Question: 1. Determine the future values utilizing a time preference rate of 9 per cent : (4) The future value of Re 15,000 invested now for

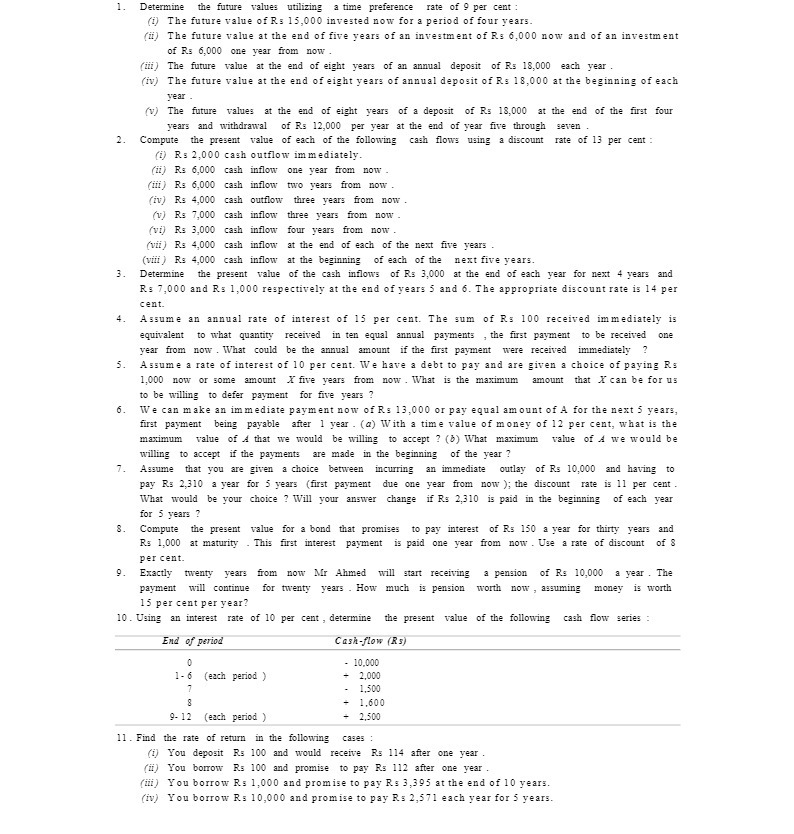

1. Determine the future values utilizing a time preference rate of 9 per cent : (4) The future value of Re 15,000 invested now for a period of four years. (") The future value at the end of five years of an investment of Re 6,000 now and of an investment of R.s 6,000 one year from now (iii) The future value at the end of eight years of an annual deposit of RE 18,000 each year . (iv) The future value at the end of eight years of annual deposit of Re 18,000 at the beginning of each year (v) The future values at the end of eight years of a deposit of Re 18,000 at the end of the first four years and withdrawal of Re 12,000 per year at the end of year five through seven . 2. Compute the present value of each of the following cash flows using a discount rate of 13 per cent : (1) Re 2,000 cash outflow immediately. (ii) Re 6,000 cash inflow one year from now (iff) Re 6,000 cash inflow two years from now "iv) Re 4,000 cash outflow three years from now . (v) Re 7,000 cash inflow three years from now . "vij Re 3,000 cash inflow four years from now (vii) Re 4,000 cash inflow at the end of each of the next five years . (wiff ) Re 4,000 cash inflow at the beginning of each of the next five years. 3. Determine the present value of the cash inflows of Re 3,000 at the end of each year for next 4 years and Re 7,000 and Re 1,000 respectively at the end of years 5 and 6. The appropriate discount rate is 14 per cent. 4 . Assume an annual rate of interest of 15 per cent. The sum of Re 100 received immediately is equivalent to what quantity received in ten equal annual payments , the first payment to be received one year from now . What could be the annual amount if the first payment were received immediately 5. Assume a rate of interest of 10 per cent. We have a debt to pay and are given a choice of paying RE 1,000 now or some amount X five years from now . What is the maximum amount that I can be for us to be willing to defer payment for five years ? 6. We can make an immediate payment now of Re 13,000 or pay equal amount of A for the next 5 years, first payment being payable after 1 year . (@) With a time value of money of 12 per cent, what is the maximum value of A that we would be willing to accept ? ($) What maximum value of A we would be willing to accept if the payments are made in the beginning of the year ? 1. Assume that you are given a choice between incurring an immediate outlay of Re 10,000 and having to pay Re 2,310 a year for 5 years (first payment due one year from now ); the discount rate is 11 per cent . What would be your choice ? Will your answer change if Re 2,310 is paid in the beginning of each year for 5 years ? S . Compute the present value for a bond that promises to pay interest of Re 150 a year for thirty years and Re 1,000 at maturity . This first interest payment is paid one year from now . Use a rate of discount of per cent. Exactly twenty years from now Mr Ahmed will start receiving a pension of Re 10,000 a year . The payment will continue for twenty years . How much is pension worth now , assuming n money is worth 15 per cent per year? 10. Using an interest rate of 10 per cent , determine the present value of the following cash flow series : End of period Cash-flow (RS) 10.000 1 - 6 (each period ) 2,000 1,500 1,600 2 (each period ) 2,500 11. Find the rate of return in the following cages : (i) You deposit Rs 100 and would receive Rs 114 after one year . (i) You borrow Rs 100 and promise to pay Rs 112 after one year (ifi) You borrow Rs 1,000 and promise to pay Re 3,395 at the end of 10 years. (iv) You borrow Re 10,000 and promise to pay Re 2,571 each year for 5 years