Question: 1. Designated market value a. is always the middle value of replacement cost, net realizable value, and net realizable value less a normal profit

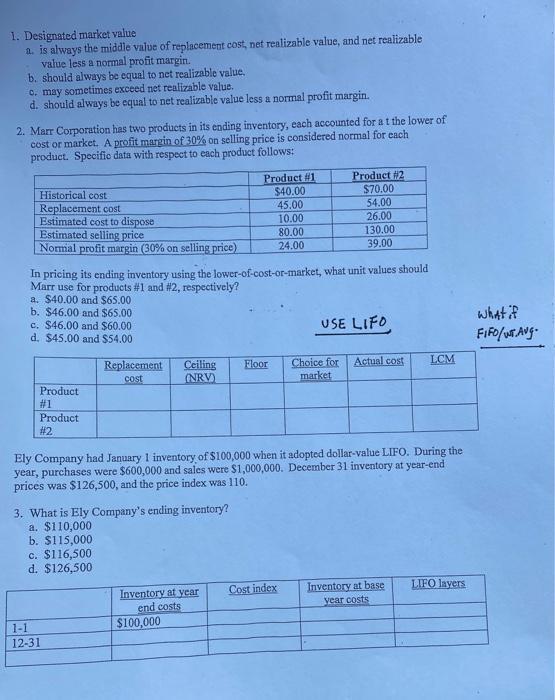

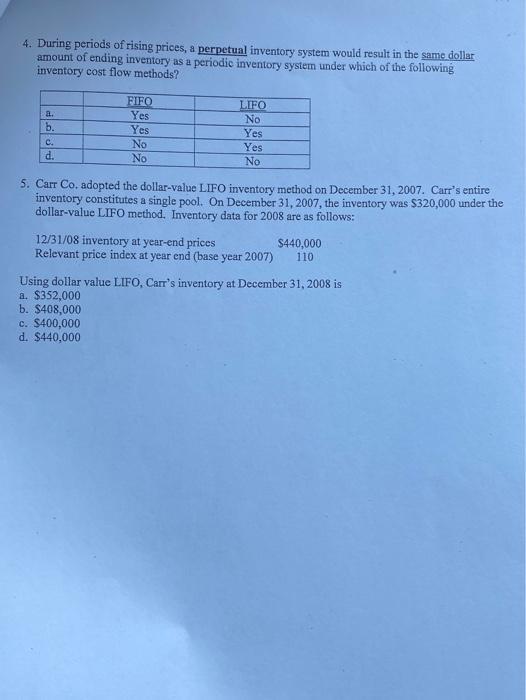

1. Designated market value a. is always the middle value of replacement cost, net realizable value, and net realizable value less a normal profit margin. b. should always be equal to net realizable value. c. may sometimes exceed net realizable value. d. should always be equal to net realizable value less a normal profit margin. 2. Marr Corporation has two products in its ending inventory, each accounted for at the lower of cost or market. A profit margin of 30% on selling price is considered normal for each product. Specific data with respect to cach product follows: Historical cost Replacement cost Estimated cost to dispose Estimated selling price Nomal profit margin (30% on selling price) Product #1 $40.00 45.00 10.00 80.00 Product #2 $70.00 54.00 26.00 130.00 24.00 39.00 In pricing its ending inventory using the lower-of-cost-or-market, what unit values should Marr use for products #1 and #2, respectively? a. $40.00 and $65.00 b. $46.00 and $65.00 c. $46.00 and $60.00 d. $45.00 and $54.00 USE LIFO what if Replacement cost Choice for market Actual cost Ceiling (NRV) Floor LCM Product #1 Product #2 Ely Company had January 1 inventory of $100,000 when it adopted dollar-value LIFO. During the year, purchases were $600,000 and sales were $1,000,000. December 31 inventory at year-end prices was $126,500, and the price index was 110. 3. What is Ely Company's ending inventory? a. $110,000 b. $115,000 c. $116,500 d. $126,500 LIFO layers Inventory at base vear costs Cost index Inventory at year end costs $100,000 1-1 12-31 4. During periods of rising prices, a perpetual inventory system would result in the same dollar amount of ending inventory as a periodic inventory system under which of the following inventory cost flow methods? FIFO Yes Yes LIFO a. No b. Yes C. No Yes d. No No 5. Carr Co, adopted the dollar-value LIFO inventory method on December 31, 2007. Carr's entire inventory constitutes a single pool. On December 31, 2007, the inventory was $320,000 under the dollar-value LIFO method. Inventory data for 2008 are as follows: 12/31/08 inventory at year-end prices Relevant price index at year end (base year 2007) $440,000 110 Using dollar value LIFO, Carr's inventory at December 31, 2008 is a. $352,000 b. $408,000 c. $400,000 d. $440,000

Step by Step Solution

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Question 1 Designated Market Value The designated market value is used to determine the appropriate value to assign to inventory when using the lowero... View full answer

Get step-by-step solutions from verified subject matter experts