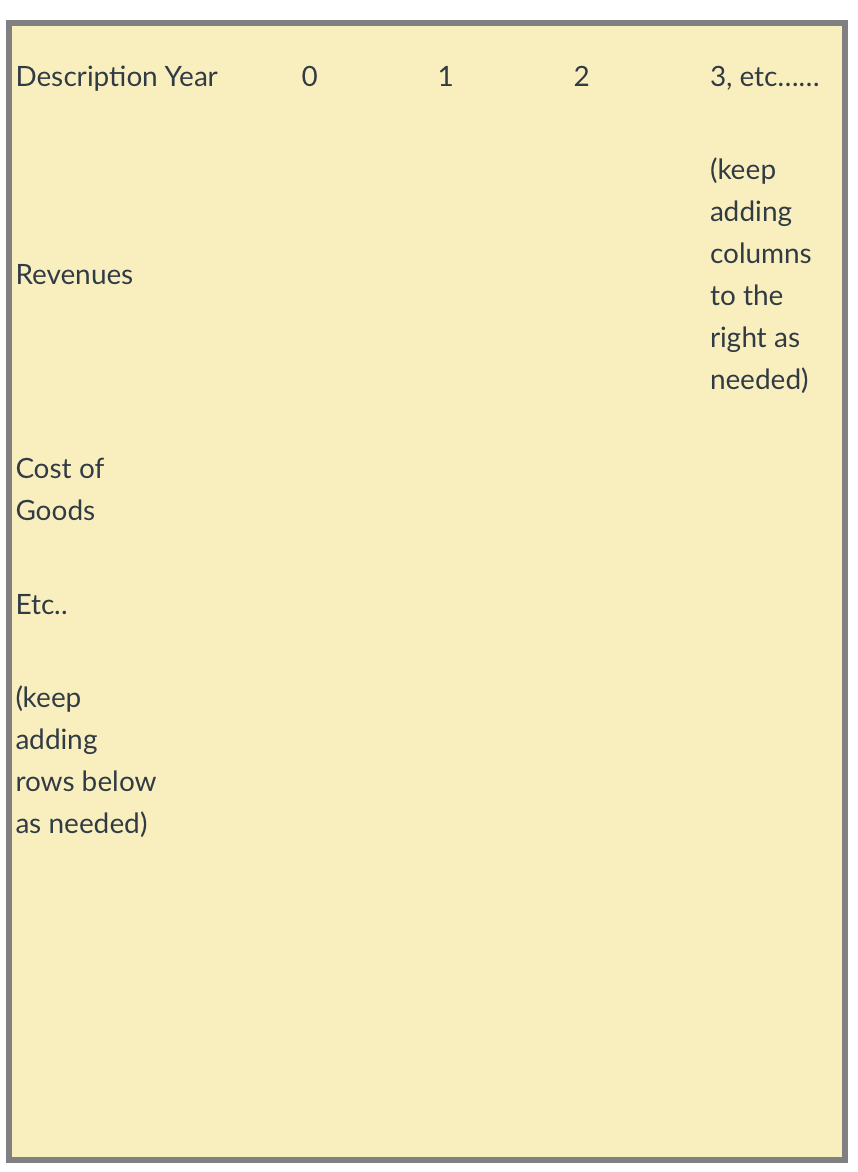

Question: 1) Create a table similar to the one below to calculate incremental earnings forecast for your proposed venture. Show each line as it appears in

1) Create a table similar to the one below to calculate incremental earnings forecast for your proposed venture. Show each line as it appears in a capital budgeting analysis.

1) Create a table similar to the one below to calculate incremental earnings forecast for your proposed venture. Show each line as it appears in a capital budgeting analysis.

2) Then further add rows to the table to calculate the free cash flows for the venture.

3) Assume that your cost of capital is 10%. What is the NPV of this venture? What is its IRR? If you are evaluating this as a stand-along project, should you invest in this project? Explain.

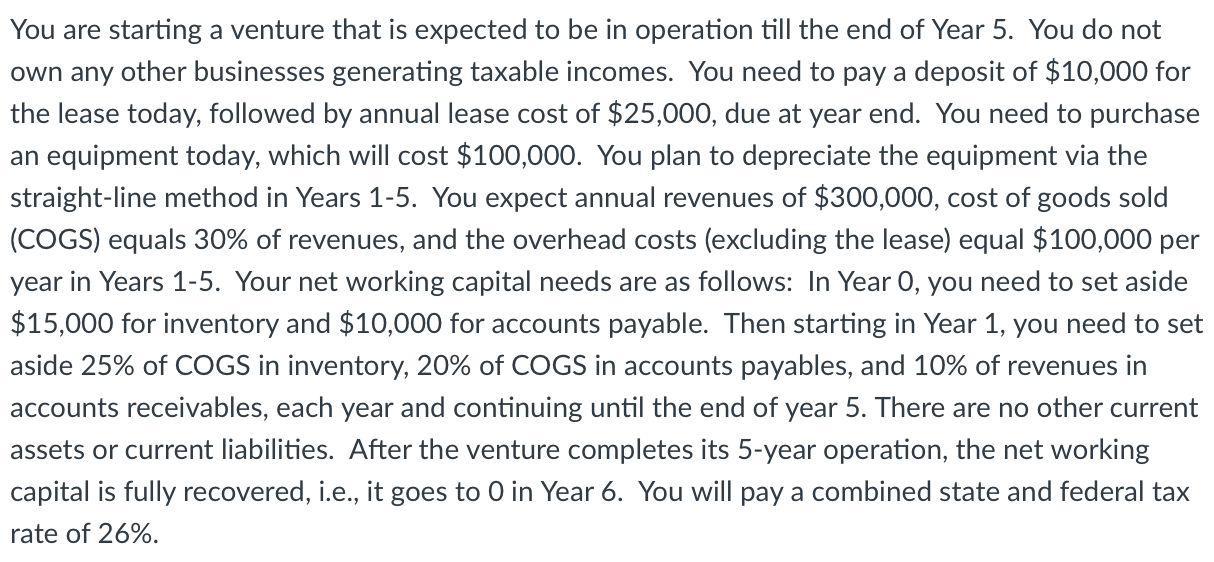

You are starting a venture that is expected to be in operation till the end of Year 5. You do not own any other businesses generating taxable incomes. You need to pay a deposit of $10,000 for the lease today, followed by annual lease cost of $25,000, due at year end. You need to purchase an equipment today, which will cost $100,000. You plan to depreciate the equipment via the straight-line method in Years 1-5. You expect annual revenues of $300,000, cost of goods sold (COGS) equals 30% of revenues, and the overhead costs (excluding the lease) equal $100,000 per year in Years 1-5. Your net working capital needs are as follows: In Year O, you need to set aside $15,000 for inventory and $10,000 for accounts payable. Then starting in Year 1, you need to set aside 25% of COGS in inventory, 20% of COGS in accounts payables, and 10% of revenues in accounts receivables, each year and continuing until the end of year 5. There are no other current assets or current liabilities. After the venture completes its 5-year operation, the net working capital is fully recovered, i.e., it goes to o in Year 6. You will pay a combined state and federal tax rate of 26%. Description Year 0 1 2 3, etc...... Revenues (keep adding columns to the right as needed) Cost of Goods Etc.. (keep adding rows below as needed) You are starting a venture that is expected to be in operation till the end of Year 5. You do not own any other businesses generating taxable incomes. You need to pay a deposit of $10,000 for the lease today, followed by annual lease cost of $25,000, due at year end. You need to purchase an equipment today, which will cost $100,000. You plan to depreciate the equipment via the straight-line method in Years 1-5. You expect annual revenues of $300,000, cost of goods sold (COGS) equals 30% of revenues, and the overhead costs (excluding the lease) equal $100,000 per year in Years 1-5. Your net working capital needs are as follows: In Year O, you need to set aside $15,000 for inventory and $10,000 for accounts payable. Then starting in Year 1, you need to set aside 25% of COGS in inventory, 20% of COGS in accounts payables, and 10% of revenues in accounts receivables, each year and continuing until the end of year 5. There are no other current assets or current liabilities. After the venture completes its 5-year operation, the net working capital is fully recovered, i.e., it goes to o in Year 6. You will pay a combined state and federal tax rate of 26%. Description Year 0 1 2 3, etc...... Revenues (keep adding columns to the right as needed) Cost of Goods Etc.. (keep adding rows below as needed)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts