Question: 1. Debit record 1. Credit record 2. Debit record 2. Credit record 3. Debit record 3. Credit record B. Calculate Bad Debt Expense for 2019

1. Debit record

1. Credit record

2. Debit record

2. Credit record

3. Debit record

3. Credit record

B. Calculate Bad Debt Expense for 2019 (Show your calculation)

C. Debit record

C. Credit record

D. Calculate the company's accounts receivable balance for the year ended Dec 31st, 2019. (Show your calculation)

E. Calculate accounts receivables balance that is over six months past due, and its historical loss rate. (Show your calculation)

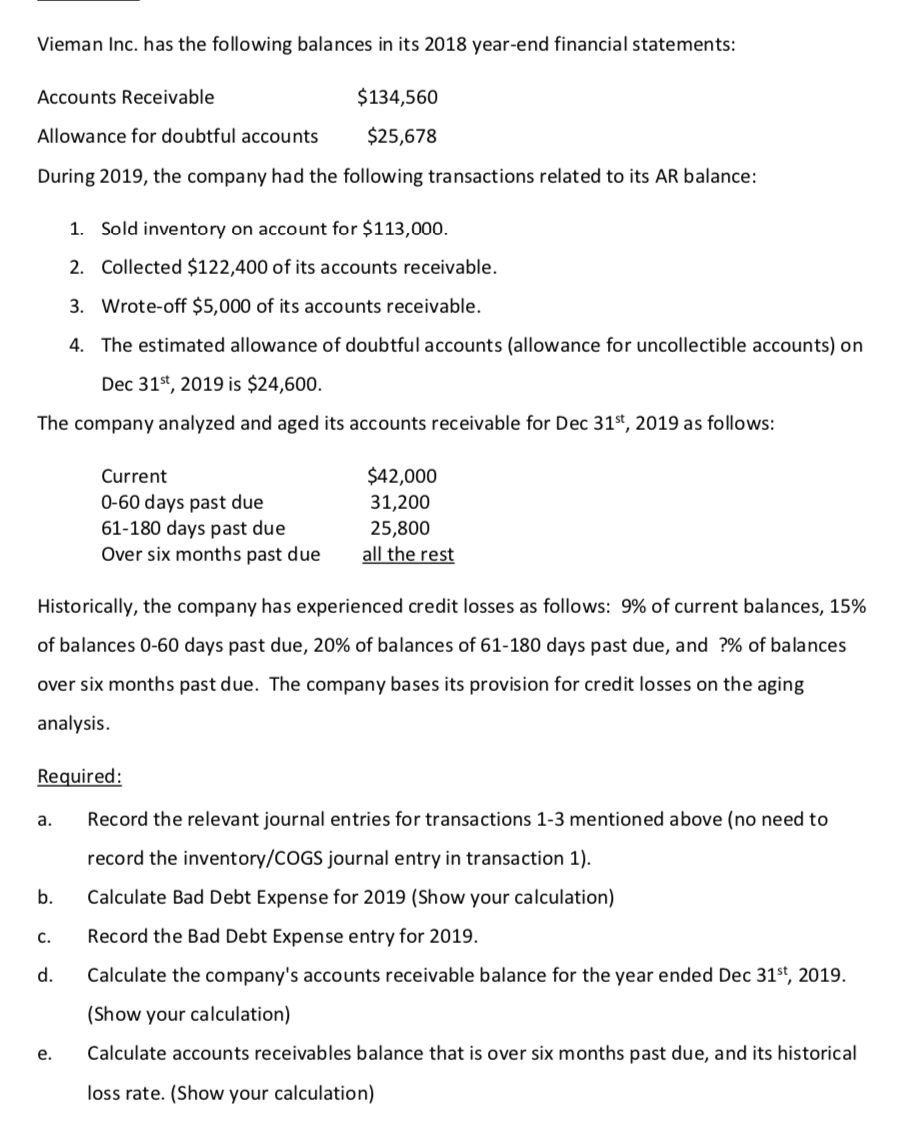

Vieman Inc. has the following balances in its 2018 year-end financial statements: Accounts Receivable $134,560 Allowance for doubtful accounts $25,678 During 2019, the company had the following transactions related to its AR balance: 1. Sold inventory on account for $113,000. 2. Collected $122,400 of its accounts receivable. 3. Wrote-off $5,000 of its accounts receivable. 4. The estimated allowance of doubtful accounts (allowance for uncollectible accounts) on Dec 31st, 2019 is $24,600. The company analyzed and aged its accounts receivable for Dec 31st, 2019 as follows: Current 0-60 days past due 61-180 days past due Over six months past due $42,000 31,200 25,800 all the rest Historically, the company has experienced credit losses as follows: 9% of current balances, 15% of balances 0-60 days past due, 20% of balances of 61-180 days past due, and ?% of balances over six months past due. The company bases its provision for credit losses on the aging analysis. Required: a. Record the relevant journal entries for transactions 1-3 mentioned above (no need to record the inventory/COGS journal entry in transaction 1). Calculate Bad Debt Expense for 2019 (Show your calculation) 0 c. d. Record the Bad Debt Expense entry for 2019. Calculate the company's accounts receivable balance for the year ended Dec 31st, 2019. (Show your calculation) Calculate accounts receivables balance that is over six months past due, and its historical loss rate. (Show your calculation)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts