Question: i) ii) Kent purchased an investment property for $750,000 today. It is expected that the annual rent for the property would be $31,200. According

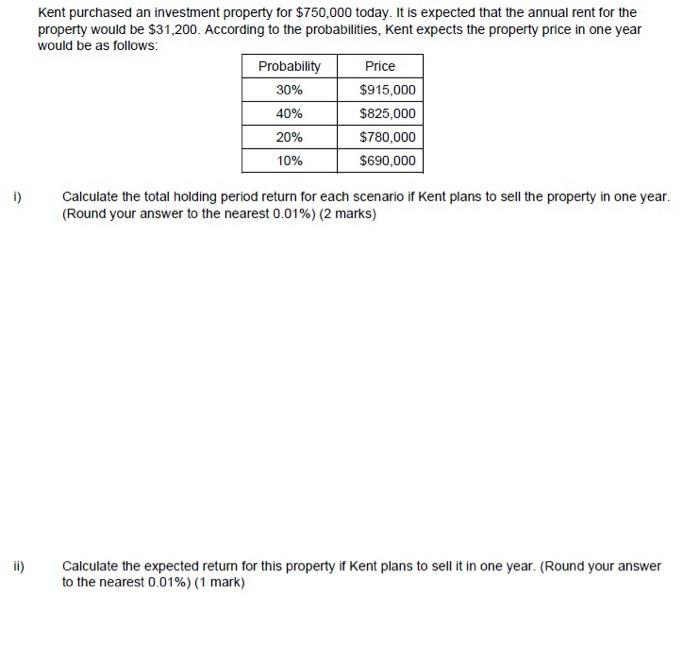

i) ii) Kent purchased an investment property for $750,000 today. It is expected that the annual rent for the property would be $31,200. According to the probabilities, Kent expects the property price in one year would be as follows: Probability 30% 40% 20% 10% Price $915,000 $825,000 $780,000 $690,000 Calculate the total holding period return for each scenario if Kent plans to sell the property in one year. (Round your answer to the nearest 0.01%) (2 marks) Calculate the expected return for this property if Kent plans to sell it in one year. (Round your answer to the nearest 0.01%) (1 mark)

Step by Step Solution

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Formulae Value of investment property Annual rent for the property i Probabilty ii Pr... View full answer

Get step-by-step solutions from verified subject matter experts