Question: 1) CONSTRUCT A BALANCESHEET AS AT 31st DECEMBER 2022 FOR LIANA2) CONSTRUCT A CASHFLOW STATEMENTS FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2022 FOR LIANA3)

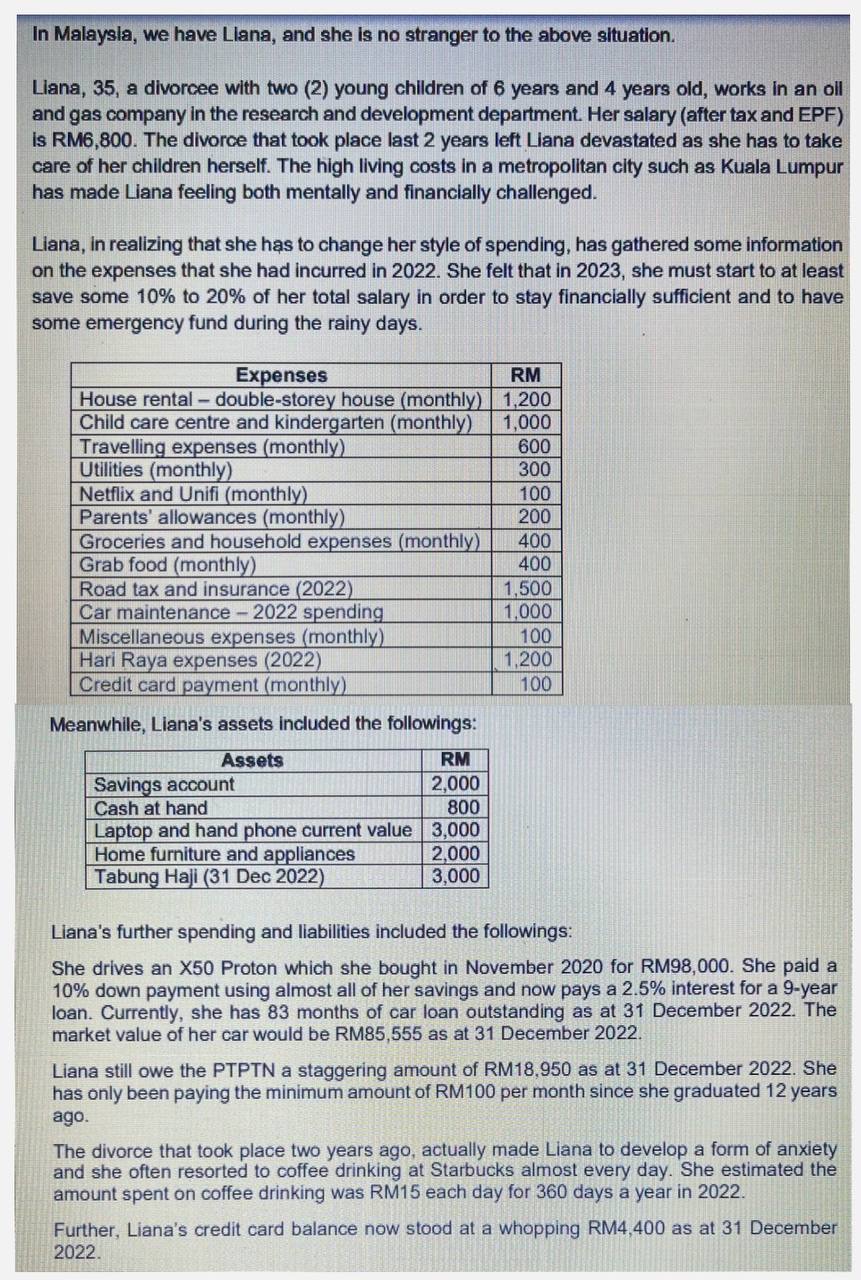

1) CONSTRUCT A BALANCESHEET AS AT 31st DECEMBER 2022 FOR LIANA2) CONSTRUCT A CASHFLOW STATEMENTS FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2022 FOR LIANA3) COMPUTE THEi) LIQUID ASSESTSii)DEBT SERVICE COVERAGE RATIOiii) COMMENT BRIEFLY ON RATIOS CALCULATED4) ANALYSE THE CURRENT FINANCIAL SITUATION OF LIANA. DETERMINE WHETHER LIANA CAN SAVE ATLEAST 10% OF HER SALARY FOR UPCOMING YEAR 2023WITH HER CURRENT SPENDING PATTERN AND IF NOT, ACTIONS THAT LIANA SHOULD TAKE TO MAKE ENDS MEET.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock