Question: 1. Daily Enterprises is purchasing a $10,000,000 machine. It will cost $50,000 to transport and install the machine. The machine has a depreciable life of

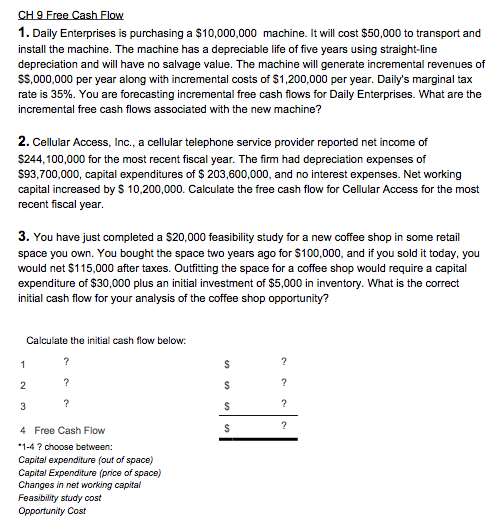

1. Daily Enterprises is purchasing a $10,000,000 machine. It will cost $50,000 to transport and install the machine. The machine has a depreciable life of five years using straight-line depreciation and will have no salvage value. The machine will generate incremental revenues of SS,000,000 per year along with incremental costs of $1,200,000 per year. Daily's marginal tax rate is 35%. You are forecasting incremental free cash flows for Daily Enterprises. What are the incremental free cash flows associated with the new machine? 2. Cellular Access, Inc., a cellular telephone service provider reported net income of S244,100,000 for the most recent fiscal year. The firm had depreciation expenses of S93,700,000, capital expenditures of S 203,600,000, and no interest expenses. Net working capital increased by S 10,200,000. Calculate the free cash flow for Cellular Access for the most recent fiscal year 3. You have just completed a $20,000 feasibility study for a new coffee shop in some retail space you own. You bought the space two years ago for $100,000, and if you sold it today, you would net $115,000 after taxes. Outfitting the space for a coffee shop would require a capital expenditure of $30,000 plus an initial investment of $5,000 in inventory. What is the correct initial cash flow for your analysis of the coffee shop opportunity? Calculate the initial cash flow below: 4 Free Cash Flow 1-4? choose between: Capital expenditure (out of space) Capital Expenditure (price of space) Changes in net working capital Feasibility study cost Opportunity Cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts