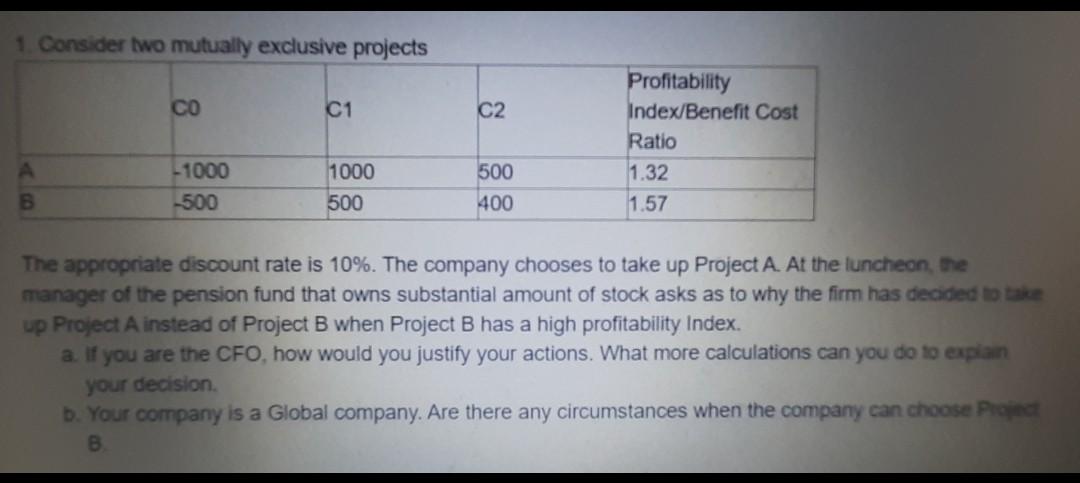

Question: 1. Consider two mutually exclusive projects CO C1 C2 Profitability Index/Benefit Cost Ratio 1.32 1.57 A -1000 500 1000 500 500 400 B The appropriate

1. Consider two mutually exclusive projects CO C1 C2 Profitability Index/Benefit Cost Ratio 1.32 1.57 A -1000 500 1000 500 500 400 B The appropriate discount rate is 10%. The company chooses to take up Project A. At the luncheon, the manager of the pension fund that owns substantial amount of stock asks as to why the firm has decided to take up Project A instead of Project B when Project B has a high profitability Index. a. If you are the CFO, how would you justify your actions. What more calculations can you do to explain your decision. b. Your company is a Global company. Are there any circumstances when the company can choose Pro B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts