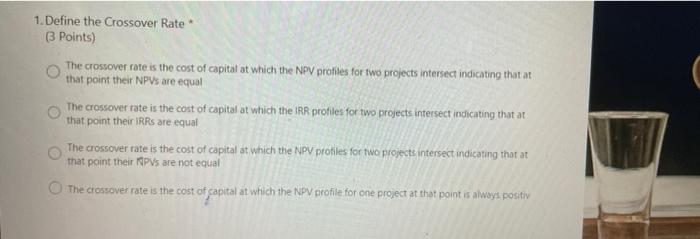

Question: 1. Define the Crossover Rate (3 Points) The crossover rate is the cost of capital at which the NPV profiles for two projects intersect indicating

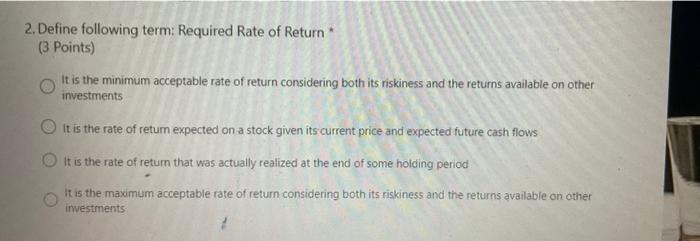

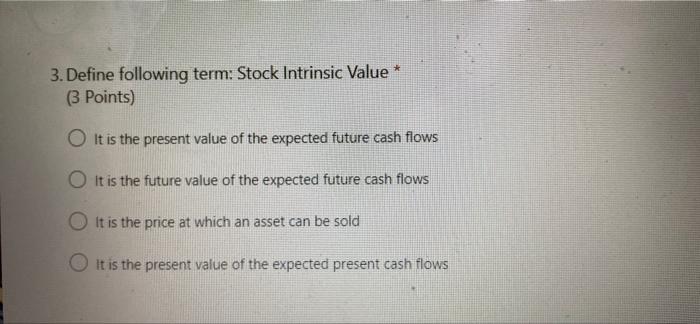

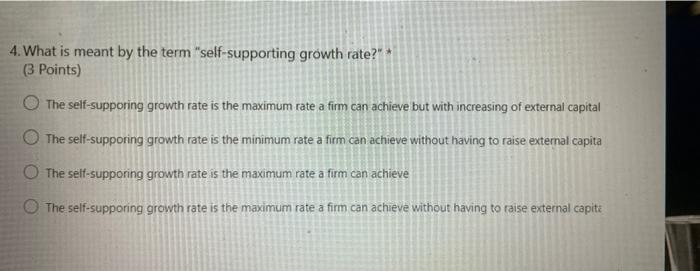

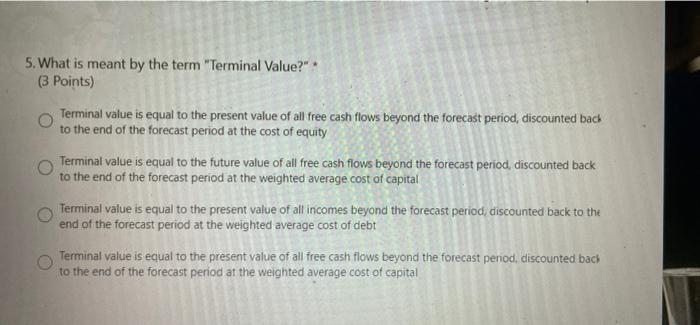

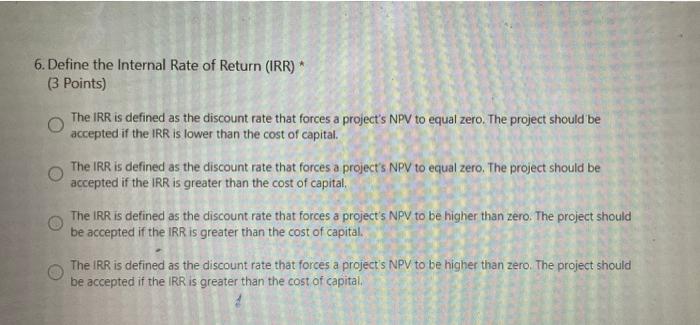

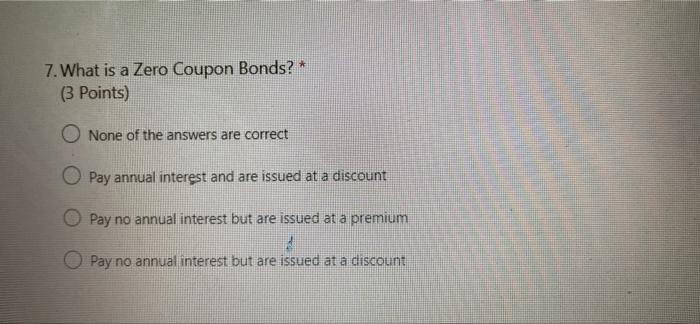

1. Define the Crossover Rate (3 Points) The crossover rate is the cost of capital at which the NPV profiles for two projects intersect indicating that at that point their NPVs are equal The crossover rate is the cost of capital at which the IRR profiles for two projects intersect indicating that at that point their IRRs are equal The crossover rate is the cost of capital at which the NPV profiles for two projects intersect indicating that at that point their NPVs are not equal The crossover rate is the cost of capital at which the NPV profile for one project at that point is always positiv 2. Define following term: Required Rate of Return (3 Points) It is the minimum acceptable rate of return considering both its riskiness and the returns available on other investments It is the rate of return expected on a stock given its current price and expected future cash flows it is the rate of return that was actually realized at the end of some holding period It is the maximum acceptable rate of return considering both its riskiness and the returns available on other investments 3. Define following term: Stock Intrinsic Value * (3 Points) O It is the present value of the expected future cash flows O It is the future value of the expected future cash flows It is the price at which an asset can be sold It is the present value of the expected present cash flows 4. What is meant by the term "self-supporting growth rate?" (3 Points) The self-supporing growth rate is the maximum rate a firm can achieve but with increasing of external capital The self-supporing growth rate is the minimum rate a firm can achieve without having to raise external capita The self-supporing growth rate is the maximum rate a firm can achieve The self-supporing growth rate is the maximum rate a firm can achieve without having to raise external capita 5. What is meant by the term "Terminal Value?" (3 Points) Terminal value is equal to the present value of all free cash flows beyond the forecast period, discounted bach to the end of the forecast period at the cost of equity Terminal value is equal to the future value of all free cash flows beyond the forecast period, discounted back to the end of the forecast period at the weighted average cost of capital Terminal value is equal to the present value of all incomes beyond the forecast period, discounted back to the end of the forecast period at the weighted average cost of debt Terminal value is equal to the present value of all free cash flows beyond the forecast period, discounted back to the end of the forecast period at the weighted average cost of capital 6. Define the Internal Rate of Return (IRR)* (3 Points) The IRR is defined as the discount rate that forces a project's NPV to equal zero. The project should be accepted if the IRR is lower than the cost of capital. The IRR is defined as the discount rate that forces a project's NPV to equal zero. The project should be accepted if the IRR is greater than the cost of capital, The IRR is defined as the discount rate that forces a project's NPV to be higher than zero. The project should be accepted if the IRR is greater than the cost of capital. The IRR is defined as the discount rate that forces a project's NPV to be higher than zero. The project should be accepted if the IRR is greater than the cost of capital. a 7. What is a Zero Coupon Bonds? * (3 Points) O None of the answers are correct Pay annual interest and are issued at a discount O Pay no annual interest but are issued at a premium O Pay no annual interest but are issued at a discount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts