Question: 1- Determine how changes in volume affect costs? (1 mark) 2- How Is Cost-Volume-Profit (CVP) Analysis Used? (1 mark) E20-23 Calculating contribution margin ratio, preparing

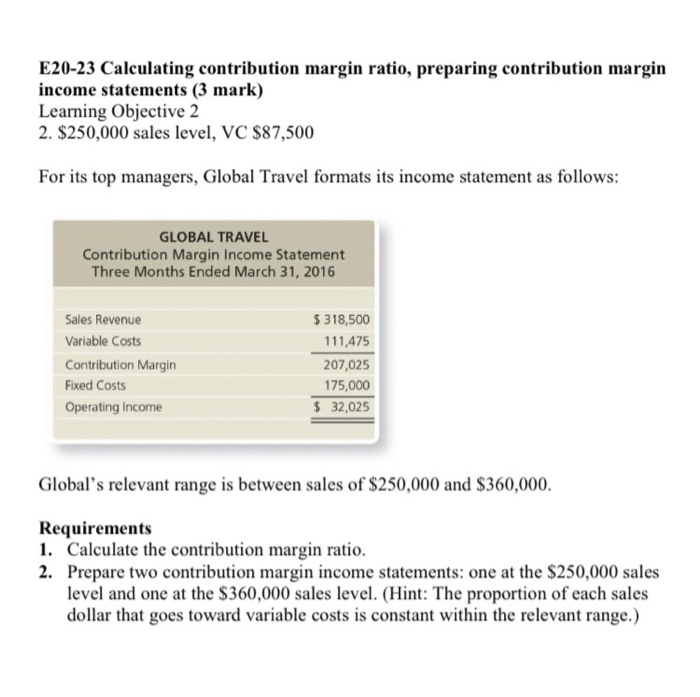

1- Determine how changes in volume affect costs? (1 mark) 2- How Is Cost-Volume-Profit (CVP) Analysis Used? (1 mark) E20-23 Calculating contribution margin ratio, preparing contribution margin income statements (3 mark) Learning Objective 2 2. $250,000 sales level, VC $87,500 For its top managers, Global Travel formats its income statement as follows: GLOBAL TRAVEL Contribution Margin Income Statement Three Months Ended March 31, 2016 Sales Revenue Variable Costs Contribution Margin Fixed Costs Operating Income $318,500 111,475 207,025 175,000 $32,025 Global's relevant range is between sales of $250,000 and $360,000. Requirements 1. Calculate the contribution margin ratio. 2. Prepare two contribution margin income statements: one at the $250,000 sales level and one at the $360,000 sales level. (Hint: The proportion of each sales dollar that goes toward variable costs is constant within the relevant range.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts