Question: 1. Contribution margin, contribution margin ratio, unit contribution margin. 2. Calculate sales, contribution margin, and unit contribution margin. 3. Variable cost per unit, contribution margin

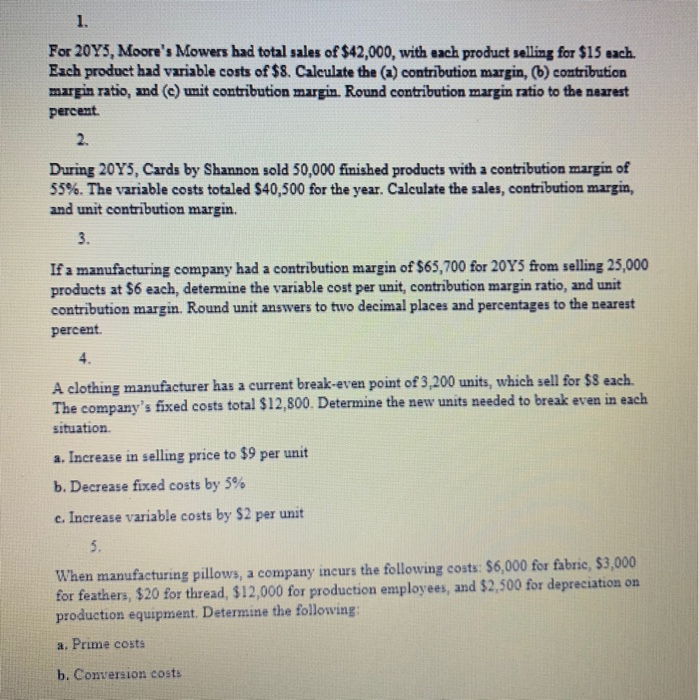

1. For 20YS, Moore's Mowers had total sales of $42,000, with each product selling for $15 each. Each product had variable costs of $8. Caleulate the (a) contribution margin, (b) contribution margin ratio, and (c) unit contribution margin. Round contribution margin ratio to the nearest percent 2. During 20YS, Cards by Shannon sold 50,000 finished products with a contribution margin of 55%. The variable costs totaled $40,500 for the year. Calculate the sales, contribution margin, and unit contribution margin. 3. If a manufacturing company had a contribution margin of $65,700 for 20Y5 from selling 25,000 products at $6 each, determine the variable cost per unit, contribution margin ratio, and unit contribution margin. Round unit answers to two decimal places and percentages to the nearest percent 4. A clothing manufacturer has a current break-even point of 3,200 units, which sell for $8 each. The company's fixed costs total $12,800. Determine the new units needed to break even in each situation. a. Increase in selling price to $9 per unit b. Decrease fixed costs by 5% e. Increase variable costs by $2 per unit 5. hen manufacturing pillows, a company incurs the following costs: $6,000 for fabric, $3,000 for feathers, $20 for thread, $12,000 for production employees, and $2,500 for depreciation on production equipment. Determine the following a. Prime costs b. Conversion costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts