1 Danone will make a euro 95 million acquisition in Ethiopia, paid in three equal instalments of Ethiopian Birr in 6,12 and 24 months. The spot rate for Birr is 47.9 and one year and two year forward trade at discount of 8% and 20 %. Calculate the 3 forward rates and the amount of Birr paid at each instalment.

2 The Euro rate is 0,01% and 0,9% for 1 and 2 years, please calculate the Birr rate for 1 and 2 years.

3 Define the three type of exposure.

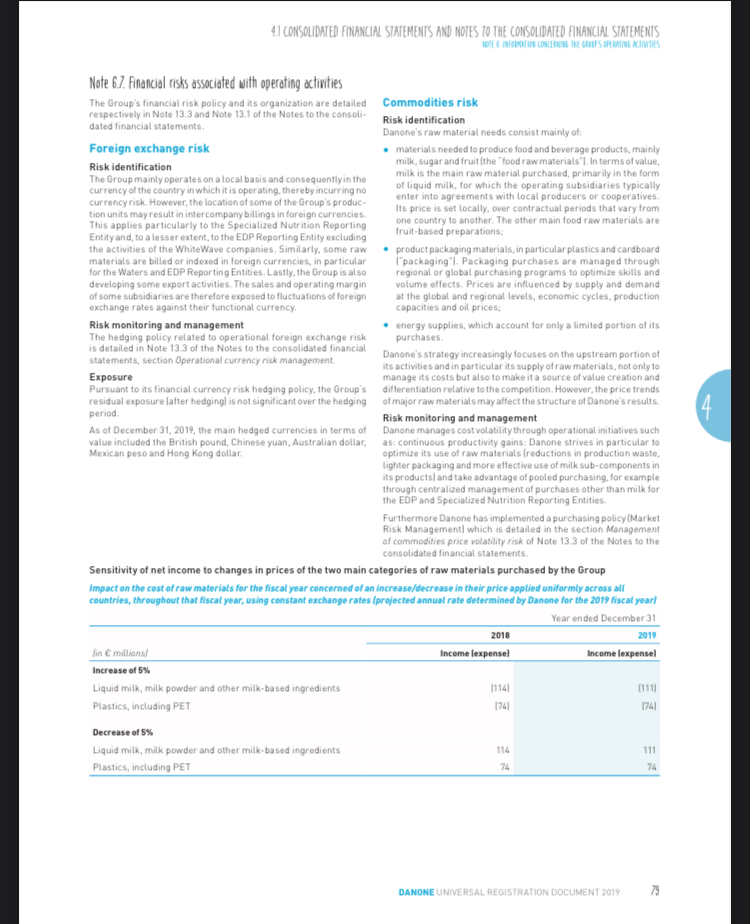

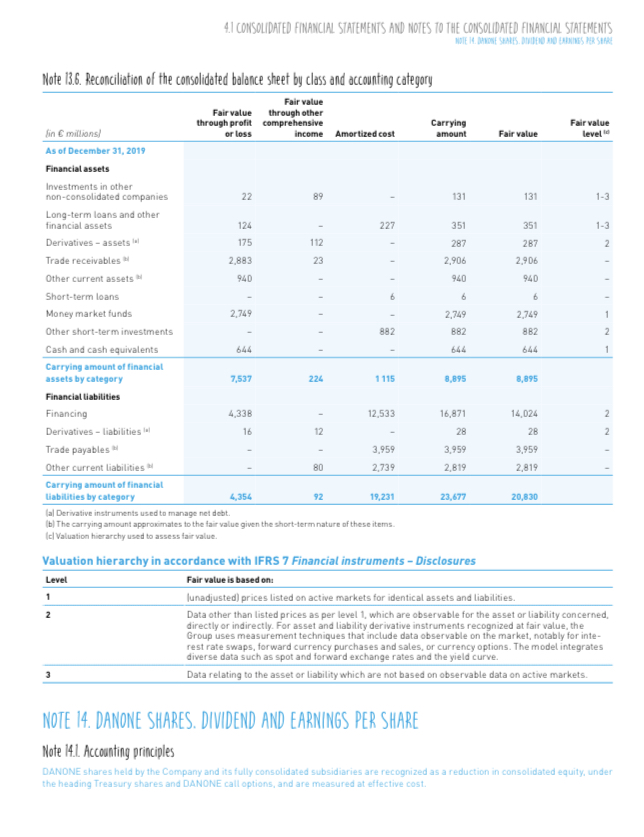

4 From the Danone document describe in a summary form (one paragraph), illustrated with numbers if applicable, the three type of exposure and the details ( ie gold gasoline or other)

5 Define the types and nature (what exposure you are trying to cover) of Derivatives used in general.

6 Define currency risk and interest rate risk

7 For Danone describe in summary form the derivatives used by category and nature.

Please reference any outside source as appropriate

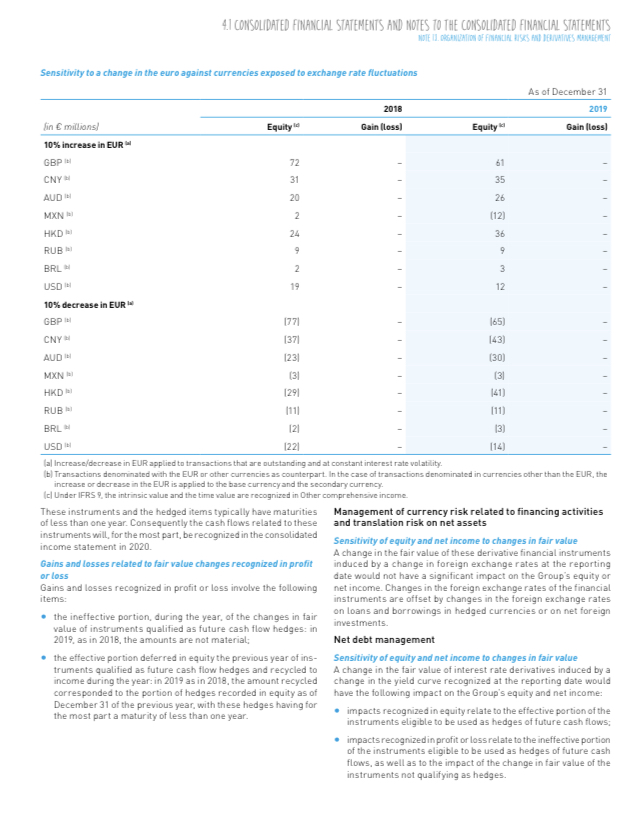

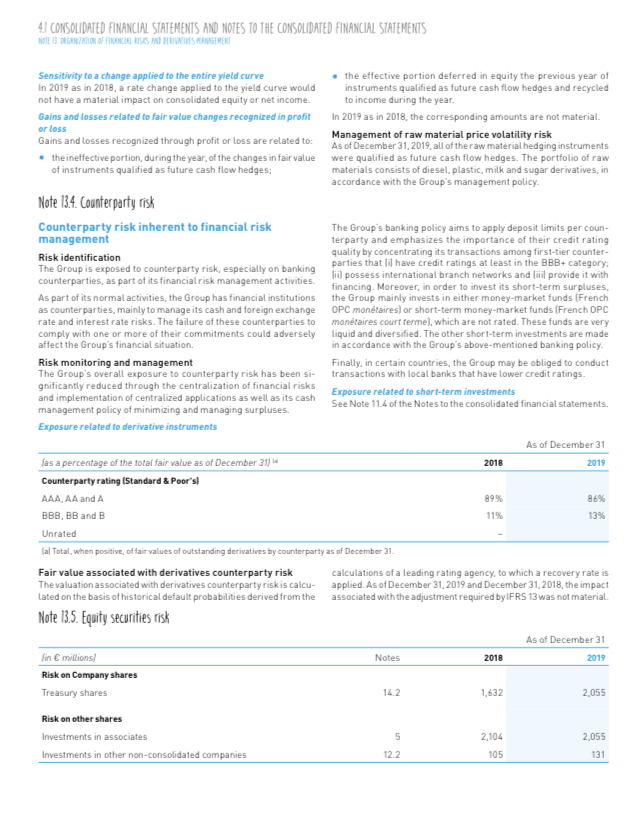

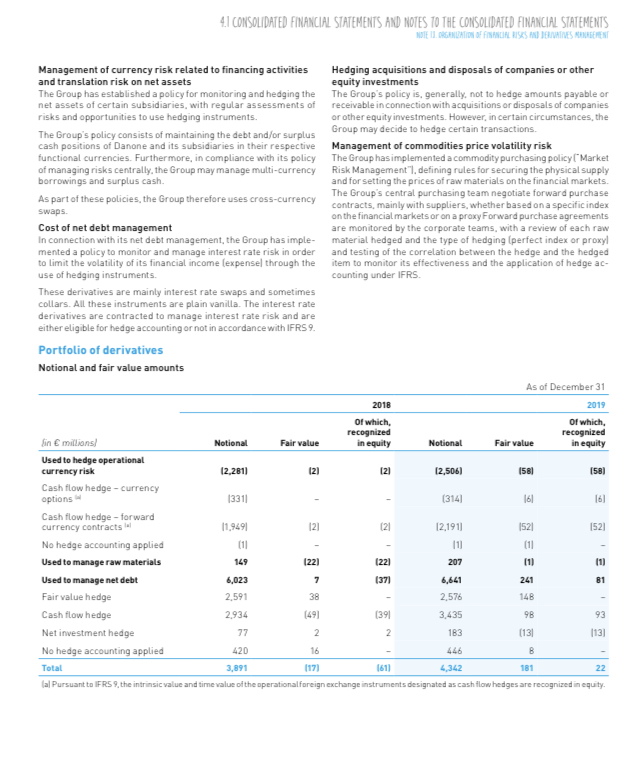

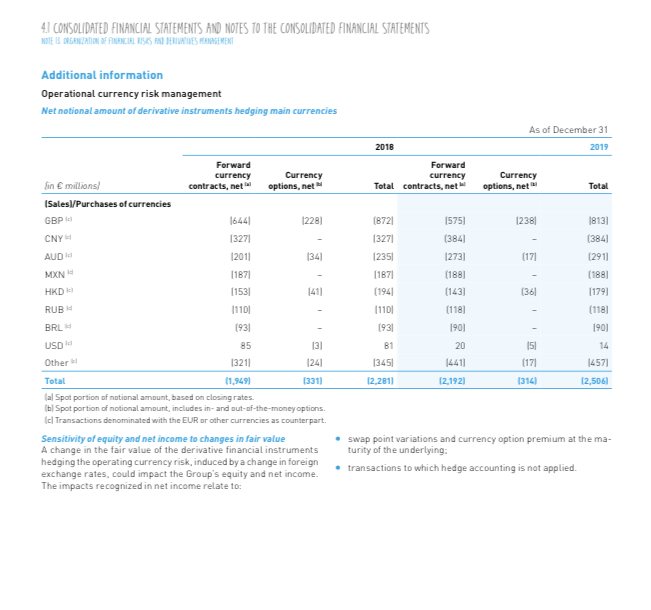

4.1 CONSOLIDATED FINANCIAL STATEMENTS AND NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS NOTE IN. ORGANISATION OF FINANCIAL BUSES AND DERIVATIVES MANAGEMENT Sensitivity to a change in the euro against currencies exposed to exchange rate fluctuations As of December 31 2018 2019 in C millions) Equity Gain [Loss) Equity ki Gain [loss] 10% increase in EUR GBP IN 72 61 CNY 31 35 AUD IN 20 26 MXIN Jail 2 (12) HKD Ixl 24 36 BRL USD IN 19 12 10% decrease in EUR GBP IN 1771 165) CNY 1371 143) AUD IN (231 (30) MXN hal (31 (31 HKD hal 1291 141) RUBIN (111 [11) BRL 121 13) USD IN 1221 [14) lal Increase/decrease in EUR applied to transactions that are outstanding and at constant interest rate volatility. b/ Transactions denominated with the EUR or other currencies as counterpart. In the case of transactions denominated in currencies other than the EUR, the increase or decrease in the EUR is applied to the base currency and the sec dary currency. cl Under IFRS P. the intrinsic value and the time value are recognized in Other comprehensive income. These instruments and the hedged items typically have maturities Management of currency risk related to financing activities of less than one year. Consequently the cash flows related to these and translation risk on net assets instruments will, for the most part, be recognized in the consolidated income statement in 2020. Sensitivity of equity and net income to changes in fair value A change in the fair value of these derivative financial instruments Gains and losses related to fair value changes recognized in profit induced by a change in foreign exchange rates at the reporting or loss date would not have a significant impact on the Group's equity or Gains and losses recognized in profit or loss involve the following net income. Changes in the foreign exchange rates of the financial items: instruments are offset by changes in the foreign exchange rates . the ineffective portion, during the year, of the changes in fair on loans and borrowings in hedged currencies or on net foreign value of instruments qualified as future cash flow hedges: in investments. 2019, as in 2018, the amounts are not material; Net debt management the effective portion deferred in equity the previous year of ins- Sensitivity of equity and net income to changes in fair value truments qualified as future cash flow hedges and recycled to A change in the fair value of interest rate derivatives induced by a income during the year: in 2019 as in 2018, the amount recycled change in the yield curve recognized at the reporting date would corresponded to the portion of hedges recorded in equity as of have the following impact on the Group's equity and net income: December 31 of the previous year, with these hedges having for the most part a maturity of less than one year. . impacts recognized in equity relate to the effective portion of the instruments eligible to be used as hedges of future cash flows; . impacts recognized in profit or loss relate to the ineffective portion of the instruments eligible to be used as hedges of future cash flows, as well as to the impact of the change in fair value of the instruments not qualifying as hedges.4.1 CONSOLIDATED FINANCIAL STATEMENTS AND NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS NOTE IS. ORGANIZATION OF FINANCIAL BUSES AND DERIVATIVES MANAGEMENT Sensitivity to a change applied to the entire yield curve . the effective portion deferred in equity the previous year of In 2019 as in 2018, a rate change applied to the yield curve would instruments qualified as future cash flow hedges and recycled not have a material impact on consolidated equity or net income. to income during the year. Gains and losses related to fair value changes recognized in profit In 2019 as in 2018, the corresponding amounts are not material. or loss Gains and losses recognized through profit or loss are related to: Management of raw material price volatility risk As of December 31, 2019, all of the raw material hedging instruments . the ineffective portion, during the year, of the changes in fair value were qualified as future cash flow hedges. The portfolio of raw of instruments qualified as future cash flow hedges; materials consists of diesel, plastic, milk and sugar derivatives, in accordance with the Group's management policy. Note 13.4. Counterparty risk Counterparty risk inherent to financial risk The Group's banking policy aims to apply deposit limits per coun- management terparty and emphasizes the importance of their credit rating Risk identification quality by concentrating its transactions among first-tier counter- The Group is exposed to counterparty risk, especially on banking parties that li] have credit ratings at least in the BBB+ category: counterparties, as part of its financial risk management activities. lii) possess international branch networks and lili] provide it with financing. Moreover, in order to invest its short-term surpluses, As part of its normal activities, the Group has financial institutions the Group mainly invests in either money-market funds (French as counter parties, mainly to manage its cash and foreign exchange OPC monetaires] or short-term money-market funds (French OPC rate and interest rate risks. The failure of these counterparties to monetaires court fermel, which are not rated. These funds are very comply with one or more of their commitments could adversely liquid and diversified. The other short-term investments are made affect the Group's financial situation. in accordance with the Group's above-mentioned banking policy. Risk monitoring and management Finally, in certain countries, the Group may be obliged to conduct The Group's overall exposure to counterparty risk has been si- transactions with local banks that have lower credit ratings. gnificantly reduced through the centralization of financial risks and implementation of centralized applications as well as its cash Exposure related to short-term investments management policy of minimizing and managing surpluses. See Note 11.4 of the Notes to the consolidated financial statements. Exposure related to derivative instruments As of December 31 las a percentage of the total fair value as of December 31) Is 2018 2019 Counterparty rating (Standard & Poor's) AAA, AA and A 89 9% 86% BBB, BB and B 11% 13% Unrated lal Total, when positive, of fair values of outstanding derivatives by counterparty as of December 31. Fair value associated with derivatives counterparty risk calculations of a leading rating agency, to which a recovery rate is The valuation associated with derivatives counterparty risk is calcu- applied. As of December 31, 2019 and December 31, 2018, the impact Lated on the basis of historical default probabilities derived from the associated with the adjustment required by IFRS 13 was not material. Note 13.5. Equity securities risk As of December 31 in C millions) Notes 2018 2019 Risk on Company shares Treasury shares 14.2 1,632 2,055 Risk on other shares Investments in associates 5 2,104 2,055 Investments in other non-consolidated companies 12.2 105 1314.1 CONSOLIDATED FINANCIAL STATEMENTS AND NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS NOTE I. FINANCING AND FINANCIAL SECURITY, NET DEBT AND COST OF NET DEBT Note II.7. Cost of net debt Accounting principles Cost of net debt in 2019 Cost of debt comprises mainly interest charges Icalculated at the During 2019, cost of net debt decreased from C1231| million in effective interest ratel on current and non-current financing and 2018 to ([220] million in 2019, reflecting the Group's gradual debt the effects of the derivatives relating to said financing reduction strategy. Interest income comprises mainly interest received and, if appli- cable, the effects of the measurement at fair value through profit or Loss of the short-term investments and cash and cash equivalents. The related cash flows are presented within Cash flows provided by lused in) operating activities. Note II.8. Financial risks associated with the net debt and the financing activity Interest rate risk Sensitivity of the cost of net debt to changes in the short-term Risk identification interest rate The Group is exposed to interest rate risk on its financial liabilities as In 2019 as in 2018, the impact of changes in short-term interest rates well as its cash and cash equivalents. Through its interest-bearing would not have had a significant impact on the cost of the Group's debt, the Group is exposed to the risk of interest rate fluctuations that net debt. This sensitivity analysis to interest rate changes reflects affect the amount of its financial expense. In addition, pursuant to the following factors: IFRS 9, interest rate fluctuations may have an impact on the Group's . financial debt net of short-term investments, cash and cash consolidated results and consolidated equity. equivalents. It excludes the financial liabilities related to put Risk management and monitoring options granted to non-controlling interests as these are not The Group has implemented a policy to monitor and manage this interest-bearing: interest rate risk in connection with its net debt management, as . active interest rate hedges as of December 31. detailed in Note 13.3 of the Notes to the consolidated financial statements, in the section related to Cost of net debt management Financial currency risk Exposure Risk identification Net debt breakdown between fixed and floating rates Due to its international presence, the Group could be exposed As of December 31, 2019 and December 31, 2018, all of the conso- to foreign exchange rate fluctuations in relation to its financing Lidated net debt was fixed rate debt. activities: in application of its risk centralization policy, the Group manages multi-currency financings and liquidities. In application of its financial currency risk hedging policy. the Group's residual exposure lafter hedgingl is not material. Risk management and monitoring The management policy regarding financial currencyrisk is detailed in Not 13.3 in the notes to the consolidated financial statements. section Management of currency risk related to financing activities and translation risk on net assets. Exposure In applying its management policy related to financial currency risk, the residual exposure is not significant.4.I CONSOLIDATED FINANCIAL STATEMENTS AND NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS NOTE IS. ORGANIZATION OF FINANCIAL BUSES AND DERIVATIVES MANAGEMENT NOTE 13. ORGANIZATION OF FINANCIAL RISKS AND DERIVATIVES MANAGEMENT Note 13.1. Organization of financial risks management As part of its normal business, the Group is exposed to financial risks, financial markets following the standards generally implemented by especially foreign currency. financing and liquidity, interest rate and first-tier companies. In addition, the Internal Control and Internal counterparty risks, securities-related risks and commodity risks. Audit Departments review the organization and procedures applied. Lastly, a monthly treasury and financing report is sent to the Group Financial risks Finance Department, enabling it to monitor the decisions taken to The Group's policy consists of lil minimizing and managing the implement the previously approved management strategies. impact that its exposure to financial market risks could have on its results and, to a lesser extent, on its balance sheet, lil monitoring Commodity risks and managing such exposure centrally. fill whenever the regulatory The Group has implemented a commodity purchasing policy |Market and monetary frameworks so allow, executing financial transactions Risk Management). The monitoring of exposures and the implemen Locally or centrally, and live using derivative instruments only for tation of this policy are carried out for each raw materials category the purpose of economic hedging- by the central purchasing team. This team negotiates forward Through its Treasury and Financing Department, which is part of the purchase agreements mainly with suppliers. Forward purchase Group Finance Department, the Group possesses the expertise and agreements are reviewed by Treasury and Financing team for each tools (trading room, front and back office software) to act on different year-end closing- Note 13.Z. Accounting principles Derivatives are recognized in the consolidated balance sheet at When derivatives are designated as future cash flow hedges: their fair value: changes in the value of the effective portion are recognized in derivatives used to manage net debt and hedges of net invest- equity under Accumulated other comprehensive income and are ments in foreign operations are recognized in Derivatives assets recycled to profit or loss, in the same heading, when the hedged or liabilities: item itself is recognized in profit or loss; foreign exchange and raw materials derivatives related to opera- time value (swap points, currency option premium and basis tions are recognized in the heading li] Other accounts receivable spread of cross-currency swaps] is recognized in equity in Other in Derivatives - assets or within (iil Other current liabilities in comprehensive income and taken to profit or loss on expiry of Derivatives - liabilities. the underlying instrument, in accordance with the principles When derivatives are designated as fair value hedges of assets or adopted by the Group. As a reminder, derivatives designated as Liabilities in the consolidated balance sheet, changes in the fair future cash flow hedges are recognized in accordance with the value of both the derivatives and the hedged items are recognized transaction-related principle (hedging of transactions included in profit or loss in the same period. in the forecastsl. When derivatives are designated as hedges of net investments in Changes in the fair value of the ineffective portions of derivatives that foreign operations, changes in the fair value of the derivatives are meet the conditions for classification as hedging instruments and recognized in equity under Translation adjustments and are recycled changes in the fair value of derivative financial instruments that do as income lexpense) when the asset is derecognized. not meet the conditions for classification as hedging instruments are recognized directly in profit or loss for the period, in a heading within operating income or financial income depending on their nature. Note 13.3. Derivatives Group's policy The execution of the hedging policy for currency risk related to Operational currency risk management operations consists of providing the necessary hedges to subsi- The Group's policy is to hedge its highly probable commercial diaries through a centralized management system, or, in the case transactions so that, as of December 31. its residual exposure in of subsidiaries where such hedges are legally prohibited, through respect of the whole of the following fiscal year is significantly re- a monitoring and control process. duced. However, when the hedging conditions of certain currencies The Group mainly applies cash flow hedge accounting. have deteriorated lless availability. high cost, etcJ. the Group may be required to limit the hedging of its highly probable commercial Based on pending transactions as of December 31, 2019, the Group's transactions in its currencies, by not hedging or only partially hed- residual exposure after hedging of exchange risks on its highly pro- ging the exposure. The Group uses forward currency contracts and bable commercial operating transactions is significantly reduced currency options to reduce its exposure. for 2020, the main currencies partially hedged being the Russian ruble, the Brazilian real, the Turkish lira and the Uruguayan Peso.4.1 CONSOLIDATED FINANCIAL STATEMENTS AND NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS NOTE IN. ORGANISATION OF FINANCIAL BUSES, AND DERIVATIVES MANAGEMENT Management of currency risk related to financing activities Hedging acquisitions and disposals of companies or other and translation risk on net assets equity investments The Group has established a policy for monitoring and hedging the The Group's policy is, generally, not to hedge amounts payable or net assets of certain subsidiaries, with regular assessments of receivable in connection with acquisitions or disposals of companies risks and opportunities to use hedging instruments. or other equity investments. However, in certain circumstances, the The Group's policy consists of maintaining the debt and/or surplus Group may decide to hedge certain transactions. cash positions of Danone and its subsidiaries in their respective Management of commodities price volatility risk functional currencies. Furthermore, in compliance with its policy The Group has implemented a commodity purchasing policy ("Market of managing risks centrally. the Group may manage multi-currency Risk Management"I. defining rules for securing the physical supply borrowings and surplus cash. and for setting the prices of raw materials on the financial markets. As part of these policies, the Group therefore uses cross-currency The Group's central purchasing team negotiate forward purchase swaps. contracts, mainly with suppliers, whether based on a specific index on the financial markets or on a proxy Forward purchase agreements Cost of net debt management are monitored by the corporate teams, with a review of each raw In connection with its net debt management, the Group has imple- material hedged and the type of hedging (perfect index or proxyl mented a policy to monitor and manage interest rate risk in order and testing of the correlation between the hedge and the hedged to limit the volatility of its financial income (expense] through the item to monitor its effectiveness and the application of hedge ac- use of hedging instruments. counting under IFRS. These derivatives are mainly interest rate swaps and sometimes collars. All these instruments are plain vanilla. The interest rate derivatives are contracted to manage interest rate risk and are either eligible for hedge accounting or not in accordance with IFRS 9. Portfolio of derivatives Notional and fair value amounts As of December 31 2018 2019 Of which Of which, recognized recognized in E millions) Notional Fair value in equity Notional Fair value in equity Used to hedge operational currency risk (2.281) 12 121 (2,506) 1581 158) Cash flow hedge - currency options (331) (314) 161 161 Cash flow hedge - forward currency contracts al (1.9491 121 [2,191) 1521 1521 No hedge accounting applied Used to manage raw materials 149 (22] (221 207 [11 11 Used to manage net debt 6,023 7 (371 5.641 241 81 Fair value hedge 2.591 38 2.576 14B Cash flow hedge 2.934 1491 (39) 3.435 93 Net investment hedge 77 2 2 183 [13) (13] No hedge accounting applied 420 16 446 B Total 3,891 (171 1611 4,342 181 22 lal Pursuant to IFRS 9, the intrinsic value and time value of the operational foreign exchange instruments designated as cash flow hedges are recognized in equity.4.1 CONSOLIDATED FINANCIAL STATEMENTS AND NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS NOTE IS. ORGANIZATION OF FINANCIAL BUSES AND DERIVATIVES MANAGEMENT Additional information Operational currency risk management Net notional amount of derivative instruments hedging main currencies As of December 31 2018 2019 Forward Forward currency Currency currency Currency lin E millions contracts, net options, net Total contracts, net options, net Total (Sales/Purchases of currencies GBP Id 16441 (2281 (872] (575) (238] 813 CNY 13271 13271 (384] [384) AUD It 1201] [235) (273] [17] (291] MXN [1871 [187) 1881 [188) HKD kci (1531 1411 [194) (143] (36) [179] RUB (110] (110) (118] [118) BRL (93) (93] 1901 USD It) 85 131 20 14 Other ' 13211 1241 1345] 14411 [17) (4571 Total 11,949 12,281] [2,192) 13141 [2,506) al Spot portion of motional amount, based on closing rates. b/ Spot portion of motional amount, includes in- and out-of-the-moneyoptions. Icl Transactions denominated with the EUR or other currencies as counterpart. Sensitivity of equity and net income to changes in fair value swap point variations and currency option premium at the ma- A change in the fair value of the derivative financial instruments turity of the underlying: hedging the operating currency risk, induced by a change in foreign exchange rates, could impact the Group's equity and net income. transactions to which hedge accounting is not applied. The impacts recognized in net income relate to:4.1 CONSOLIDATED FINANCIAL STATEMENTS AND NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS NOVE E. INFORMATION CONCERNING THE GROUP'S OPERATING ACTIVITIES Note 6.7. Financial risks associated with operating activities The Group's financial risk policy and its organization are detailed Commodities risk respectively in Note 13.3 and Note 13.1 of the Notes to the consoli- dated financial statements. Risk identification Danone's raw material needs consist mainly of: Foreign exchange risk . materials needed to produce food and beverage products, mainly Risk identification milk, sugar and fruit [the " food raw materials'|. In terms of value. The Group mainly operates on a local basis and consequently in the milk is the main raw material purchased, primarily in the form currency of the country in which it is operating, thereby incurring no of liquid milk, for which the operating subsidiaries typically currency risk. However, the location of some of the Group's produc- enter into agreements with local producers or cooperatives. tion units may result in intercompany billings in foreign currencies. Its price is set locally, over contractual periods that vary from This applies particularly to the Specialized Nutrition Reporting one country to another. The other main food raw materials are Entity and, to a lesser extent, to the EDP Reporting Entity excluding fruit-based preparations; the activities of the WhiteWave companies. Similarly, some raw product packaging materials, in particular plastics and cardboard materials are billed or indexed in foreign currencies, in particular [ "packaging'l. Packaging purchases are managed through for the Waters and EDP Reporting Entities. Lastly, the Group is also regional or global purchasing programs to optimize skills and developing some export activities. The sales and operating margin volume effects. Prices are influenced by supply and demand of some subsidiaries are therefore exposed to fluctuations of foreign at the global and regional levels, economic cycles, production exchange rates against their functional currency capacities and oil prices; Risk monitoring and management . energy supplies, which account for only a limited portion of its The hedging policy related to operational foreign exchange risk purchases. is detailed in Note 13.3 of the Notes to the consolidated financial statements, section Operational currency risk management. Danone's strategy increasingly focuses on the upstream portion of its activities and in particular its supply of raw materials, not only to Exposure manage its costs but also to make it a source of value creation and Pursuant to its financial currency risk hedging policy, the Group's differentiation relative to the competition. However, the price trends residual exposure lafter hedgingl is not significant over the hedging of major raw mi ture of Danone's results. period. Risk monitoring and management As of December 31, 2019, the main hedged currencies in terms of Danone manages cost volatility through operational initiatives such value included the British pound, Chinese yuan, Australian dollar. as: continuous productivity gains: Danone strives in particular to Mexican peso and Hong Kong dollar. optimize its use of raw materials (reductions in production waste, lighter packaging and more effective use of milk sub-components in its products] and take advantage of pooled purchasing, for example through centralized management of purchases other than milk for the EDP and Specialized Nutrition Reporting Entities. Furthermore Danone has implemented a purchasing policy (Market Risk Management] which is detailed in the section Management of commodities price volatility risk of Note 13.3 of the Notes to the consolidated financial statements. Sensitivity of net income to changes in prices of the two main categories of raw materials purchased by the Group Impact on the cost of raw materials for the fiscal year concerned of an increase/decrease in their price applied uniformly across all countries, throughout that fiscal year, using constant exchange rates [projected annual rate determined by Danone for the 2019 fiscal year) Year ended December 31 2018 2019 lin E millions) Income lexpense Income lexpensel Increase of 5%% Liquid milk, milk powder and other milk-based ingredients (1141 [111] Plastics, including PET 1741 (741 Decrease of 5% Liquid milk, milk powder and other milk-based ingredients 114 111 Plastics, including PET 74 74 DANONE UNIVERSAL REGISTRATION DOCUMENT 2019 794.1 CONSOLIDATED FINANCIAL STATEMENTS AND NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS NOTE 14. DANONE SHARES. DIVIDEND AND EARNINGS PER SHARE Note 13.6. Reconciliation of the consolidated balance sheet by class and accounting category Fair value Fair value through other through profit comprehensive Carrying Fair value in C millions) or loss income Amortized cost amount Fair value level 18 As of December 31, 2019 Financial assets Investments in other non-consolidated companies 22 89 131 131 1-3 Long-term loans and other financial assets 124 227 351 351 1-3 Derivatives - assets lal 175 112 287 287 2 Trade receivables 2,883 23 2,906 2.906 Other current assets 076 940 940 Short-term loans Money market funds 2,749 2.74 2.749 Other short-term investments 982 8:82 8 82 Cash and cash equivalents 644 644 644 Carrying amount of financial assets by category 7,537 224 1 115 8,895 8,895 Financial Liabilities Financing 4,338 12 533 16,871 14,024 Derivatives - liabilities lal 16 12 28 Trade payables 3.959 3.959 3.959 Other current liabilities 80 2,739 2,819 2,819 Carrying amount of financial liabilities by category 4.354 92 19,231 23.677 20,830 al Derivative instruments used to manage net debt. b) The carrying amount approximates to the fair value given the short-term nature of these items. cl Valuation hierarchy user to assess fair value. Valuation hierarchy in accordance with IFRS 7 Financial instruments - Disclosures Level Fair value is based on: unadjusted) prices listed on active markets for identical assets and liabilities. Data other than listed prices as per level 1, which are observable for the asset or liability concerned, directly or indirectly. For asset and liability derivative instruments recognized at fair value, the Group uses measurement techniques that include data observable on the market, notably for inte- rest rate swaps, forward currency purchases and sales, or currency options. The model integrates diverse data such as spot and forward exchange rates and the yield curve. Data relating to the asset or liability which are not based on observable data on active markets. NOTE 14. DANONE SHARES. DIVIDEND AND EARNINGS PER SHARE Note 14.1. Accounting principles DANONE shares held by the Company and its fully consolidated subsidiaries are recognized as a reduction in consolidated equity, under the heading Treasury shares and DANONE call options, and are measured at effective cost