Question: 1. Construct a simple balance sheet for a bank with assets of $400m. There are five items on the balance sheet: government securities, capital, reserves,

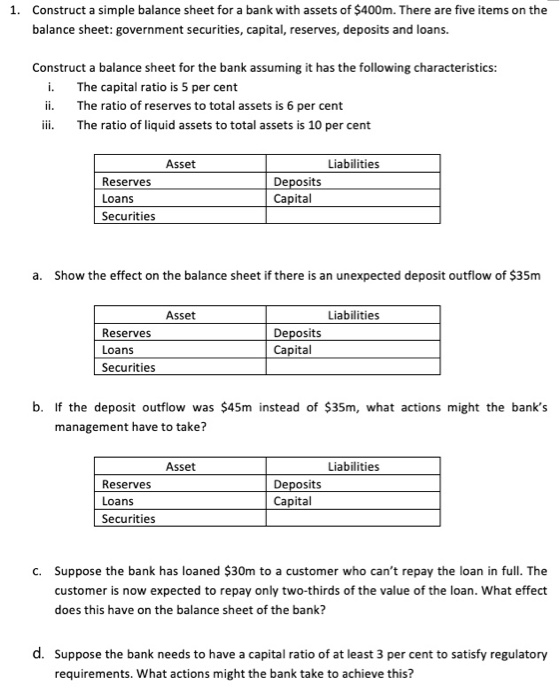

1. Construct a simple balance sheet for a bank with assets of $400m. There are five items on the balance sheet: government securities, capital, reserves, deposits and loans. Construct a balance sheet for the bank assuming it has the following characteristics: i. The capital ratio is 5 per cent ii. The ratio of reserves to total assets is 6 per cent ili. The ratio of liquid assets to total assets is 10 per cent Asset Liabilities Reserves Loans Securities Deposits Capital a. Show the effect on the balance sheet if there is an unexpected deposit outflow of $35m Asset Liabilities Reserves Loans Securities Deposits Capital b. If the deposit outflow was $45m instead of $35m, what actions might the bank's management have to take? Asset Liabilities Reserves Deposits Capital Loans Securities C. Suppose the bank has loaned $30m to a customer who can't repay the loan in full. The customer is now expected to repay only two-thirds of the value of the loan. What effect does this have on the balance sheet of the bank? d. Suppose the bank needs to have a capital ratio of at least 3 per cent to satisfy regulatory requirements. What actions might the bank take to achieve this

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts