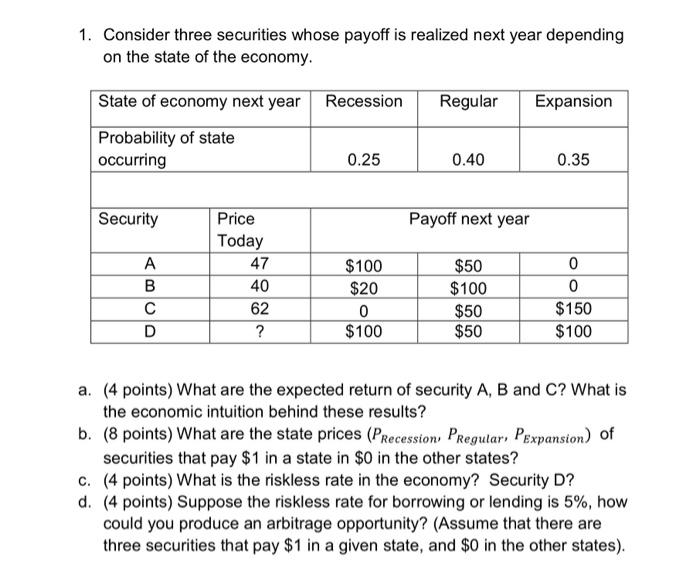

Question: 1. Consider three securities whose payoff is realized next year depending on the state of the economy. State of economy next year Recession Regular Expansion

1. Consider three securities whose payoff is realized next year depending on the state of the economy. State of economy next year Recession Regular Expansion Probability of state occurring 0.25 0.40 0.35 Security Payoff next year A B D Price Today 47 40 62 ? $100 $20 0 $100 $50 $100 $50 $50 0 0 $150 $100 a. (4 points) What are the expected return of security A, B and C? What is the economic intuition behind these results? b. (8 points) What are the state prices (Precession, Pregular, Pexpansion of securities that pay $1 in a state in $0 in the other states? C. (4 points) What is the riskless rate in the economy? Security D? d. (4 points) Suppose the riskless rate for borrowing or lending is 5%, how could you produce an arbitrage opportunity? (Assume that there are three securities that pay $1 in a given state, and $0 in the other states)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts