Question: ( 1 ) During 2 0 2 1 , its first year of operations as a delivery service, Underwood Corp. ( 1 ) During 2

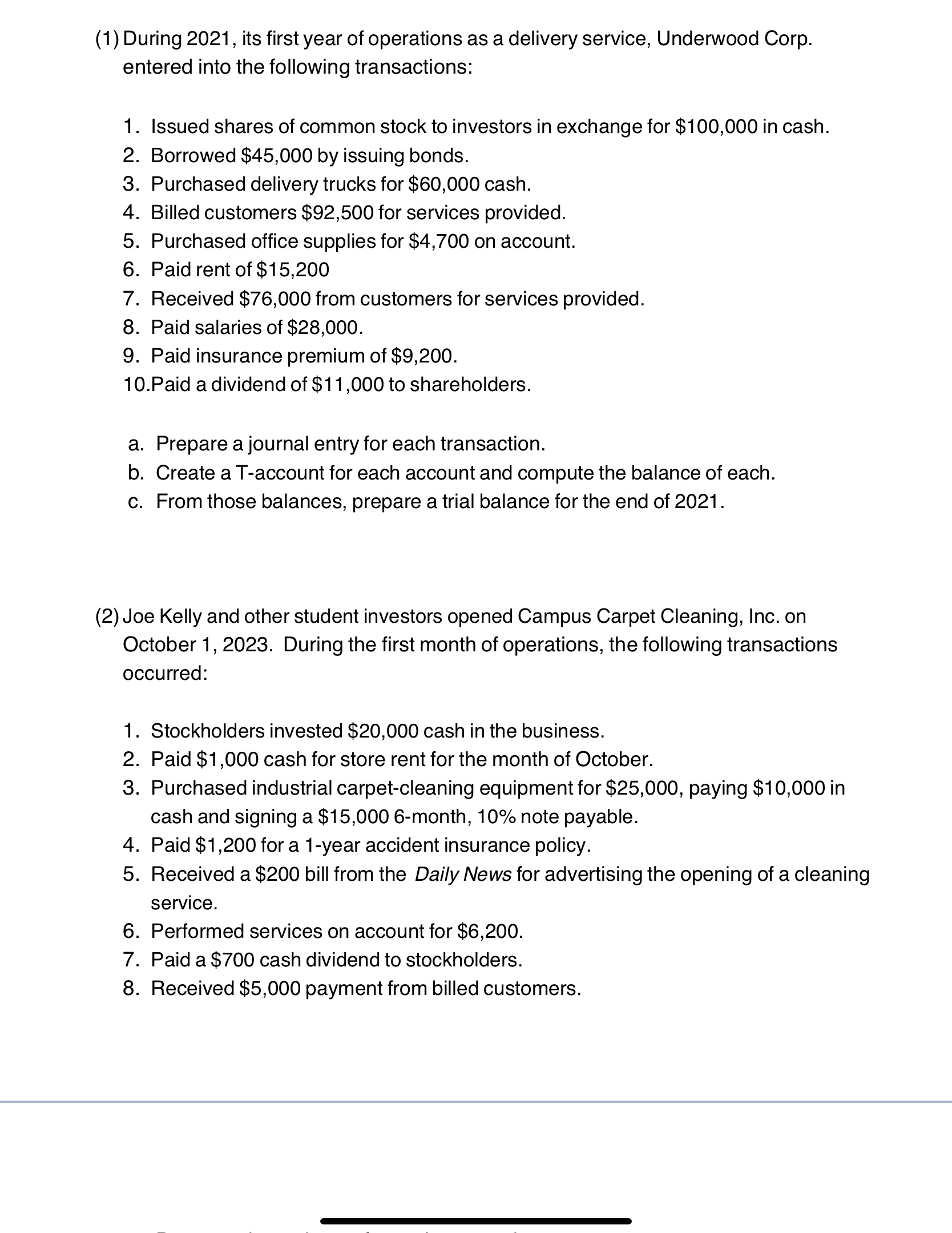

During its first year of operations as a delivery service, Underwood Corp.

During its first year of operations as a delivery service, Underwood Corp.

entered into the following transactions:

Issued shares of common stock to investors in exchange for $ in cash.

Borrowed $ by issuing bonds.

Purchased delivery trucks for $ cash.

Billed customers $ for services provided.

Purchased office supplies for $ on account.

Paid rent of $

Received $ from customers for services provided.

Paid salaries of $

Paid insurance premium of $

Paid a dividend of $ to shareholders.

a Prepare a journal entry for each transaction.

b Create a Taccount for each account and compute the balance of each.

c From those balances, prepare a trial balance for the end of

Joe Kelly and other student investors opened Campus Carpet Cleaning, Inc. on

October During the first month of operations, the following transactions

occurred:

Stockholders invested $ cash in the business.

Paid $ cash for store rent for the month of October.

Purchased industrial carpetcleaning equipment for $ paying $ in

cash and signing a $month, note payable.

Paid $ for a year accident insurance policy.

Received a $ bill from the Daily News for advertising the opening of a cleaning

service.

Performed services on account for $

Paid a $ cash dividend to stockholders.

Received $ payment from billed customers.

entered into the following transactions:

Issued shares of common stock to investors in exchange for $ in cash.

Borrowed $ by issuing bonds.

Purchased delivery trucks for $ cash.

Billed customers $ for services provided.

Purchased office supplies for $ on account.

Paid rent of $

Received $ from customers for services provided.

Paid salaries of $

Paid insurance premium of $

Paid a dividend of $ to shareholders.

a Prepare a journal entry for each transaction.

b Create a Taccount for each account and compute the balance of each.

c From those balances, prepare a trial balance for the end of

Joe Kelly and other student investors opened Campus Carpet Cleaning, Inc. on

October During the first month of operations, the following transactions

occurred:

Stockholders invested $ cash in the business.

Paid $ cash for store rent for the month of October.

Purchased industrial carpetcleaning equipment for $ paying $ in

cash and signing a $month, note payable.

Paid $ for a year accident insurance policy.

Received a $ bill from the Daily News for advertising the opening of a cleaning

service.

Performed services on account for $

Paid a $ cash dividend to stockholders.

Received $ payment from billed customers.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock