Question: 1. Create a general ledger and post the transactions to the general ledger 2. Create a trial balance as of 1/31 3. Record the necessary

1. Create a general ledger and post the transactions to the general ledger

2. Create a trial balance as of 1/31

3. Record the necessary adjusting journal entries at 1/31

4. Post the adjusting journal entries to the general ledger

5. Create an adjusted trial balance as of 1/31

6. Prepare the income statement, retained earnings statement and balance sheet at and for the month of January

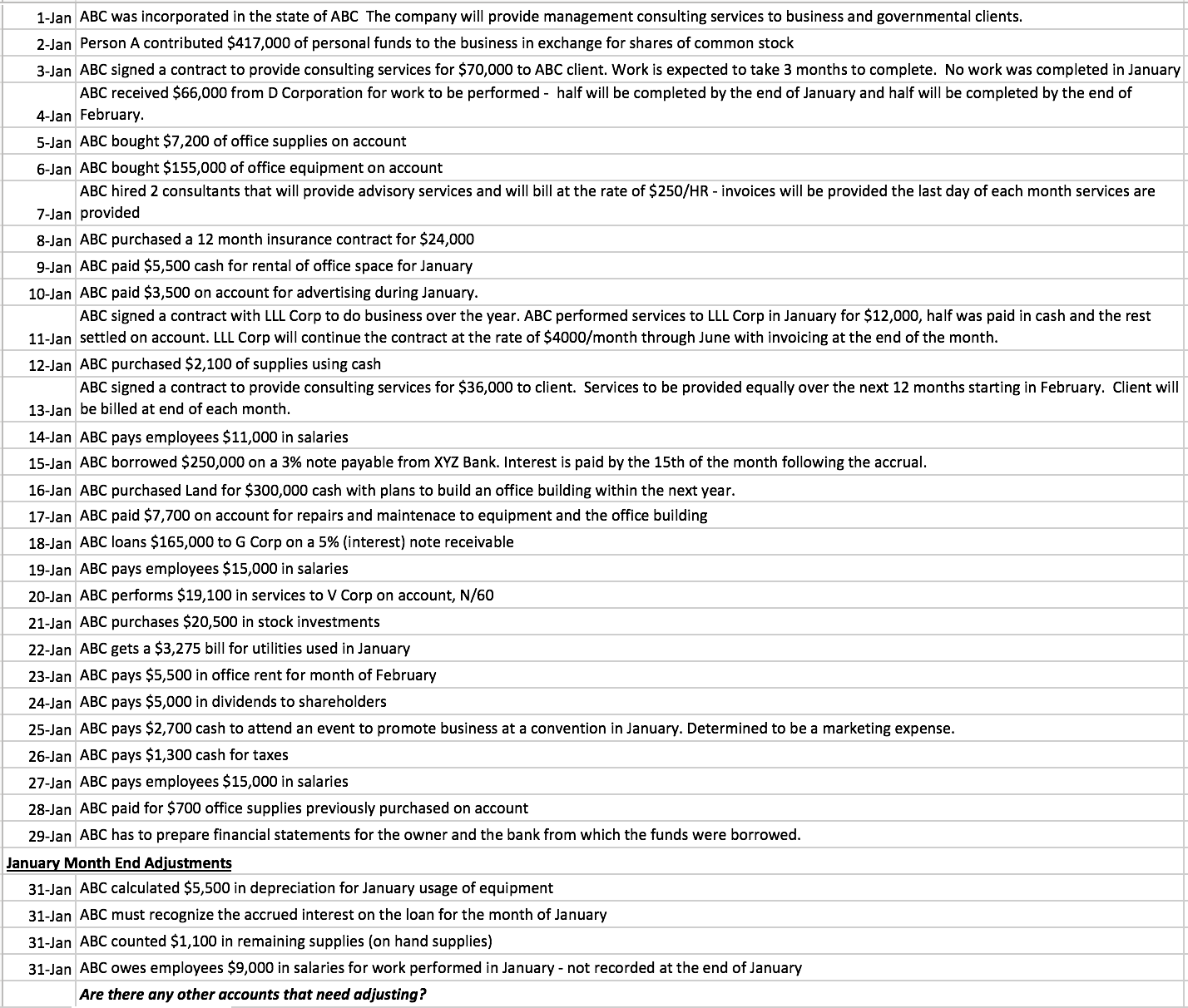

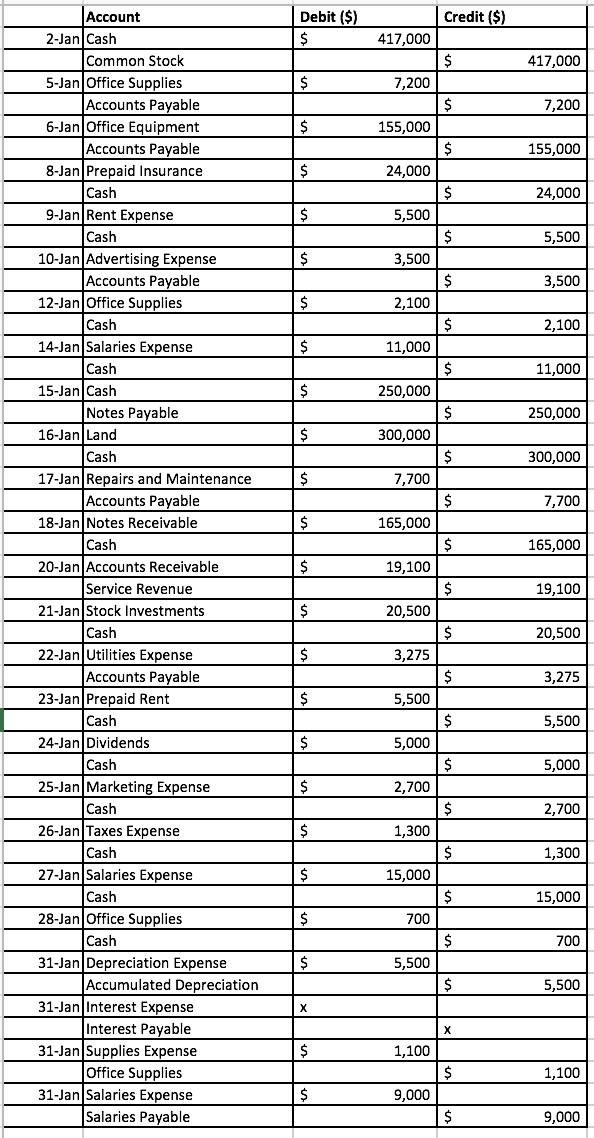

1-Jan ABC was incorporated in the state of ABC The company will provide management consulting services to business and governmental clients. 2-Jan Person A contributed $417,000 of personal funds to the business in exchange for shares of common stock 3-Jan ABC signed a contract to provide consulting services for $70,000 to ABC client. Work is expected to take 3 months to complete. No work was completed in January ABC received $66,000 from D Corporation for work to be performed - half will be completed by the end of January and half will be completed by the end of 4-Jan February. 5-Jan ABC bought $7,200 of office supplies on account 6-Jan ABC bought $155,000 of office equipment on account ABC hired 2 consultants that will provide advisory services and will bill at the rate of $250/HR - invoices will be provided the last day of each month services are 7-Jan provided 8-Jan ABC purchased a 12 month insurance contract for $24,000 9-Jan ABC paid $5,500 cash for rental of office space for January 10 -Jan ABC paid $3,500 on account for advertising during January. ABC signed a contract with LLL Corp to do business over the year. ABC performed services to LLL Corp in January for $12,000, half was paid in cash and the rest 11-Jan settled on account. LLL Corp will continue the contract at the rate of $4000/ month through June with invoicing at the end of the month. 12-Jan ABC purchased $2,100 of supplies using cash ABC signed a contract to provide consulting services for $36,000 to client. Services to be provided equally over the next 12 months starting in February. Client will 13-Jan be billed at end of each month. 14-Jan ABC pays employees $11,000 in salaries 15-Jan ABC borrowed $250,000 on a 3% note payable from XYZ Bank. Interest is paid by the 15 th of the month following the accrual. 16-Jan ABC purchased Land for $300,000 cash with plans to build an office building within the next year. 17-Jan ABC paid $7,700 on account for repairs and maintenace to equipment and the office building 18 -Jan ABC loans $165,000 to G Corp on a 5% (interest) note receivable 19JanABC pays employees $15,000 in salaries 20-Jan ABC performs $19,100 in services to V Corp on account, N/60 21-Jan ABC purchases $20,500 in stock investments 22-Jan ABC gets a $3,275 bill for utilities used in January 23-Jan ABC pays $5,500 in office rent for month of February 24-Jan ABC pays $5,000 in dividends to shareholders 25JanABC pays $2,700 cash to attend an event to promote business at a convention in January. Determined to be a marketing expense. 26Jan 27-Jan ABC pays employees $15,000 in salaries 28-Jan ABC paid for $700 office supplies previously purchased on account 29-Jan ABC has to prepare financial statements for the owner and the bank from which the funds were borrowed. January Month End Adjustments 31-Jan ABC calculated $5,500 in depreciation for January usage of equipment 31-Jan ABC must recognize the accrued interest on the loan for the month of January 31-Jan ABC counted $1,100 in remaining supplies (on hand supplies) 31-Jan ABC owes employees $9,000 in salaries for work performed in January - not recorded at the end of January Are there any other accounts that need adjusting? \begin{tabular}{|c|c|c|c|} \hline & Account & Debit (\$) & Credit (\$) \\ \hline \multirow[t]{2}{*}{ 2-Jan } & Cash & 417,000 & \\ \hline & Common Stock & & 417,000 \\ \hline \multirow[t]{2}{*}{ 5-Jan } & Office Supplies & 7,200 & \\ \hline & Accounts Payable & & 7,200 \\ \hline \multirow[t]{2}{*}{ 6-Jan } & Office Equipment & 155,000 & \\ \hline & Accounts Payable & & 155,000 \\ \hline \multirow[t]{2}{*}{ 8-Jan } & Prepaid Insurance & 24,000 & \\ \hline & Cash & & 24,000 \\ \hline \multirow[t]{2}{*}{ 9-Jan } & Rent Expense & 5,500 & \\ \hline & Cash & & 5,500 \\ \hline \multirow[t]{2}{*}{ 10-Jan } & Advertising Expense & 3,500 & \\ \hline & Accounts Payable & & 3,500 \\ \hline \multirow[t]{2}{*}{ 12-Jan } & Office Supplies & 2,100 & \\ \hline & Cash & & 2,100 \\ \hline \multirow[t]{2}{*}{ 14-Jan } & Salaries Expense & 11,000 & \\ \hline & Cash & & 11,000 \\ \hline \multirow[t]{2}{*}{ 15-Jan } & Cash & 250,000 & \\ \hline & Notes Payable & & 250,000 \\ \hline \multirow[t]{2}{*}{ 16-Jan } & Land & 300,000 & \\ \hline & Cash & & 300,000 \\ \hline \multirow[t]{2}{*}{ 17-Jan } & Repairs and Maintenance & 7,700 & \\ \hline & Accounts Payable & & 7,700 \\ \hline \multirow[t]{2}{*}{ 18-Jan } & Notes Receivable & 165,000 & \\ \hline & Cash & & 165,000 \\ \hline \multirow[t]{2}{*}{ 20-Jan } & Accounts Receivable & 19,100 & \\ \hline & Service Revenue & & 19,100 \\ \hline \multirow[t]{2}{*}{ 21-Jan } & Stock Investments & 20,500 & \\ \hline & Cash & & 20,500 \\ \hline \multirow[t]{2}{*}{ 22-Jan } & Utilities Expense & 3,275 & \\ \hline & Accounts Payable & & 3,275 \\ \hline \multirow[t]{2}{*}{ 23-Jan } & Prepaid Rent & 5,500 & \\ \hline & Cash & & 5,500 \\ \hline \multirow[t]{2}{*}{ 24-Jan } & Dividends & 5,000 & \\ \hline & Cash & & 5,000 \\ \hline \multirow[t]{2}{*}{ 25-Jan } & Marketing Expense & 2,700 & \\ \hline & Cash & & 2,700 \\ \hline \multirow[t]{2}{*}{ 26-Jan } & Taxes Expense & 1,300 & \\ \hline & Cash & & 1,300 \\ \hline \multirow[t]{2}{*}{ 27-Jan } & Salaries Expense & 15,000 & \\ \hline & Cash & & 15,000 \\ \hline \multirow[t]{2}{*}{ 28-Jan } & Office Supplies & 700 & \\ \hline & Cash & & 700 \\ \hline \multirow[t]{2}{*}{ 31-Jan } & Depreciation Expense & 5,500 & \\ \hline & Accumulated Depreciation & & 5,500 \\ \hline 31-Jan & Interest Expense & x & \\ \hline & Interest Payable & & x \\ \hline 31-Jan & Supplies Expense & 1,100 & \\ \hline & Office Supplies & & 1,100 \\ \hline 31-Jan & Salaries Expense & 9,000 & \\ \hline & Salaries Payable & & 9,000 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts