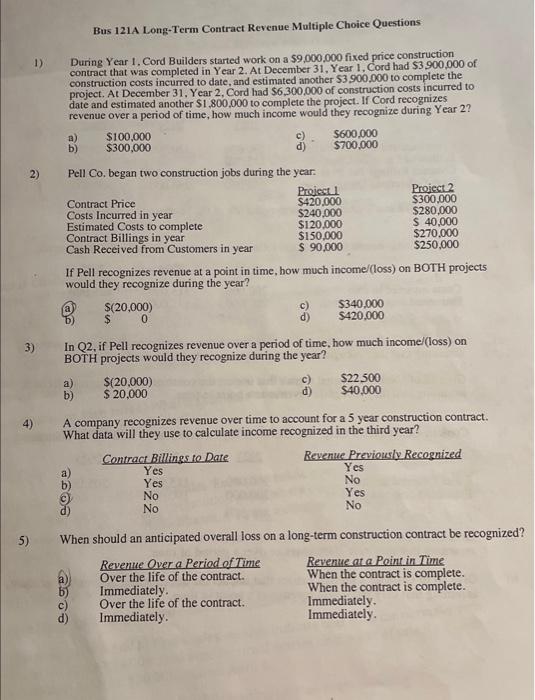

Question: 1) During Year 1. Cord Builders started work on a $9,000,000 fixed price construction contract that was completed in Year 2. At December 31, Year

1) During Year 1. Cord Builders started work on a $9,000,000 fixed price construction contract that was completed in Year 2. At December 31, Year 1, Cord had $3,900,000 of construction costs incurred to date, and estimated another $3,900,000 to compiete the project. At December 31, Year 2, Cord had $6,300,000 of construction costs incurred to date and estimated another $1,800,000 to complete the project. If Cord recognizes. revenue over a period of time, how much income would they recognize during Year 2 ? a) $100,000 c) $600,000 d) $700,000 2) Pell Co, began two construction jobs during the year: If Pell recognizes revenue at a point in time, how much income/(loss) on BOTH projects would they recognize during the year? (a) $(20,000) c) $340,000 3) In Q2, if Pell recognizes revenue over a period of time, how much income/(loss) on BOTH projects would they recognize during the year? a) $(20,000) c) $22.500 b) $20,000 d) $40,000 4) A company recognizes revenue over time to account for a 5 year construction contract. What data will they use to calculate income recognized in the third year? 5) When should an anticipated overall loss on a long-term construction contract be recognized

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts