Question: 1) Construct a three level (four leaves) binomial tree to price a European call and put option with the following parameters: S = 17, X

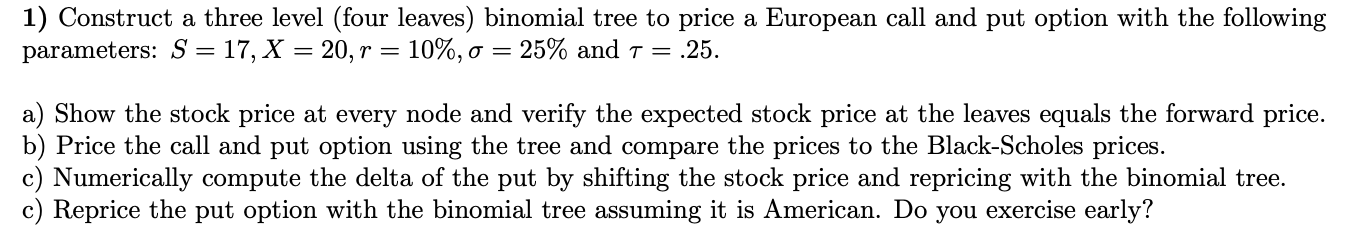

1) Construct a three level (four leaves) binomial tree to price a European call and put option with the following parameters: S = 17, X = 20, r = 10%, o = 25% and T= .25. = a) Show the stock price at every node and verify the expected stock price at the leaves equals the forward price. b) Price the call and put option using the tree and compare the prices to the Black-Scholes prices. c) Numerically compute the delta of the put by shifting the stock price and repricing with the binomial tree. c) Reprice the put option with the binomial tree assuming it is American. Do you exercise early? 1) Construct a three level (four leaves) binomial tree to price a European call and put option with the following parameters: S = 17, X = 20, r = 10%, o = 25% and T= .25. = a) Show the stock price at every node and verify the expected stock price at the leaves equals the forward price. b) Price the call and put option using the tree and compare the prices to the Black-Scholes prices. c) Numerically compute the delta of the put by shifting the stock price and repricing with the binomial tree. c) Reprice the put option with the binomial tree assuming it is American. Do you exercise early

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts