 64 7,5 July 18/2020 Sep

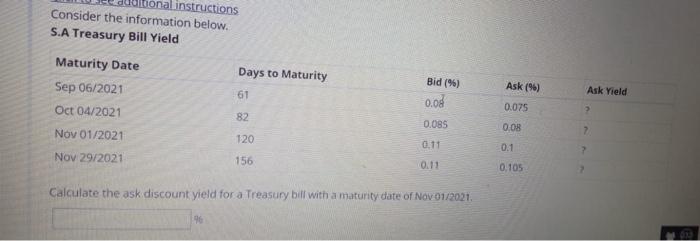

1. Consider the information below S.A Treasury Bill Yield Maturity Days to Maturity BID March 5/2020 57 6,75 June 8/2020 64 7,5 July 18/2020 Sep 5/2020 182 12,1 ASK 5,9 6,8 7,9 11 ASK YIELD ? ? ? ? W 91 8,5 a. Calculate the ask and bid discount yield from March 5/2020 to Sep 5/2020 b. Calculate the purchase price for each yield c. Calculate the Ask yield (bond equivalent yield) from March to Sep onal instructions Consider the information below. S.A Treasury Bill Yield Maturity Date Sep 06/2021 Oct 04/2021 Days to Maturity 61 Bid (9) Ask (96) Ask Yield 0.08 0.075 2 82 0.08S 0.08 Nov 01/2021 2 120 0.11 0.1 7 Nov 29/2021 156 0.11 0.105 Calculate the ask discount yield for a Treasury bill with a maturity date of Nov 01/2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts