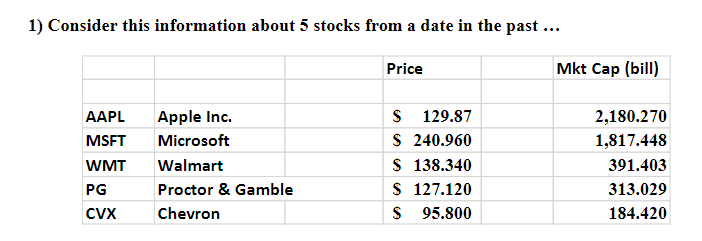

Question: 1) Consider this information about 5 stocks from a date in the past ... Price Mkt Cap (bill) AAPL MSFT WMT PG CVX Apple Inc.

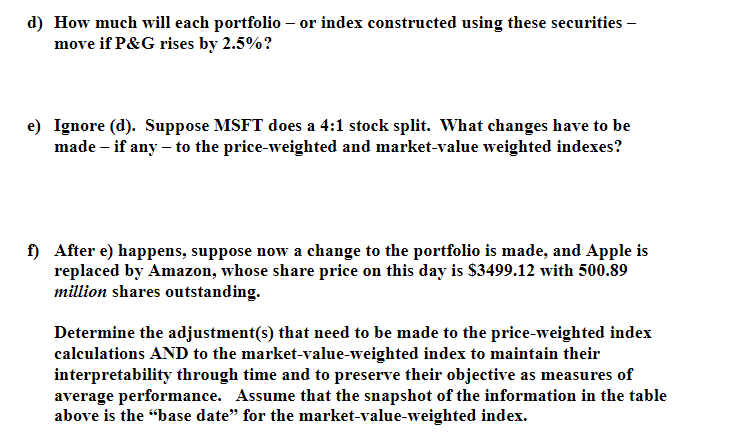

1) Consider this information about 5 stocks from a date in the past ... Price Mkt Cap (bill) AAPL MSFT WMT PG CVX Apple Inc. Microsoft Walmart Proctor & Gamble Chevron S 129.87 S 240.960 S 138.340 S 127.120 S 95.800 2,180.270 1,817.448 391.403 313.029 184.420 d) How much will each portfolio - or index constructed using these securities - move if P&G rises by 2.5%? e) Ignore (d). Suppose MSFT does a 4:1 stock split. What changes have to be made - if any to the price-weighted and market value weighted indexes? f) After e) happens, suppose now a change to the portfolio is made, and Apple is replaced by Amazon, whose share price on this day is $3499.12 with 500.89 million shares outstanding. Determine the adjustment(s) that need to be made to the price-weighted index calculations AND to the market value-weighted index to maintain their interpretability through time and to preserve their objective as measures of average performance. Assume that the snapshot of the information in the table above is the "base date for the market-value-weighted index. 1) Consider this information about 5 stocks from a date in the past ... Price Mkt Cap (bill) AAPL MSFT WMT PG CVX Apple Inc. Microsoft Walmart Proctor & Gamble Chevron S 129.87 S 240.960 S 138.340 S 127.120 S 95.800 2,180.270 1,817.448 391.403 313.029 184.420 d) How much will each portfolio - or index constructed using these securities - move if P&G rises by 2.5%? e) Ignore (d). Suppose MSFT does a 4:1 stock split. What changes have to be made - if any to the price-weighted and market value weighted indexes? f) After e) happens, suppose now a change to the portfolio is made, and Apple is replaced by Amazon, whose share price on this day is $3499.12 with 500.89 million shares outstanding. Determine the adjustment(s) that need to be made to the price-weighted index calculations AND to the market value-weighted index to maintain their interpretability through time and to preserve their objective as measures of average performance. Assume that the snapshot of the information in the table above is the "base date for the market-value-weighted index

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts