Question: 1. Does CAPM Work? 2. What are some of Application problems of CAPM? 3. Chicago Corp stock will pay a dividend of $1.32 next year.

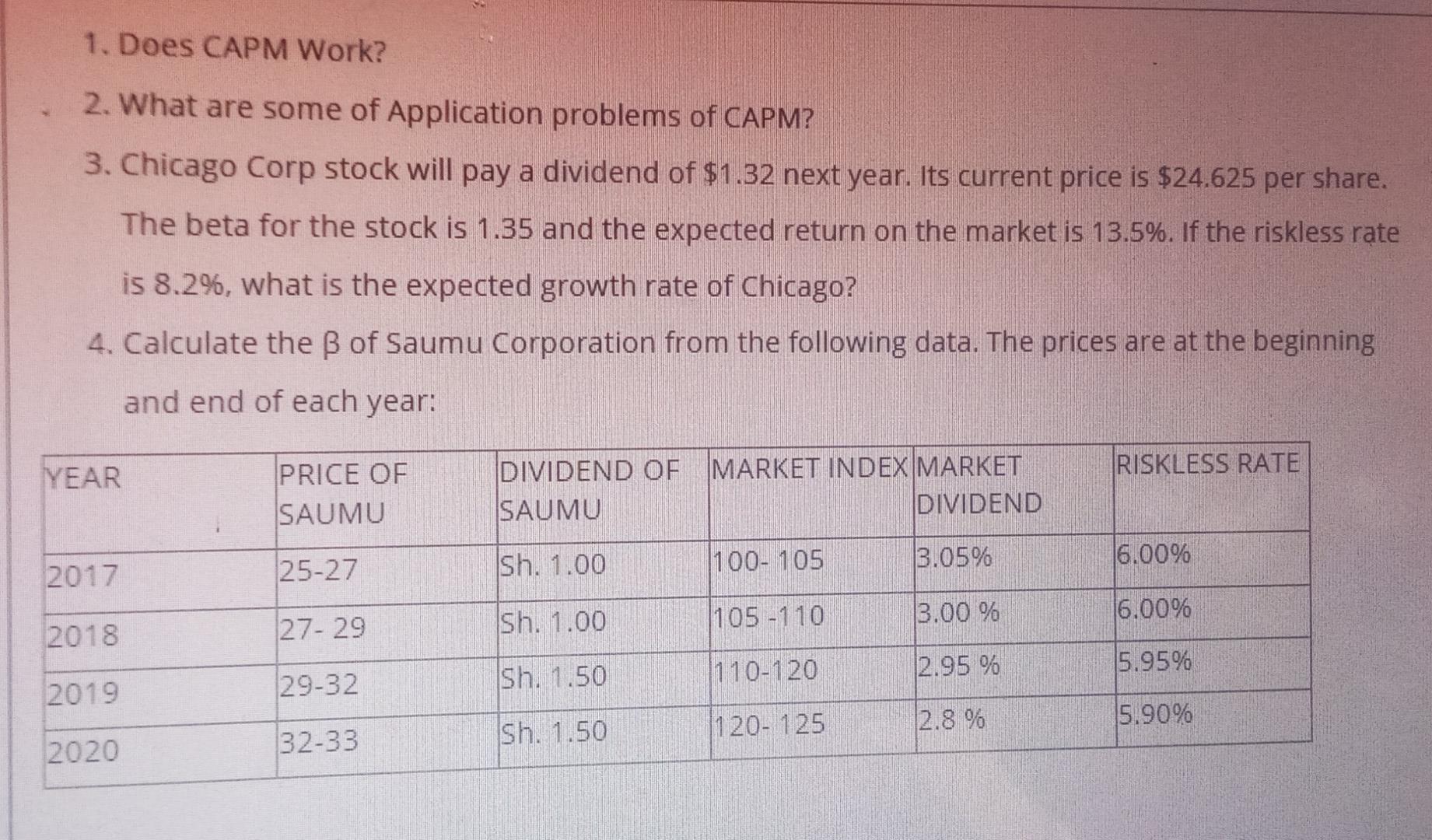

1. Does CAPM Work? 2. What are some of Application problems of CAPM? 3. Chicago Corp stock will pay a dividend of $1.32 next year. Its current price is $24.625 per share. The beta for the stock is 1.35 and the expected return on the market is 13.5%. If the riskless rate is 8.2%, what is the expected growth rate of Chicago? 4. Calculate the B of Saumu Corporation from the following data. The prices are at the beginning and end of each year: YEAR RISKLESS RATE PRICE OF SAUMU DIVIDEND OF MARKET INDEX MARKET SAUMU DIVIDEND 100-105 Sh. 1.00 25-27 3.05% 6.00% 2017 1105 -110 3.00 % Sh. 1.00 16.00% 2018 27-29 1110-120 2.95 % 5.95% Sh. 1.50 2019 29-32 2.8 % 5.90% 1120-125 Sh. 1.50 2020 32-33

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts