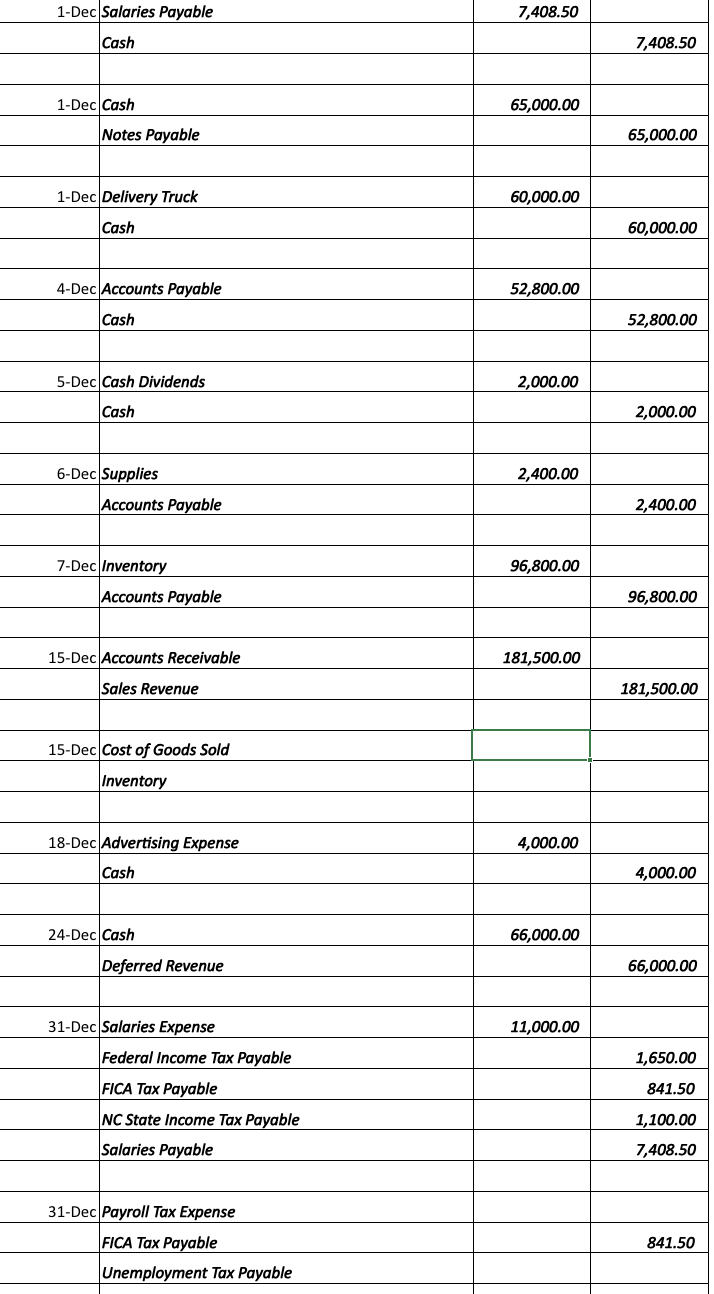

Question: 1 - Dec Salaries Payable 7 , 4 0 8 . 5 0 Cash 7 , 4 0 8 . 5 0 1 - Dec

Dec Salaries Payable Cash Dec Cash Notes Payable Dec Delivery Truck Cash Dec Accounts Payable Cash Dec Cash Dividends Cash Dec Supplies Accounts Payable Dec Inventory Accounts Payable Dec Accounts Receivable Sales Revenue Dec Cost of Goods Sold Inventory Dec Advertising Expense Cash Dec Cash Deferred Revenue Dec Salaries Expense Federal Income Tax Payable FICA Tax Payable NC State Income Tax Payable Salaries Payable Dec Payroll Tax Expense FICA Tax Payable Unemployment Tax Payable

Post all the Daily Transactions to the Ledger on the Ledger tab.

As of December a search revealed the following information. Record any necessary adjusting entries for the year on the Adjusting

Entries tab.

Post all the Adjusting Entires to the Ledger on the Ledger tab.

Based on the account balances in the ledger, create an adjusted trial balance on the Adjusted Trial Balance tab.

Based on the adjusted trial balance, prepare a multistep income statement on the Income Statement tab.

Based on the adjusted trial balance, prepare the statement of stockholders' equity on the Equity Statement tab.

Based on the adjusted trial balance, prepare the balance sheet on the Balance Sheet tab.

Prepare the closing entries DO NOT POST them to the ledger, just produce the entries When journaling, close the accounts in the

order they appear on the Trial Balance. Do one entry for revenue accounts, one for expense accounts and one for dividend accounts.

Calculate the ratios on the Ratios tab.

I need the COG calculated and the final payroll expense Dec st

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock