Question: 1 drop down options: 200,000 , 160,000 , 20,000 , 120,000 , 40,000. 2nd drop down option: in addition to or but eould forfeit. 3rd:

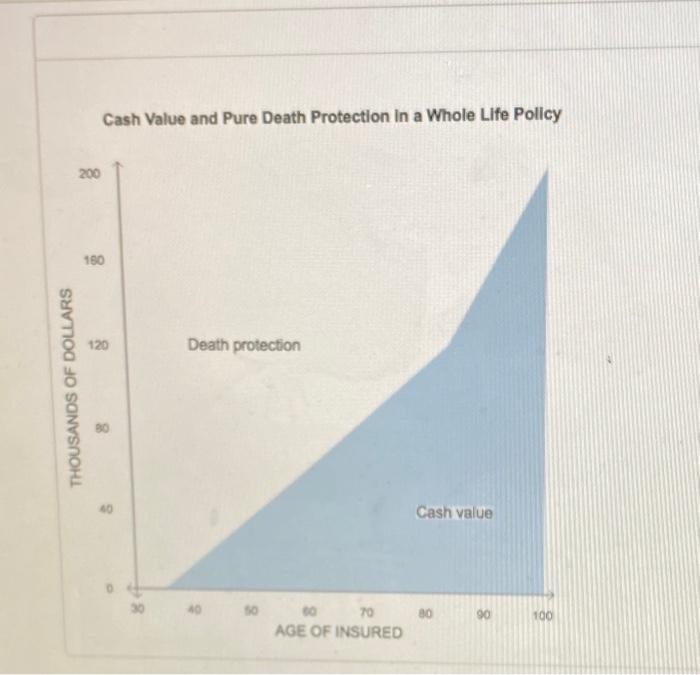

Cash Value and Pure Death Protection in a Whole Life Policy 200 180 120 Death protection THOUSANDS OF DOLLARS 8 Cash value 30 SO 80 90 100 30 70 AGE OF INSURED The graph projects the cash value and death protection for a $200,000 whole life policy. If the dient were to die at age 90, his beneficiaries would receive roughly in death protection the cash value. If instead, at age 70, the client were to cancel or borrow against the policy, he would be able to withdraw up to because of the associated with whole life insurance True or False: The actual cash value of the plan is subject to change based on annual market rates of return. True Faise

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts