Question: 1 . Draw a decision tree reflecting the uncertainty over the next two periods. Identify each node in terms of demand and exchange rate and

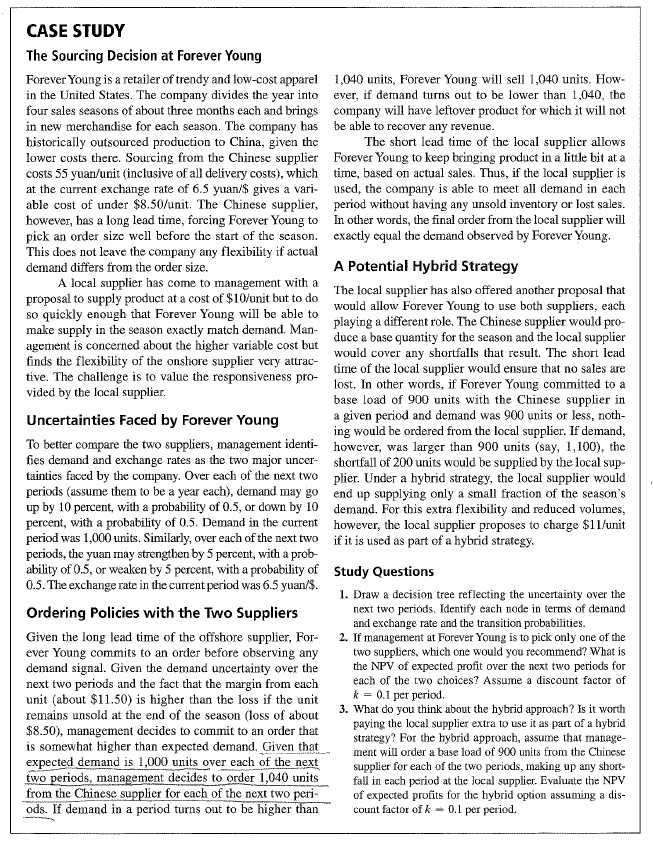

Draw a decision tree reflecting the uncertainty over the next two periods. Identify each node in terms of demand and exchange rate and the transition probabilities. If management at Forever Young is to pick only one of the two suppliers, which one would you recommend? What is the NPV of expected profit over the next two periods for each of the two choices? Assume a discount factor of k per period. What do you think about the hybrid approach? Is it worth paying the local supplier extra to use it as part of a hybrid strategy? for the hybrid approach assume that management will order a base load of units from the Chinese supplier for each of the periods, making up any shortfall in each period at the local supplier. Evaluate the NVP of expected profits for the hybrid option assuming a discount factor of k per period.

how you get below values? yuan$ E and yuan$ E

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock