Question: 1. Contribution margin per unit 2. Breakeven point in units Breakeven point in dollars 3. Required level of sales in units 4. Units sales The

1. Contribution margin per unit 2. Breakeven point in units Breakeven point in dollars 3. Required level of sales in units 4. Units sales

1. Contribution margin per unit 2. Breakeven point in units Breakeven point in dollars 3. Required level of sales in units 4. Units sales

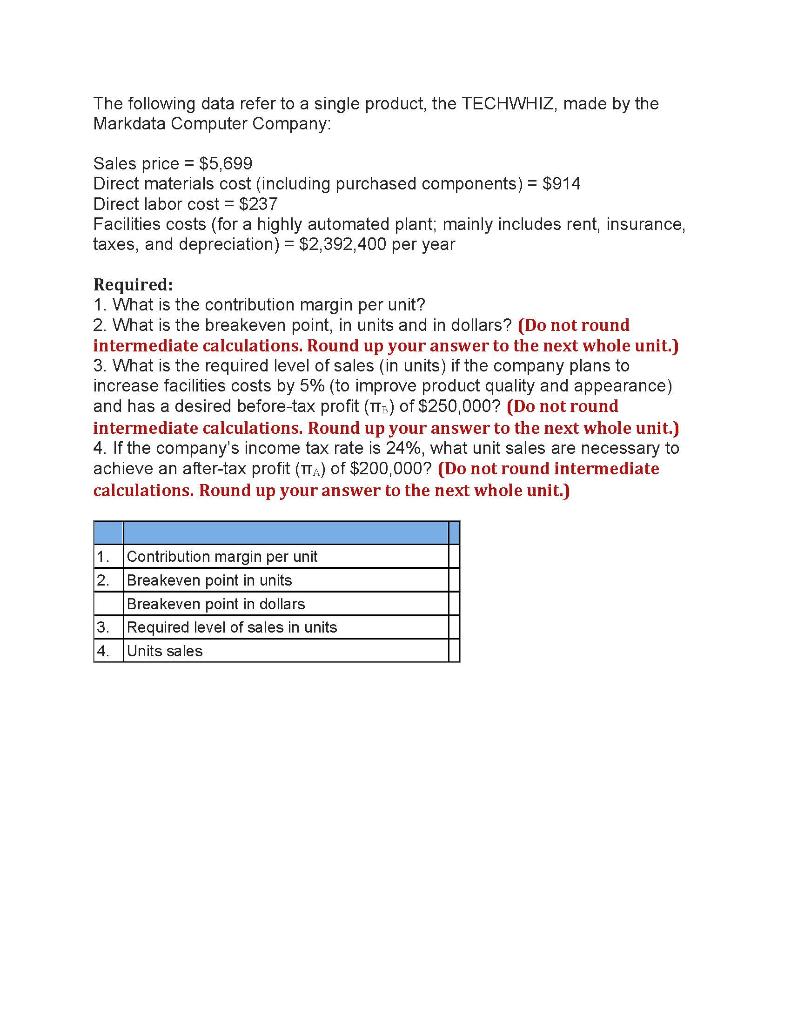

The following data refer to a single product, the TECHWHIZ, made by the Markdata Computer Company: Sales price = $5,699 Direct materials cost (including purchased components) = $914 Direct labor cost = $237 Facilities costs (for a highly automated plant; mainly includes rent, insurance, taxes, and depreciation) = $2,392,400 per year Required: 1. What is the contribution margin per unit? 2. What is the breakeven point, in units and in dollars? (Do not round intermediate calculations. Round up your answer to the next whole unit.) 3. What is the required level of sales (in units) if the company plans to increase facilities costs by 5% (to improve product quality and appearance) and has a desired before-tax profit (TTT) of $250,000? (Do not round intermediate calculations. Round up your answer to the next whole unit.) 4. If the company's income tax rate is 24%, what unit sales are necessary to achieve an after-tax profit (TTA) of $200,000? (Do not round intermediate calculations. Round up your answer to the next whole unit.) 1. Contribution margin per unit 2. Breakeven point in units Breakeven point in dollars 3. Required level of sales in units 4. Units sales

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts