Question: 1. Define the following concepts - a common stock - a preferred stock 2. What are the main characteristics of the common stock? 3. What

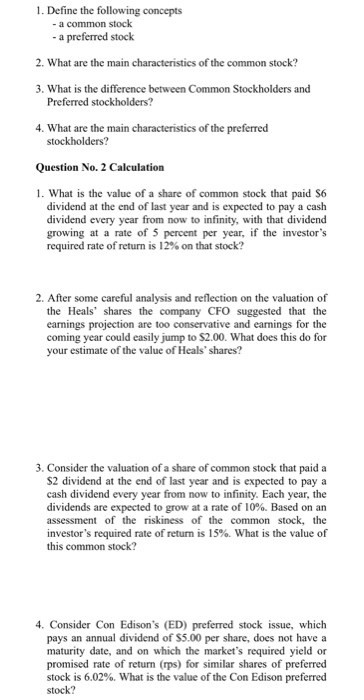

1. Define the following concepts - a common stock - a preferred stock 2. What are the main characteristics of the common stock? 3. What is the difference between Common Stockholders and Preferred stockholders? 4. What are the main characteristics of the preferred stockholders? Question No. 2 Calculation 1. What is the value of a share of common stock that paid $6 dividend at the end of last year and is expected to pay a cash dividend every year from now to infinity, with that dividend growing at a rate of 5 percent per year, if the investor's required rate of return is 12% on that stock? 2. After some careful analysis and reflection on the valuation of the Heals' shares the company CFO suggested that the eamings projection are too conservative and earnings for the coming year could easily jump to $2.00. What does this do for your estimate of the value of Heals' shares? 3. Consider the valuation of a share of common stock that paid a $2 dividend at the end of last year and is expected to pay a cash dividend every year from now to infinity. Each year, the dividends are expected to grow at a rate of 10%. Based on an assessment of the riskiness of the common stock, the investor's required rate of return is 15%. What is the value of this common stock? 4. Consider Con Edison's (ED) preferred stock issue, which pays an annual dividend of $5.00 per share, does not have a maturity date, and on which the market's required yield or promised rate of return (ps) for similar shares of preferred stock is 6.02%. What is the value of the Con Edison preferred stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts