Question: 1. Consider three preferred stocks, call them A, B and C, issued by the same corporation. Each preferred stock is expected to pay $1.5 dividends

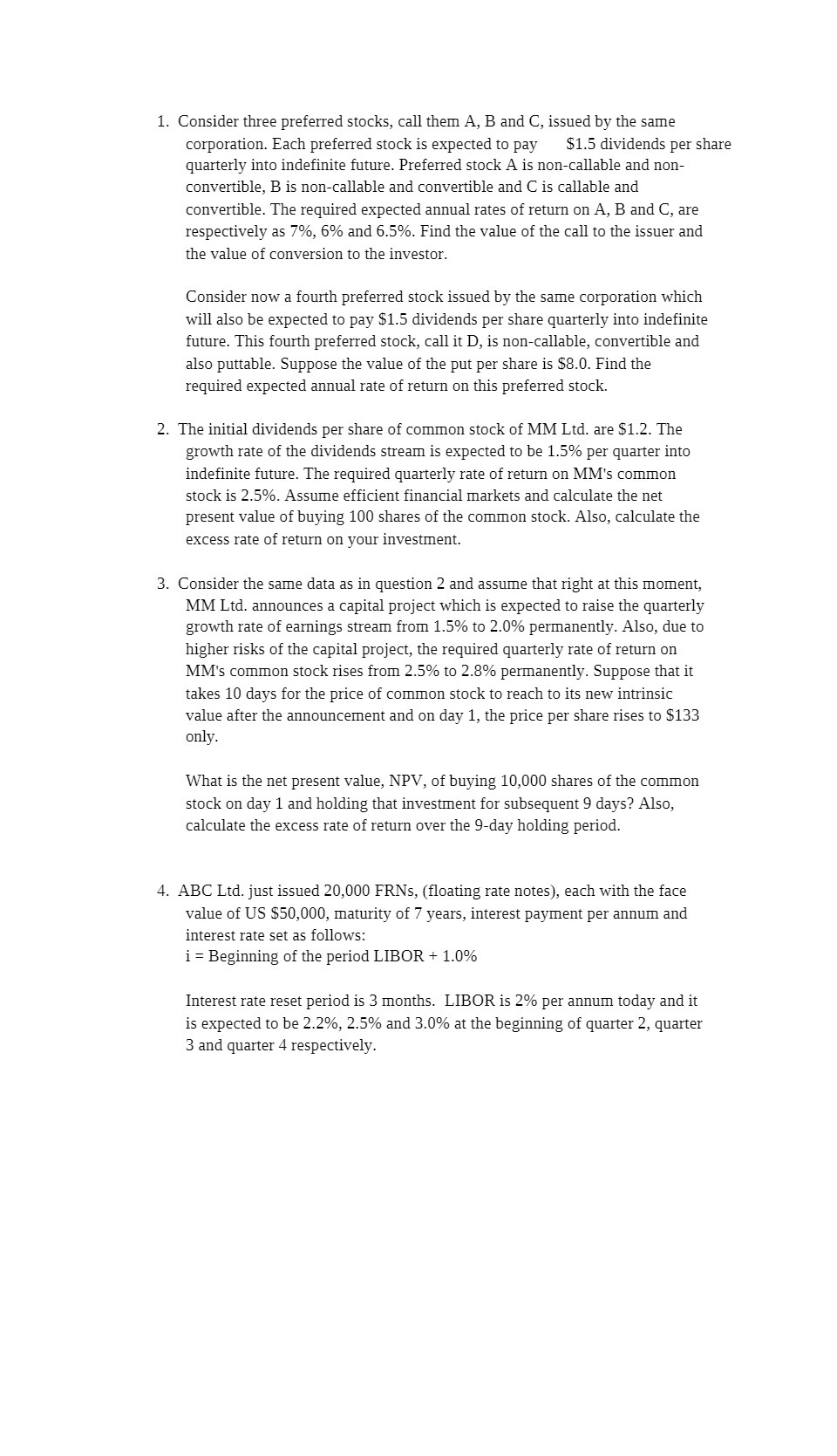

1. Consider three preferred stocks, call them A, B and C, issued by the same corporation. Each preferred stock is expected to pay $1.5 dividends per share quarterly into indefinite future. Preferred stock A is noncallable and non convertible, B is nonecallable and convertible and C is callable and convertible. The required expected annual rates of return on A, B and C, are respectively as 7%, 6% and l6.5%. Find the value of the call to the issuer and the value of conversion to the investor. Consider now a fourth preferred stock issued by the same corporation which will also be expected to pay $1.5 dividends per share quarterly into indefinite future. This fourth preferred stock, call it D, is noncallable, convertible and also puttable. Suppose the value of the put per share is $8.0. Find the required expected annual rate of return on this preferred stock. 2. The initial dividends per share of common stock of MM Ltd. are $1.2. The growth rate of the dividends stream is expected to be 1.5% per quarter into indefinite future. The required quarterly rate of return on MM's common stock is 2.5%. Assume efficient financial markets and calculate the net present value of buying 100 shares of the common stock. Also, calculate the excess rate of return on your investment. 3. Consider the same data as in question 2 and assume that right at this moment, MM Ltd. announces a capital project which is expected to raise the quarterly growth rate of earnings stream from 1.5% to 2.0% permanently. Also, due to higher risks of the capital project, the required quarterly rate of return on MM's common stock rises from 2.5% to 2.8% permanently. Suppose that it takes 10 days for the price of common stock to reach to its new intrinsic value after the announcement and on day 1, the price per share rises to $133 only. What is the net present value, NPV, of buying 10,000 shares of the common stock on day 1 and holding that investment for subsequent 9 days? Also, calculate the excess rate of return over the 9day holding period. 4. ABC Ltd. just issued 20,000 FRNs, (oating rate notes), each with the face value of US $50,000, maturity of 7 years, interest payment per annum and interest rate set as follows: i : Beginning of the period LlBOR + 1.0% Interest rate reset period is 3 months. LlBOR is 2% per annum today and it is expected to be 2.2%, 2.5% and 3.0% at the beginning of quarter 2, quarter 3 and quarter 4 respecively

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts