Question: (1) Do you remember that link to the U.S. Code in the syllabus? Good, so now go find Code $ 165, look it over, then

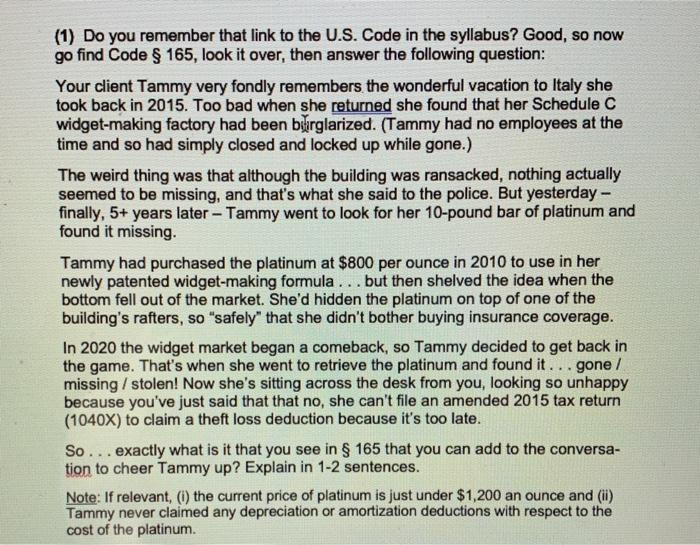

(1) Do you remember that link to the U.S. Code in the syllabus? Good, so now go find Code $ 165, look it over, then answer the following question: Your client Tammy very fondly remembers the wonderful vacation to Italy she took back in 2015. Too bad when she returned she found that her Schedule C widget-making factory had been blirglarized. (Tammy had no employees at the time and so had simply closed and locked up while gone.) The weird thing was that although the building was ransacked, nothing actually seemed to be missing, and that's what she said to the police. But yesterday - finally, 5+ years later - Tammy went to look for her 10-pound bar of platinum and found it missing. Tammy had purchased the platinum at $800 per ounce in 2010 to use in her newly patented widget-making formula ... but then shelved the idea when the bottom fell out of the market. She'd hidden the platinum on top of one of the building's rafters, so "safely" that she didn't bother buying insurance coverage. In 2020 the widget market began a comeback, so Tammy decided to get back in the game. That's when she went to retrieve the platinum and found it... gone / missing / stolen! Now she's sitting across the desk from you, looking so unhappy because you've just said that that no, she can't file an amended 2015 tax return (1040X) to claim a theft loss deduction because it's too late. So... exactly what is it that you see in 165 that you can add to the conversa- tion to cheer Tammy up? Explain in 1-2 sentences. Note: If relevant, () the current price of platinum is just under $1,200 an ounce and (ii) Tammy never claimed any depreciation or amortization deductions with respect to the cost of the platinum. (1) Do you remember that link to the U.S. Code in the syllabus? Good, so now go find Code $ 165, look it over, then answer the following question: Your client Tammy very fondly remembers the wonderful vacation to Italy she took back in 2015. Too bad when she returned she found that her Schedule C widget-making factory had been blirglarized. (Tammy had no employees at the time and so had simply closed and locked up while gone.) The weird thing was that although the building was ransacked, nothing actually seemed to be missing, and that's what she said to the police. But yesterday - finally, 5+ years later - Tammy went to look for her 10-pound bar of platinum and found it missing. Tammy had purchased the platinum at $800 per ounce in 2010 to use in her newly patented widget-making formula ... but then shelved the idea when the bottom fell out of the market. She'd hidden the platinum on top of one of the building's rafters, so "safely" that she didn't bother buying insurance coverage. In 2020 the widget market began a comeback, so Tammy decided to get back in the game. That's when she went to retrieve the platinum and found it... gone / missing / stolen! Now she's sitting across the desk from you, looking so unhappy because you've just said that that no, she can't file an amended 2015 tax return (1040X) to claim a theft loss deduction because it's too late. So... exactly what is it that you see in 165 that you can add to the conversa- tion to cheer Tammy up? Explain in 1-2 sentences. Note: If relevant, () the current price of platinum is just under $1,200 an ounce and (ii) Tammy never claimed any depreciation or amortization deductions with respect to the cost of the platinum

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts