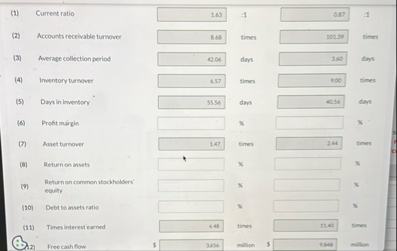

Question: ( 1 ) Current ratio ( 2 ) Accounts recelvable turnover ( 3 ) Average collection period ( 4 ) Inventory burnover ( 5 )

Current ratio

Accounts recelvable turnover

Average collection period

Inventory burnover

Dayininventory

Prohtmrgin

Asset turnover

Return on ansets

Return on common stockholders' equity

Debi to ansets ratio

Times interest earned

Free canh flow

milion

$Selected Inpothetical financial data of Target and Walmart for are presented here in millions

tableTarget Corporation,Walmart Inc.Income Statement Data for YearNet sales,,$$Cost of goods sold,,Selling and administrative expenses,,Interest expense, Other income expenseIncome tar eopense,,Net income,,$$Balance Sheet Data End of YearCurrent assets,,$$Noncurrent assets,,Totatimels$$Current liabilities,,$$tong term dett,,Total stockholders'equity,,$$BeginningofYear BalancestableBeginningofYear BalancesTotal assets,$$Total stockholders' equity,Current liabilities,Total liabilities,Average net accounts receivable,$$Average inventory,Net cash provided by operating activities,Capital expenditures,Cash dividends paid,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock