Question: 1. Demonstrate graphically and explain how a reduction in default risk affects the demand and supply of corporate and Treasury bonds. What happens to the

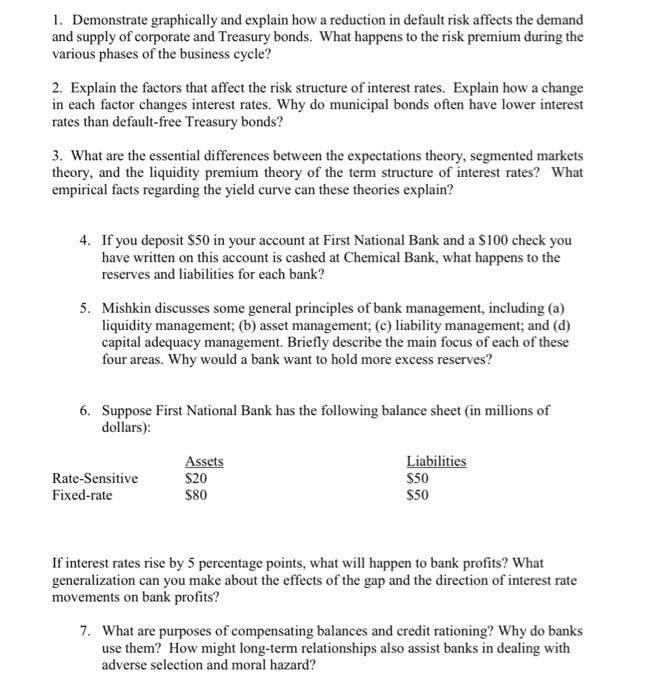

1. Demonstrate graphically and explain how a reduction in default risk affects the demand and supply of corporate and Treasury bonds. What happens to the risk premium during the various phases of the business cycle? 2. Explain the factors that affect the risk structure of interest rates. Explain how a change in each factor changes interest rates. Why do municipal bonds often have lower interest rates than default-free Treasury bonds? 3. What are the essential differences between the expectations theory, segmented markets theory, and the liquidity premium theory of the term structure of interest rates? What empirical facts regarding the yield curve can these theories explain? 4. If you deposit $50 in your account at First National Bank and a $100 check you have written on this account is cashed at Chemical Bank, what happens to the reserves and liabilities for each bank? 5. Mishkin discusses some general principles of bank management, including (a) liquidity management; (b) asset management; (c) liability management; and (d) capital adequacy management. Briefly describe the main focus of each of these four areas. Why would a bank want to hold more excess reserves? 6. Suppose First National Bank has the following balance sheet (in millions of dollars): If interest rates rise by 5 percentage points, what will happen to bank profits? What generalization can you make about the effects of the gap and the direction of interest rate movements on bank profits? 7. What are purposes of compensating balances and credit rationing? Why do banks use them? How might long-term relationships also assist banks in dealing with adverse selection and moral hazard

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts