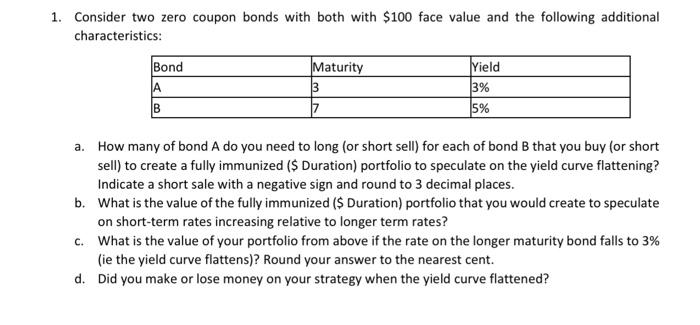

Question: 1. Consider two zero coupon bonds with both with $100 face value and the following additional characteristics: Bond A B Maturity 3 7 Yield 3%

1. Consider two zero coupon bonds with both with $100 face value and the following additional characteristics: Bond A B Maturity 3 7 Yield 3% 5% a. How many of bond A do you need to long (or short sell) for each of bond B that you buy (or short sell) to create a fully immunized ($ Duration) portfolio to speculate on the yield curve flattening? Indicate a short sale with a negative sign and round to 3 decimal places. b. What is the value of the fully immunized ($ Duration) portfolio that you would create to speculate on short-term rates increasing relative to longer term rates? c. What is the value of your portfolio from above if the rate on the longer maturity bond falls to 3% (ie the yield curve flattens)? Round your answer to the nearest cent. d. Did you make or lose money on your strategy when the yield curve flattened? 1. Consider two zero coupon bonds with both with $100 face value and the following additional characteristics: Bond A B Maturity 3 7 Yield 3% 5% a. How many of bond A do you need to long (or short sell) for each of bond B that you buy (or short sell) to create a fully immunized ($ Duration) portfolio to speculate on the yield curve flattening? Indicate a short sale with a negative sign and round to 3 decimal places. b. What is the value of the fully immunized ($ Duration) portfolio that you would create to speculate on short-term rates increasing relative to longer term rates? c. What is the value of your portfolio from above if the rate on the longer maturity bond falls to 3% (ie the yield curve flattens)? Round your answer to the nearest cent. d. Did you make or lose money on your strategy when the yield curve flattened

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts