Question: 1. Determine the appropriate weights for each component in the capital structure: Use the amount of retained earnings (as part of common equity) provided. The

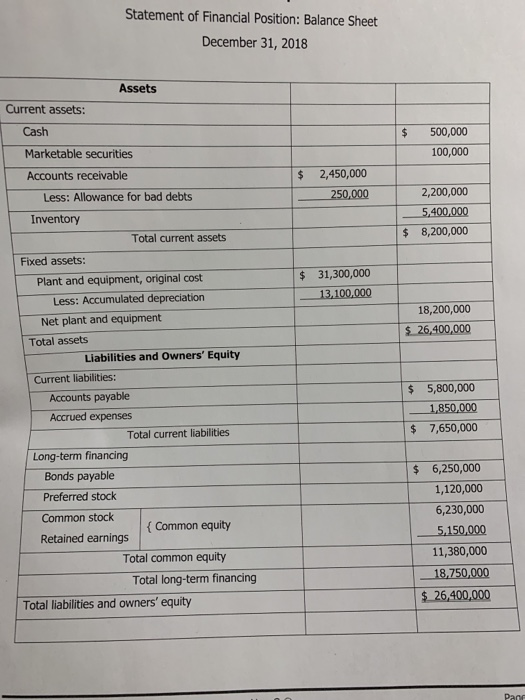

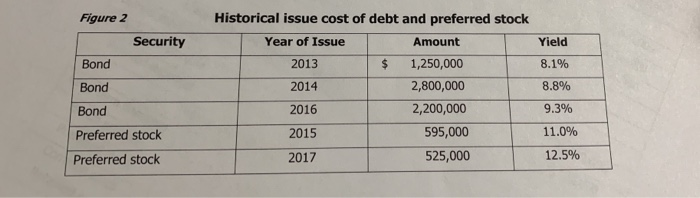

1. Determine the appropriate weights for each component in the capital structure: Use the amount of retained earnings (as part of common equity) provided. The percentage composition (weights) in the capital structure for bonds, preferred stock, and common equity should be based on the current capital structure long-term financing section as shown in Figure 1 (indicated as $18.75 million). Common equity will remain at the current weight throughout the case, and the combined tax rate is 25%. Statement of Financial Position: Balance Sheet December 31, 2018 500,000 100,000 $ 2,450,000 250,000 2,200,000 5,400,000 8,200,000 $ $ 31,300,000 13,100,000 18,200,000 $ 26,400,000 Assets Current assets: Cash Marketable securities Accounts receivable Less: Allowance for bad debts Inventory Total current assets Fixed assets: Plant and equipment, original cost Less: Accumulated depreciation Net plant and equipment Total assets Liabilities and Owners' Equity Current liabilities: Accounts payable Accrued expenses Total current liabilities Long-term financing Bonds payable Preferred stock Common stock { Common equity Retained earnings Total common equity Total long-term financing Total liabilities and owners' equity $ 5,800,000 1,850,000 7,650,000 $ $ 6,250,000 1,120,000 6,230,000 5.150,000 11,380,000 18,750,000 $ 26,400,000 Figure 2 Security Bond Bond Bond Preferred stock Preferred stock Historical issue cost of debt and preferred stock Year of Issue Amount 2013 $ 1,250,000 2014 2,800,000 2016 2,200,000 2015 595,000 2017 525,000 Yield 8.1% 8.8% 9.3% 11.0% 12.5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts