Question: 1. Consider two zero-coupon bonds, A and B. A has one year to maturity and a price of 955.11 and ( B ) has 2

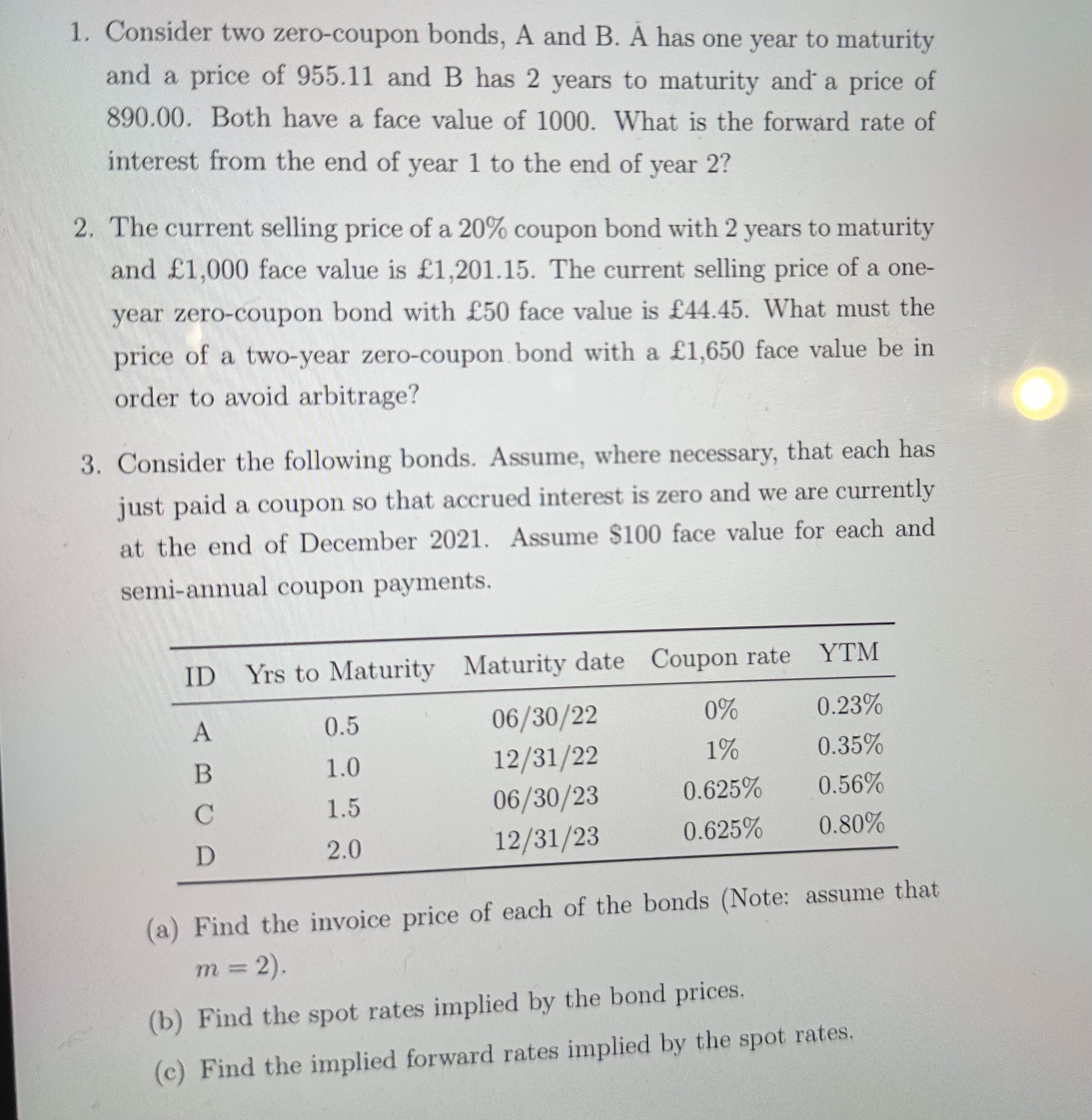

1. Consider two zero-coupon bonds, A and B. A has one year to maturity and a price of 955.11 and \\( B \\) has 2 years to maturity and a price of 890.00. Both have a face value of 1000 . What is the forward rate of interest from the end of year 1 to the end of year 2 ? 2. The current selling price of a \20 coupon bond with 2 years to maturity and \\( 1,000 \\) face value is \\( 1,201.15 \\). The current selling price of a oneyear zero-coupon bond with \\( 50 \\) face value is \\( 44.45 \\). What must the price of a two-year zero-coupon bond with a \\( 1,650 \\) face value be in order to avoid arbitrage? 3. Consider the following bonds. Assume, where necessary, that each has just paid a coupon so that accrued interest is zero and we are currently at the end of December 2021. Assume \\( \\$ 100 \\) face value for each and semi-annual coupon payments. (a) Find the invoice price of each of the bonds (Note: assume ulat \\( m=2 \\) ). (b) Find the spot rates implied by the bond prices. (c) Find the implied forward rates implied by the spot rates

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts