Question: Complete Earned Value Management Formulas You are the project manager of the Divell Project for your company. This project is scheduled to last 18

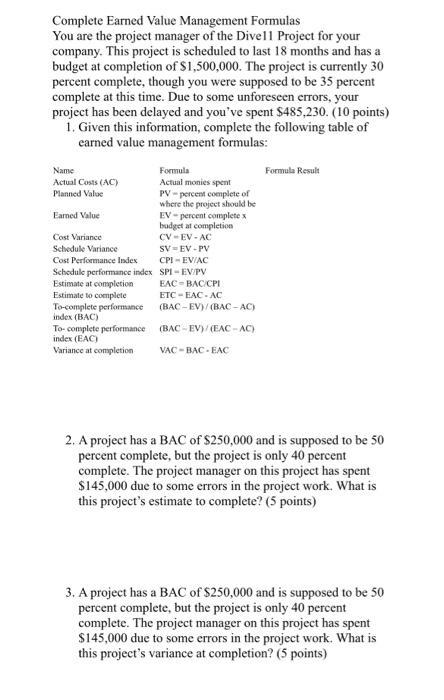

Complete Earned Value Management Formulas You are the project manager of the Divell Project for your company. This project is scheduled to last 18 months and has a budget at completion of $1,500,000. The project is currently 30 percent complete, though you were supposed to be 35 percent complete at this time. Due to some unforeseen errors, your project has been delayed and you've spent $485,230. (10 points) 1. Given this information, complete the following table of earned value management formulas: Name Actual Costs (AC) Planned Value Earned Value Cost Variance Schedule Variance Cost Performance Index Schedule performance index Estimate at completion Estimate to complete To-complete performance index (BAC) To-complete performance index (EAC) Variance at completion Formula Actual monies spent PV-percent complete of where the project should be EV-percent complete x budget at completion CV-EV-AC SV EV-PV CPI-EV/AC SPI-EV/PV EAC BAC/CPI ETC-EAC-AC (BAC-EV)/(BAC-AC) (BAC-EV)/(EAC-AC) VAC-BAC EAC Formula Result 2. A project has a BAC of $250,000 and is supposed to be 50 percent complete, but the project is only 40 percent complete. The project manager on this project has spent $145,000 due to some errors in the project work. What is this project's estimate to complete? (5 points) 3. A project has a BAC of $250,000 and is supposed to be 50 percent complete, but the project is only 40 percent complete. The project manager on this project has spent $145,000 due to some errors in the project work. What is this project's variance at completion? (5 points)

Step by Step Solution

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Answer 1 Actual Costs AC485230 Planned Value450000 Earned Val... View full answer

Get step-by-step solutions from verified subject matter experts