Question: 1. Does the transaction (all or in part) qualify for section 351 treatment? Explain. 2. For each shareholder, compute: a) Amount of realized gain or

1. Does the transaction (all or in part) qualify for section 351 treatment? Explain.

1. Does the transaction (all or in part) qualify for section 351 treatment? Explain.

2. For each shareholder, compute:

a) Amount of realized gain or loss

b) Amount of recognized gain or loss

c) Identify the nature ( ordinary vs. capital) of any such recognized gain or loss

d) The Investor shareholder's basis in Shadow's stock

3. What is Shadow's basis in the following property received?

a) Inventory

b) Machinery

c) Land

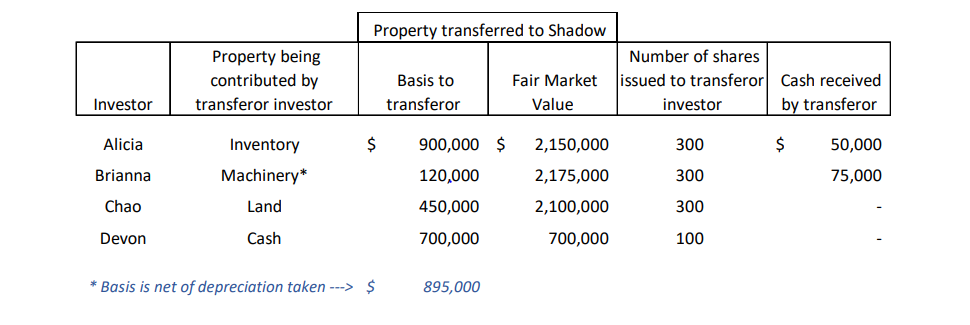

Property transferred to Shadow Property being contributed by transferor investor Basis to transferor Fair Market Value Number of shares issued to transferor Cash received investor by transferor Investor Alicia $ 900,000 $ 2,150,000 300 $ Inventory Machinery* 50,000 75,000 Brianna 120,000 300 2,175,000 2,100,000 Chao Land 450,000 300 Devon Cash 700,000 700,000 100 * Basis is net of depreciation taken ---> $ 895,000 Property transferred to Shadow Property being contributed by transferor investor Basis to transferor Fair Market Value Number of shares issued to transferor Cash received investor by transferor Investor Alicia $ 900,000 $ 2,150,000 300 $ Inventory Machinery* 50,000 75,000 Brianna 120,000 300 2,175,000 2,100,000 Chao Land 450,000 300 Devon Cash 700,000 700,000 100 * Basis is net of depreciation taken ---> $ 895,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts