Question: 1 Current Attempt in Progress Sandhill Stores is a new company that started operations on March 1, 2024' The company has decided to use a

1

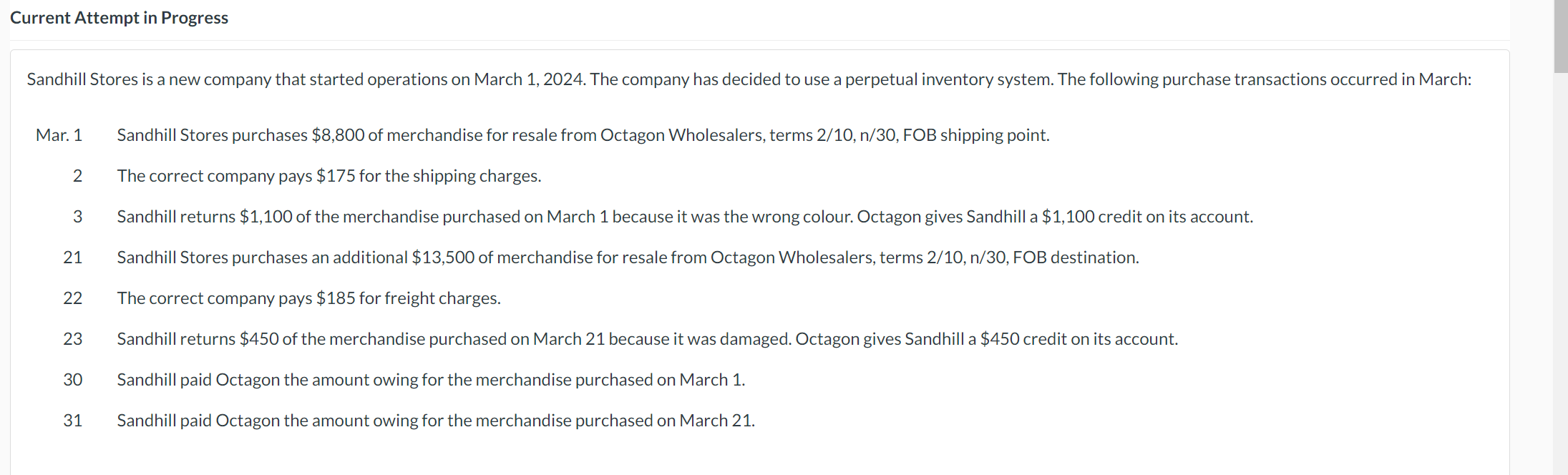

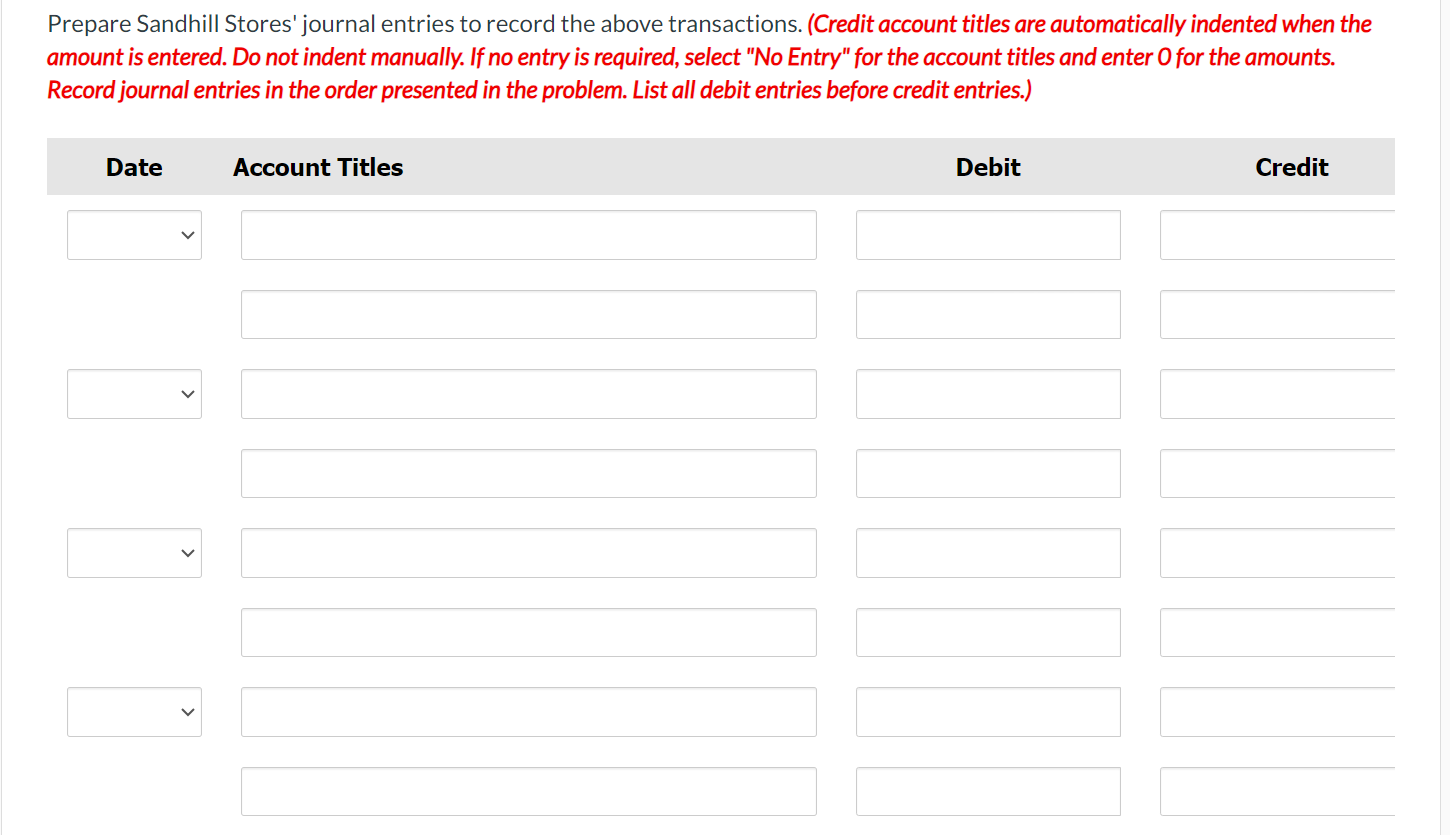

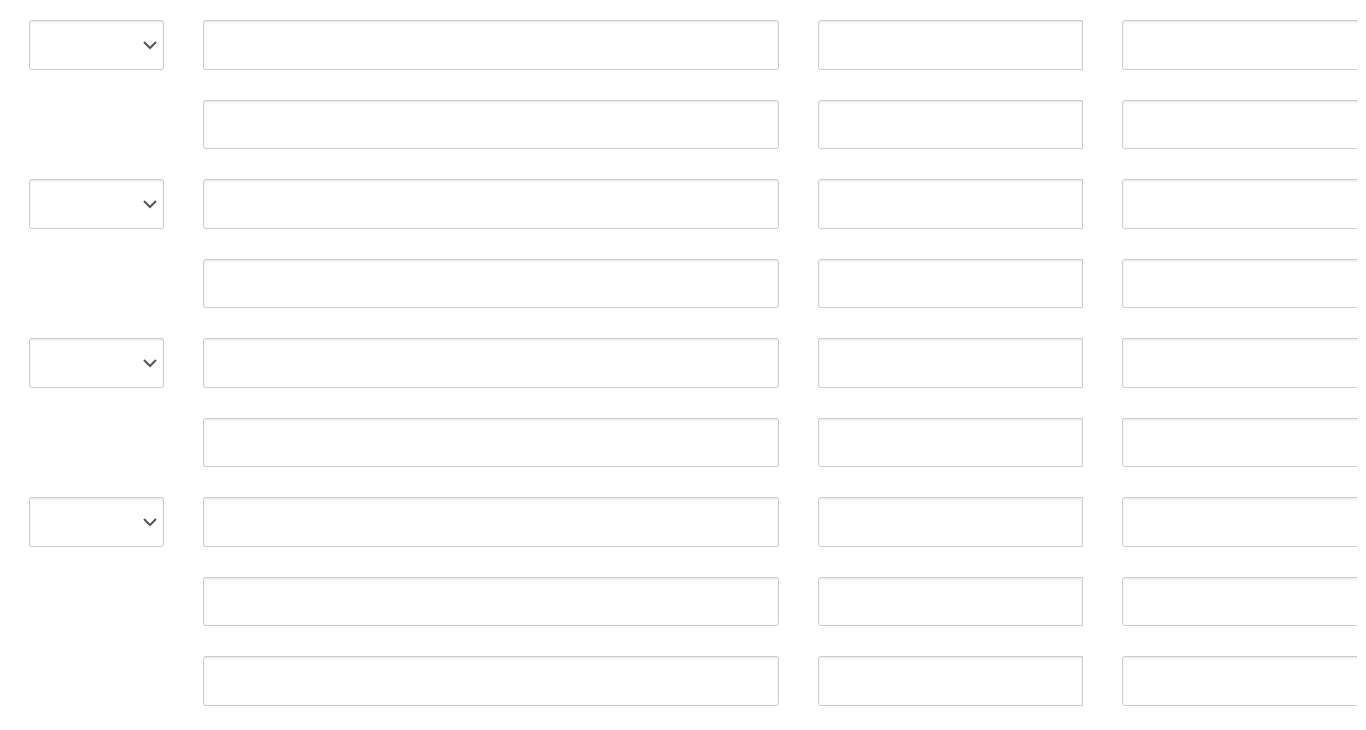

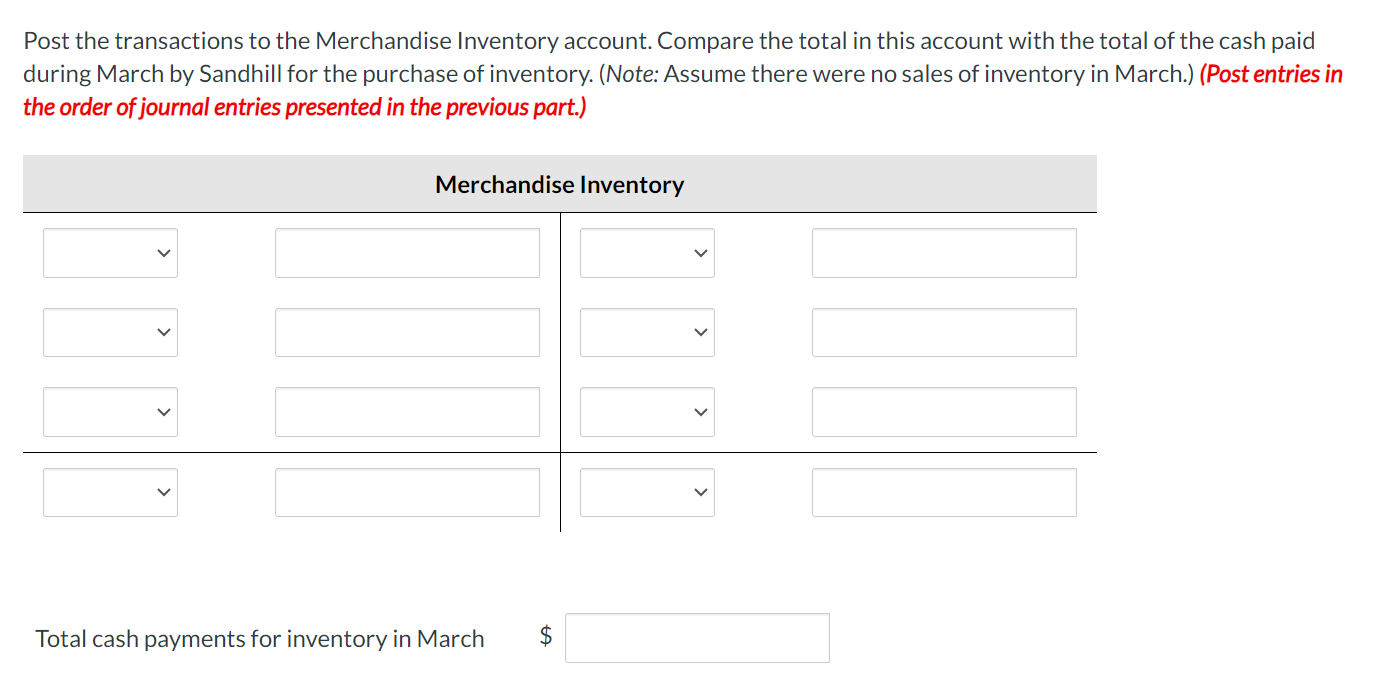

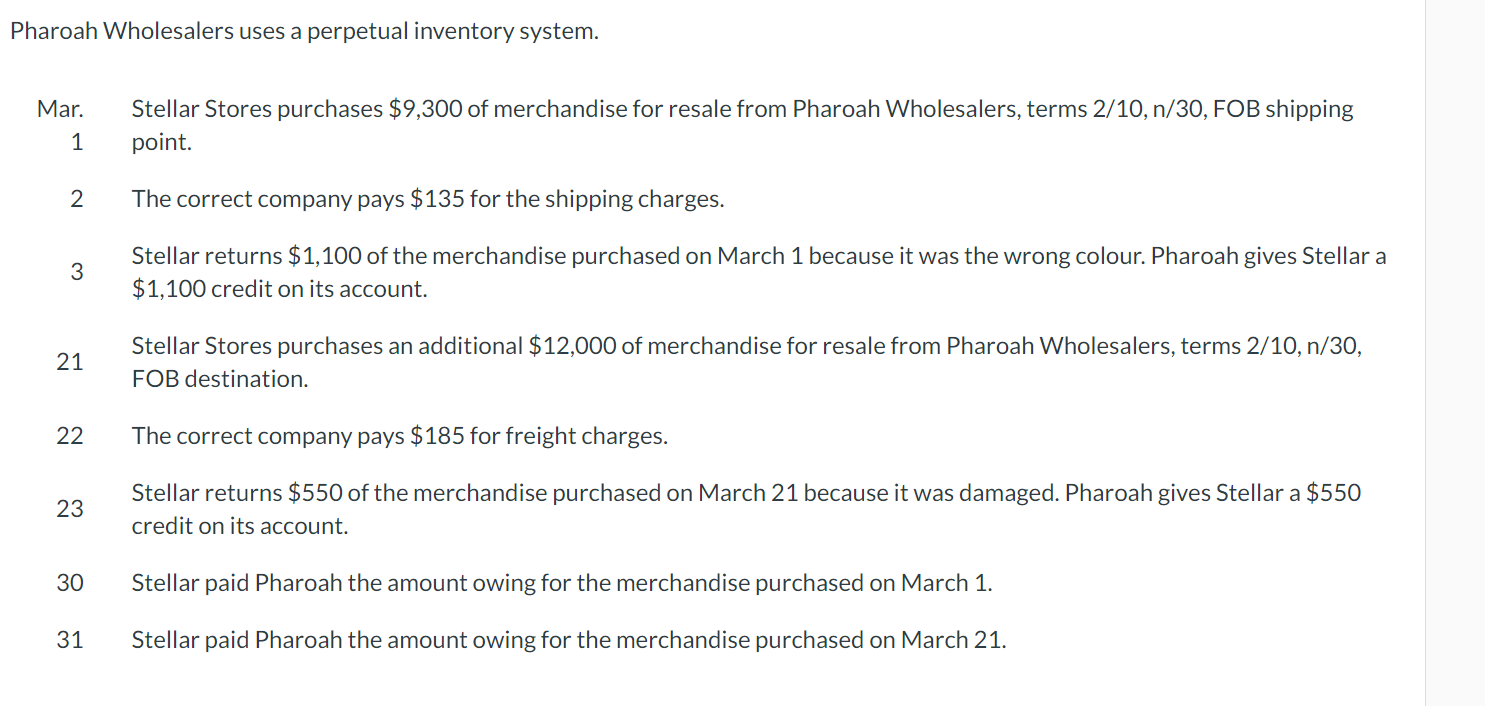

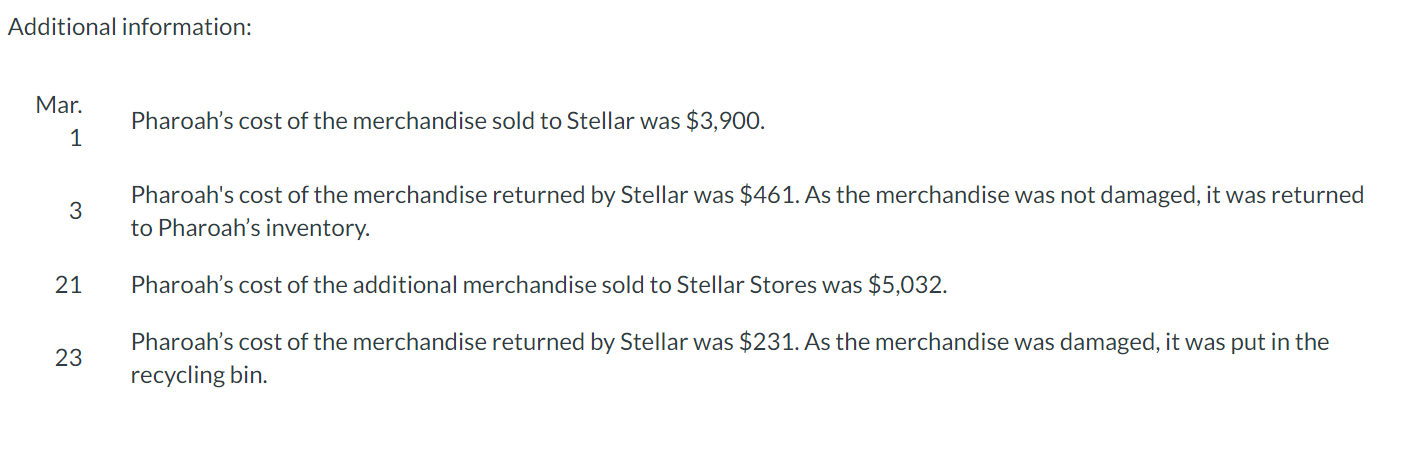

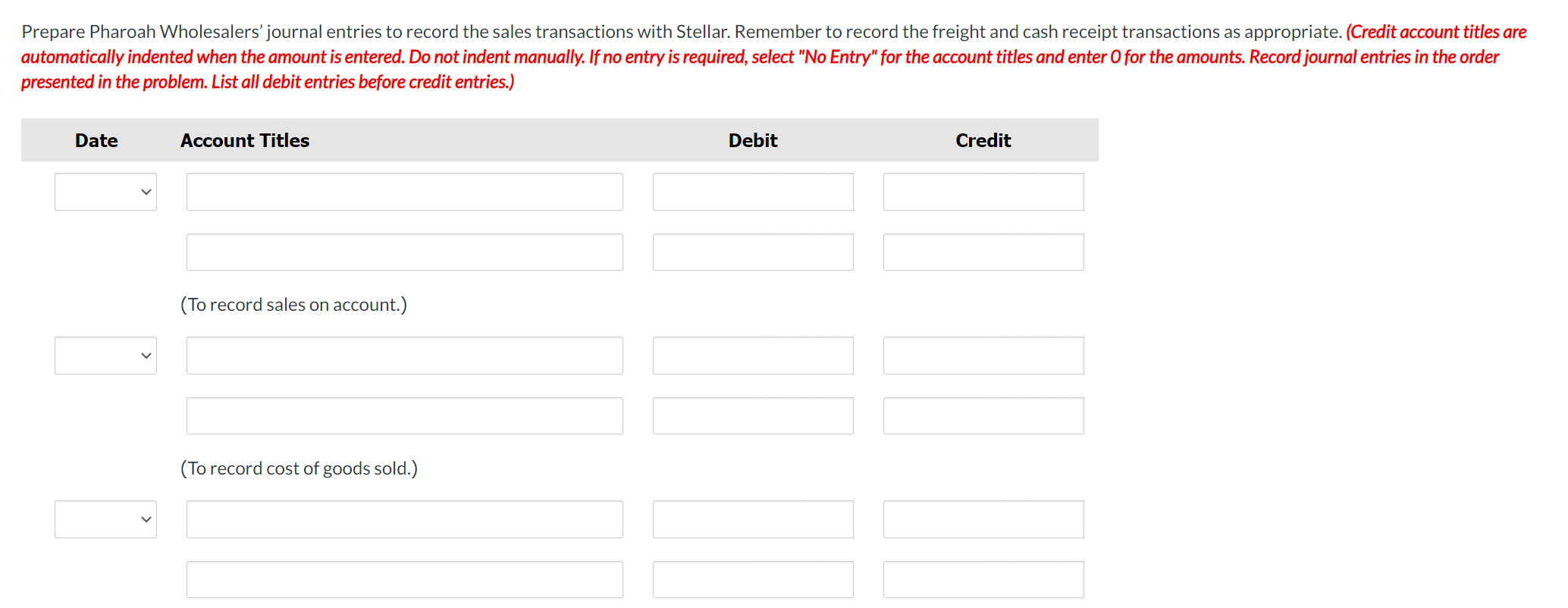

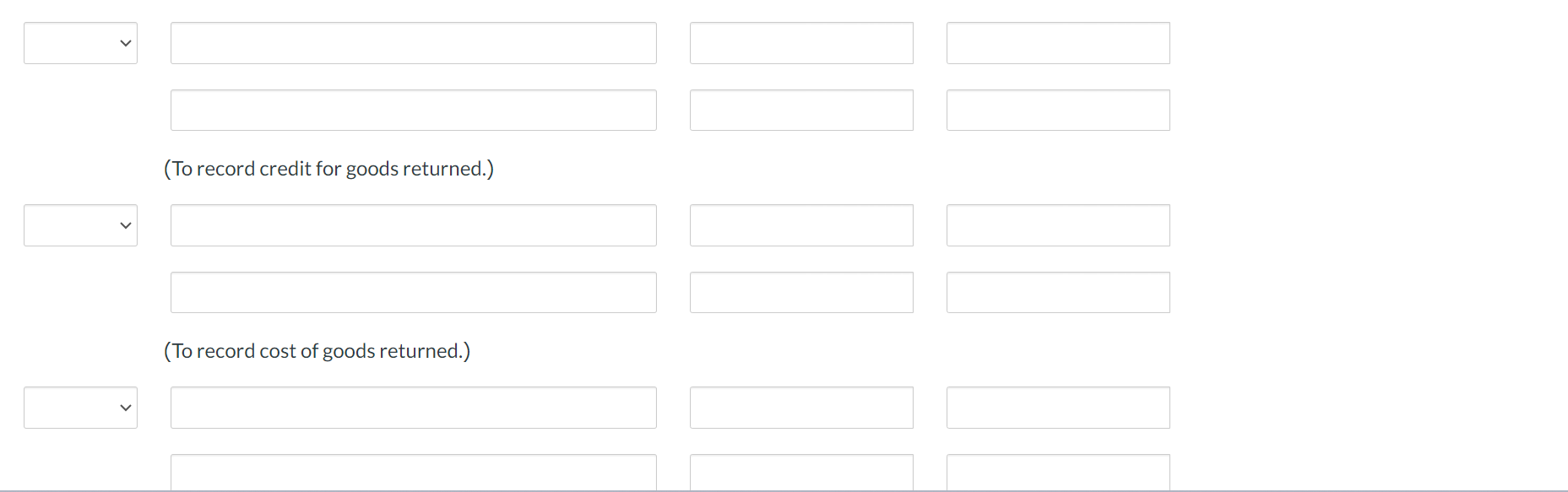

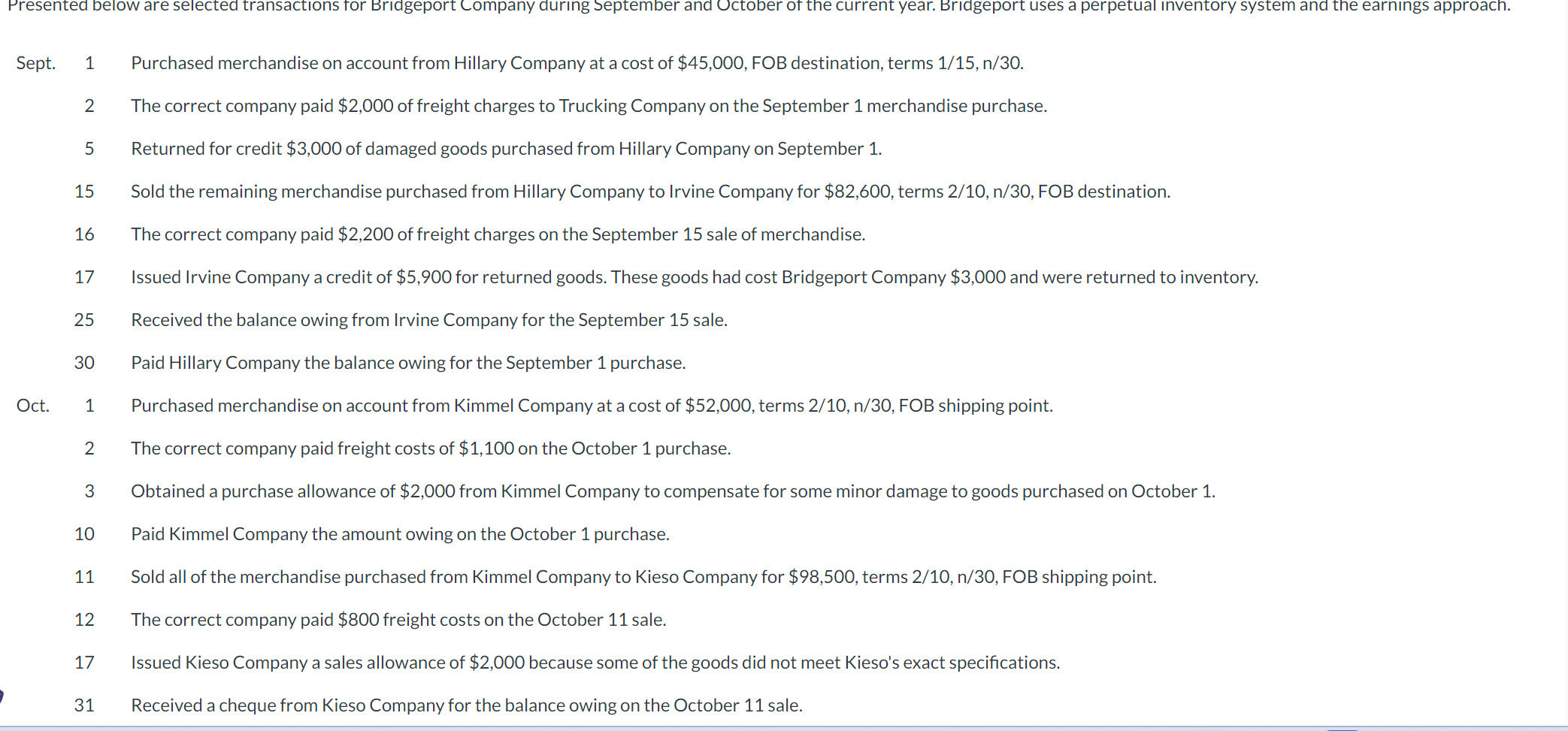

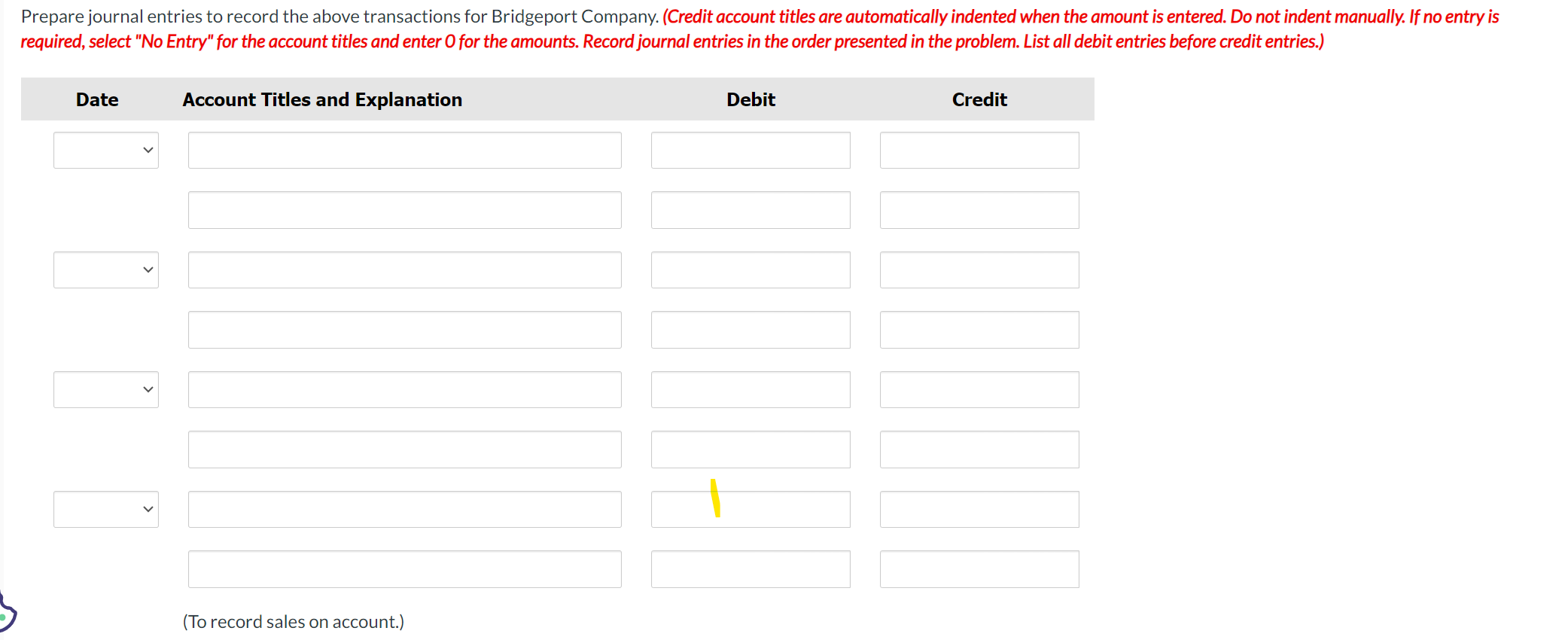

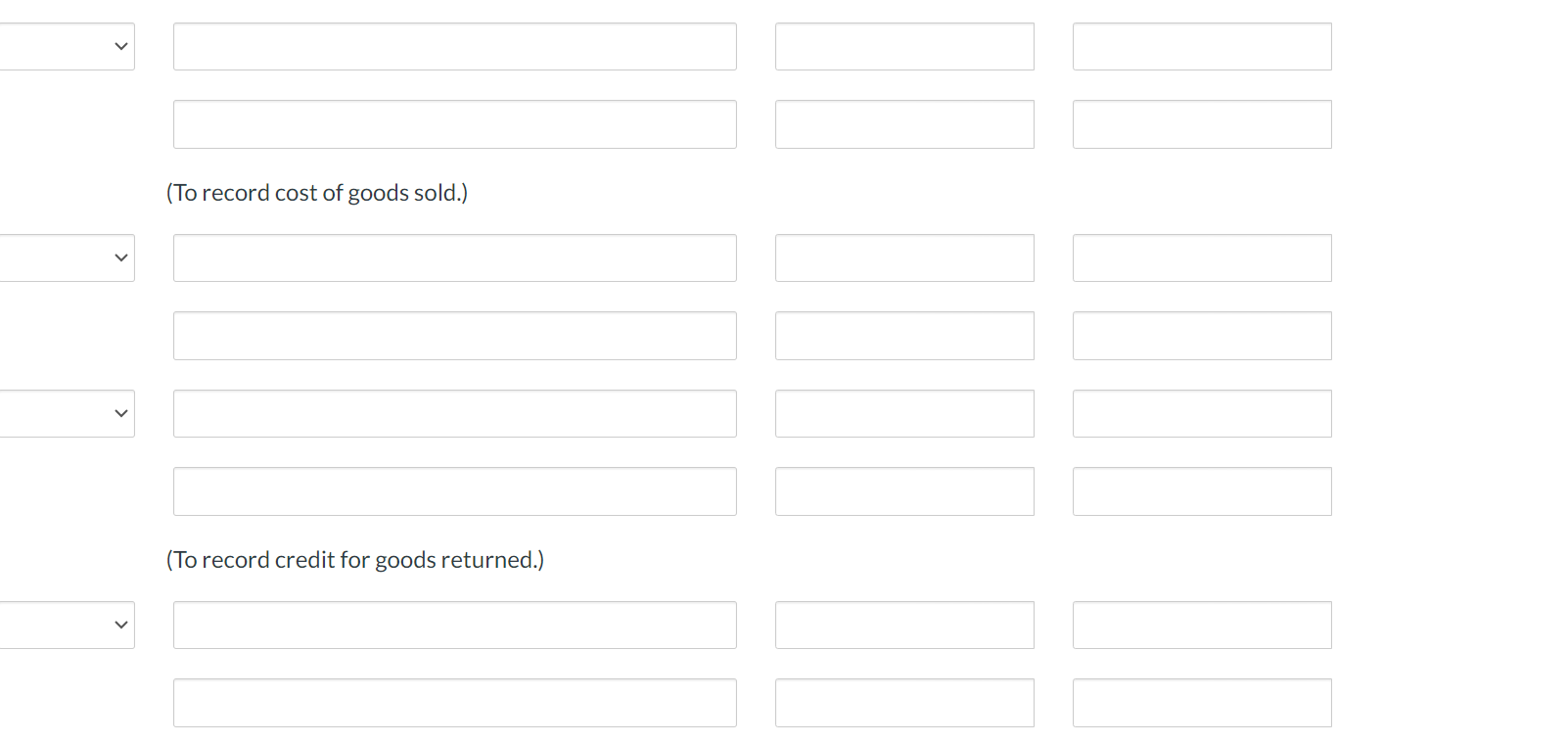

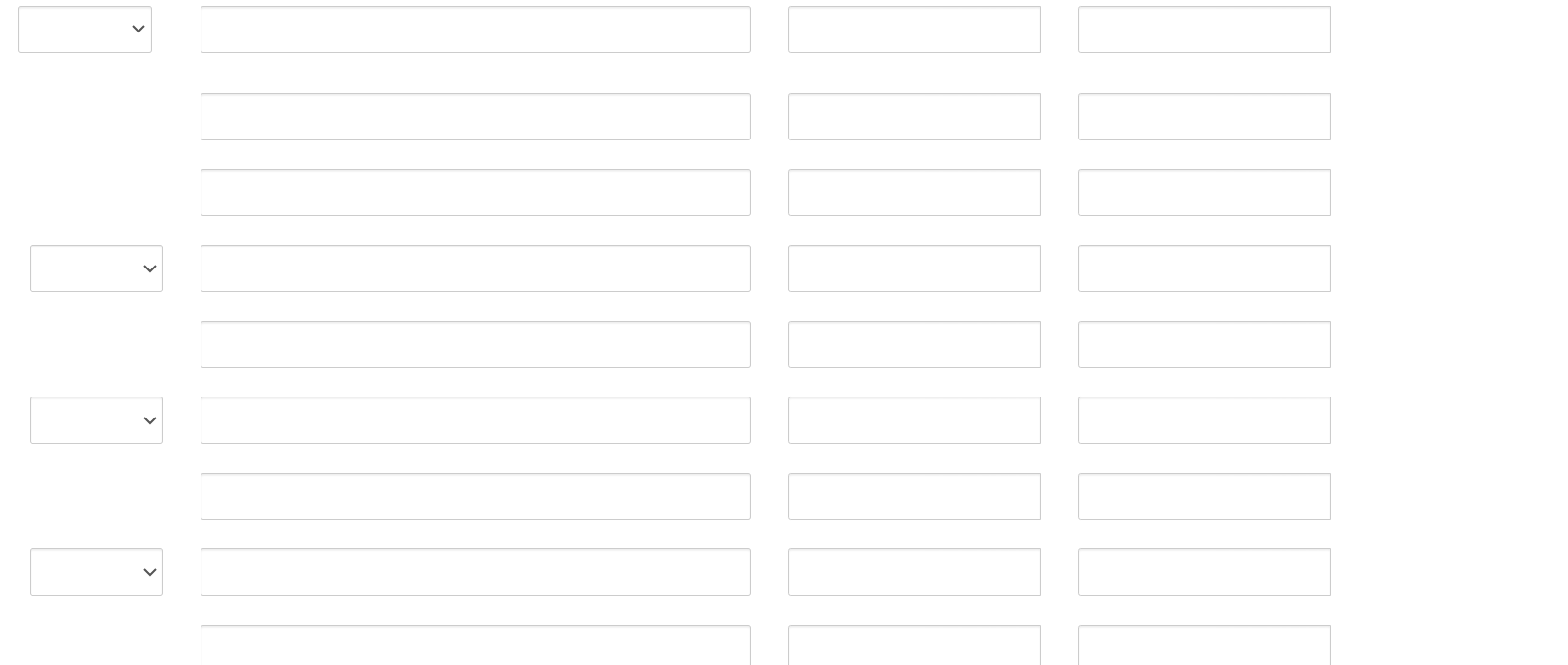

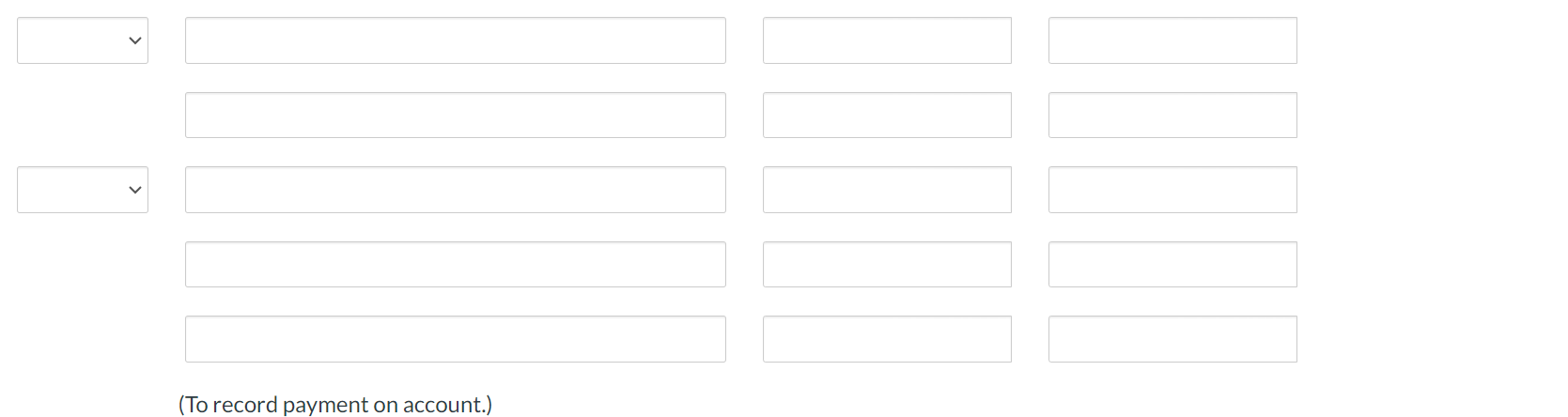

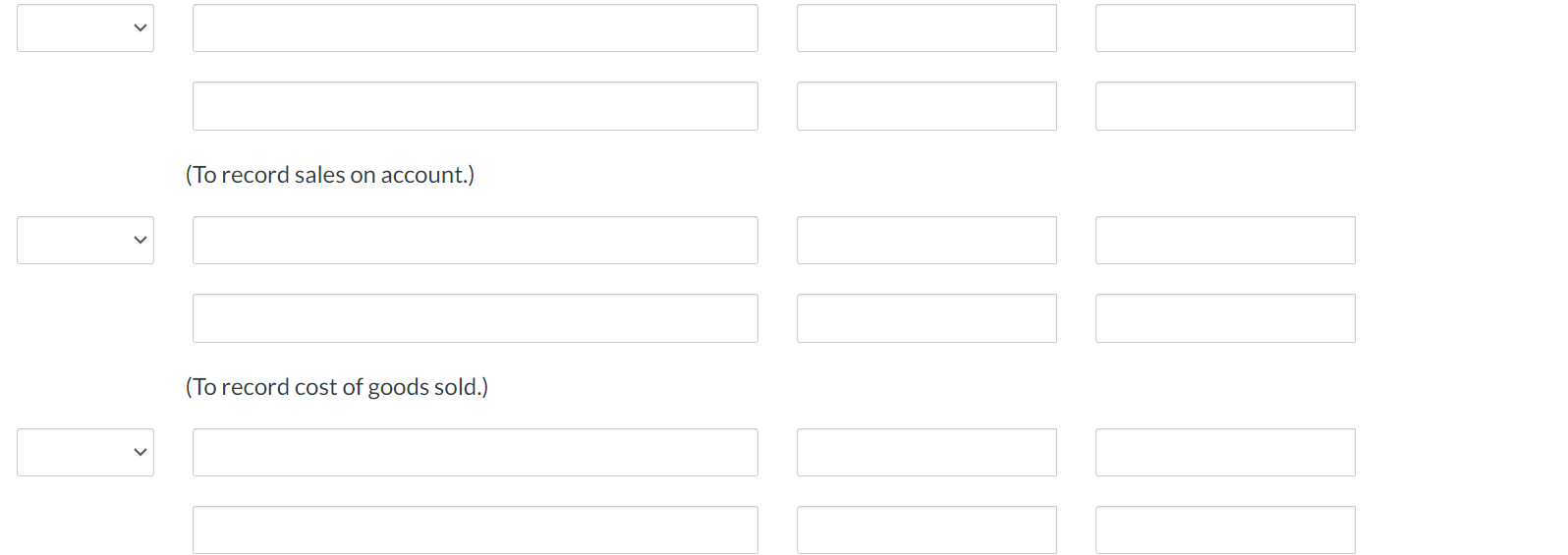

Current Attempt in Progress Sandhill Stores is a new company that started operations on March 1, 2024' The company has decided to use a perpetual inventory system The following purchase transactions occurred in March: Mar. 1 Sandhill Stores purchases $8,800 of merchandise for resale from Octagon Wholesalers, terms 2/10, n/SO, FOB shipping point. 2 The correct company pays $175 for the shipping charges, 3 Sandhill returns $1,100 of the merchandise purchased on March 1 because it was the wrong colour, Octagon gives Sandhill a $1,100 credit on its account 21 Sandhill Stores purchases an additional $13,500 of merchandise for resale from Octagon Wholesalers, terms 2/10, n/30, FOB destination 22 The correct company pays $185 for freight charges 23 Sandhill returns $450 of the merchandise purchased on March 21 because it was damaged, Octagon gives Sandhill a $450 credit on its accounts 30 Sandhill paid Octagon the amount owing for the merchandise purchased on March 1' 31 Sandhill paid Octagon the amount owing for the merchandise purchased on March 21' Prepare Sand hill Stores' jou rnal entries to record the above transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. lf no entry is required, select \"No Entry" for the account titles and enter 0 for the amounts. Record journal entries in the order presented in the problem. List all debit entries before credit entries.) Date Account Titles Debit Credit \fPost the transactions to the Merchandise Inventory account. Compare the total in this account with the total of the cash paid during March by Sandhill for the purchase of inventory. (Note: Assume there were no sales of inventory in March.) {Post entries in the order of journal entries presented in the previous part.) Merchandise Inventory V V V V v v V V Total cash payments for inventory in March $ Pharoah Wholesalers uses a perpetual inventory system. Mar. Stellar Stores purchases $9,300 of merchandise for resale from Pharoah Wholesalers, terms 2/10, n/30, FOB shipping 1 point. 2 The correct company pays $135 for the shipping charges. Stellar returns $1,100 of the merchandise purchased on March 1 because it was the wrong colour. Pharoah gives Stellar a $1,100 credit on its account. Stellar Stores purchases an additional $12,000 of merchandise for resale from Pharoah Wholesalers, terms 2/10, n/30, 21 FOB destination. 22 The correct company pays $185 for freight charges. Stellar returns $550 of the merchandise purchased on March 21 because it was damaged. Pharoah gives Stellar a $550 23 . . credit on Its account. 30 Stellar paid Pharoah the amount owing for the merchandise purchased on March 1. 31 Stellar paid Pharoah the amount owing for the merchandise purchased on March 21. Additional information: Ma; Pharoah's cost of the merchandise sold to Stellar was $3,900. 3 Pharoah's cost of the merchandise returned by Stellar was $461. As the merchandise was not damaged, it was returned to Pharoah's inventory. 21 Pharoah's cost of the additional merchandise sold to Stellar Stores was $5,032. 23 Pharoah's cost of the merchandise returned by Stellar was $231. As the merchandise was damaged, it was put in the recycling bin. Prepare Pharoah Wholesalers' journal entries to record the sales transactions with Stellar. Remember to record the freight and cash receipt transactions as appropriate. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record journal entries in the order presented in the problem. List all debit entries before credit entries.) Date Account Titles Debit Credit (To record sales on account.) (To record cost of goods sold.)A To record credit for goods returned.) A To record cost of goods returned.) ( To record sales on account.) A To record cost of goods sold.) \fCalculate Pharoah's net sales, cost of goods sold, and gross prot for these sales, Net sales $ Cost of goods sold $ Gross prot $ Presented below are selected transactions for Bridgeport Company during September and October of the current year. Bridgeport uses a perpetual inventory system and the earnings approach. Sept. 1 Purchased merchandise on account from Hillary Company at a cost of $45,000, FOB destination, terms 1/15, n/30. 2 The correct company paid $2,000 of freight charges to Trucking Company on the September 1 merchandise purchase. 5 Returned for credit $3,000 of damaged goods purchased from Hillary Company on September 1. 15 Sold the remaining merchandise purchased from Hillary Company to Irvine Company for $82,600, terms 2/10, n/30, FOB destination. 16 The correct company paid $2,200 of freight charges on the September 15 sale of merchandise. 17 Issued Irvine Company a credit of $5,900 for returned goods. These goods had cost Bridgeport Company $3,000 and were returned to inventory. 25 Received the balance owing from Irvine Company for the September 15 sale. 30 Paid Hillary Company the balance owing for the September 1 purchase. Oct. 1 Purchased merchandise on account from Kimmel Company at a cost of $52,000, terms 2/10, n/30, FOB shipping point. 2 The correct company paid freight costs of $1, 100 on the October 1 purchase. 3 Obtained a purchase allowance of $2,000 from Kimmel Company to compensate for some minor damage to goods purchased on October 1. 10 Paid Kimmel Company the amount owing on the October 1 purchase. 11 Sold all of the merchandise purchased from Kimmel Company to Kieso Company for $98,500, terms 2/10, n/30, FOB shipping point. 12 The correct company paid $800 freight costs on the October 11 sale. 17 Issued Kieso Company a sales allowance of $2,000 because some of the goods did not meet Kieso's exact specifications. 31 Received a cheque from Kieso Company for the balance owing on the October 11 sale.Prepare journal entries to record the above transactions for Bridgeport Company. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. if no entry is required, select "No Entry " for the account titles and enter 0 for the amounts. Record journal entries in the order presented in the problem. List all debit entries before credit entries.) Date Account Titles and Explanation Debit Credit (To record sales on account.) n To record cost of goods sold.) a To record credit for goods returned.) \f(To record payment on account.)To record sales on account.) To record cost of goods sold.) \f

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts