Question: 1. Discuss the difference between book values and market values and explain which one is more important to the financial manager and why 2. Bonner

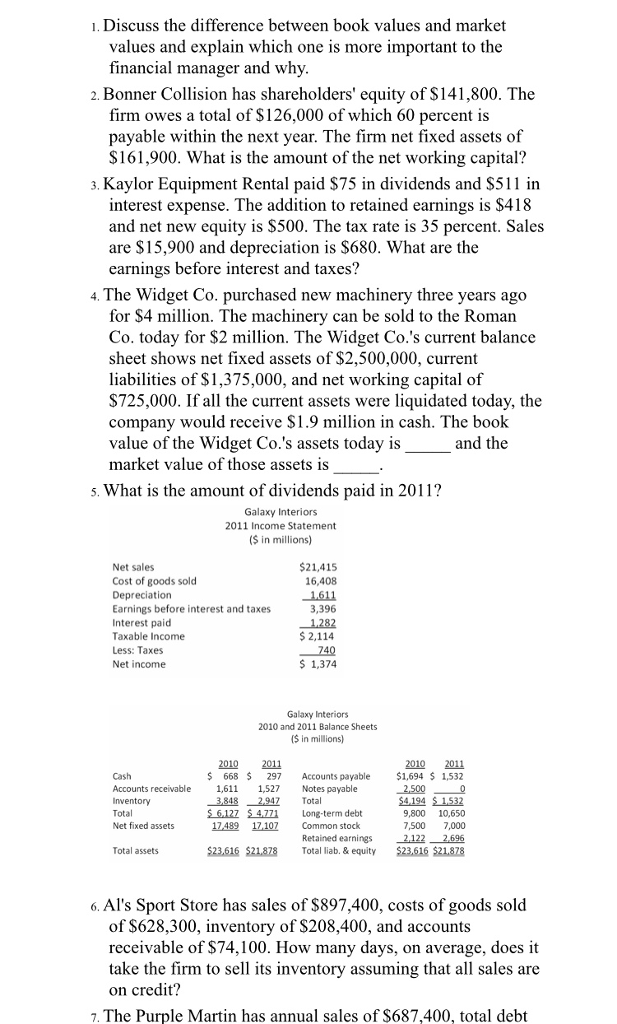

1. Discuss the difference between book values and market values and explain which one is more important to the financial manager and why 2. Bonner Collision has shareholders' equity of S141,800. The firm owes a total of S126,000 of which 60 percent is payable within the next year. The firm net fixed assets of $161,900. What is the amount of the net working capital? 3. Kaylor Equipment Rental paid $75 in dividends and S511 in interest expense. The addition to retained earnings is $418 and net new equity is $500. The tax rate is 35 percent. Sales are S15,900 and depreciation is S680. What are the earnings before interest and taxes? 4. The Widget Co. purchased new machinery three years ago for S4 million. The machinery can be sold to the Roman Co. today for $2 million. The Widget Co.'s current balance sheet shows net fixed assets of $2,500,000, current liabilities of $1,375,000, and net working capital of S725,000. If all the current assets were liquidated today, the company would receive $1.9 million in cash. The book value of the Widget Co.'s assets today is market value of those assets is and the s. What is the amount of dividends paid in 2011? Galaxy Interiors 2011 Income Statement ($ in millions) Net sales Cost of goods sold Depreciation Earnings before interest and taxes Interest paid Taxable Income Less: Taxes Net income 21,415 16,408 1611 3,396 1,282 2,114 740 $ 1,374 Galaxy Interiors 2010 and 2011 Balance Sheets (S in millions) 2010 2011 2010 2011 $668 $ 297 Accounts payable $1,694 $ 1,532 Cash Accounts receivable ,61 1,527 Notes payable 2,500 -3848 2.947 Total $612 4771 ong-term deblt 17489 1710 Common stock $4,194 $1532 9,800 10,650 7,500 7,000 Retained earnings21222.696 523,616 $21,878 Total liab. & equity $23,616 $21,878 Total Net fixed assets Total assets 6. Al's Sport Store has sales of $897,400, costs of goods sold of S628,300, inventory of $208,400, and accounts receivable of $74,100. How many days, on average, does it take the firm to sell its inventory assuming that all sales are on credit? 7. The Purple Martin has annual sales of S687,400, total debt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts