Question: 1. Cummins Crane Corporation (3C) is considering replacing its controllers on its heavy lift cranes with new portable infrared controllers. 3C expects to achieve cost

1.

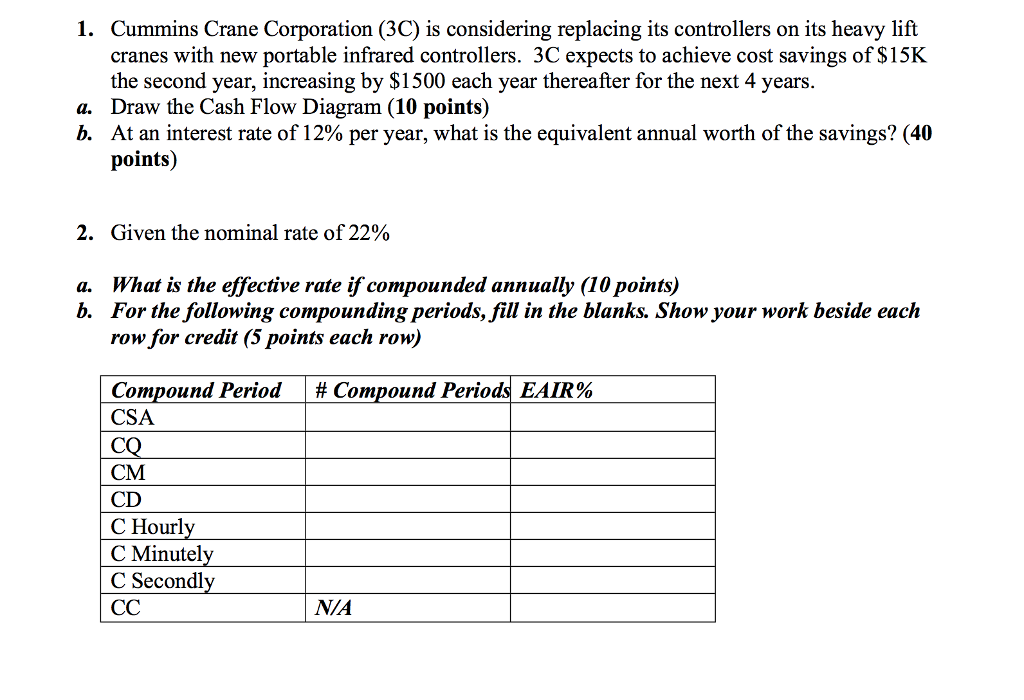

Cummins Crane Corporation (3C) is considering replacing its controllers on its heavy lift

cranes with new portable infrared controllers. 3C expects to achieve cost savings of $15K

the second year, increasing by $1500 each year thereafter for the next 4 years.

a.

Draw the Cash Flow Diagram (

10 points

)

b.

At an interest rate of 12% per year, what is the equivalent annual worth of the savings? (

40

points

)

2.

Given the nominal rate of 22%

a. What is the effective rate if compounded annually (10 points)

b. For the following compounding periods, fill in the blanks. Show your work beside each

row for credit (5 points each row)

Compound Period

# Compound Periods

EAIR%

CSA

CQ

CM

CD

C Hourly

C Minutely

C Secondly

CC

N/A

I am stuck on the second question parta and b.

I have the Equivalent annual worth as $13,830

1. Cummins Crane Corporation (3C) is considering replacing its controllers on its heavy lift cranes with new portable infrared controllers. 3C expects to achieve cost savings of $15K the second year, increasing by $1500 each year thereafter for the next 4 years. Draw the Cash Flow Diagram (10 points) At an interest rate of 12% per year, what is the equivalent annual worth of the savings? (40 points) a. 2. Given the nominal rate of 22% What is the effective rate if compounded annually (10 points) For the following compounding periods, fill in the blanks. Show your work beside each row for credit (5 points each row) a. b. Compound Period CSA # Compound Periods EAIR% CM CD C Hourly C Minutely C Secondly N/A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts