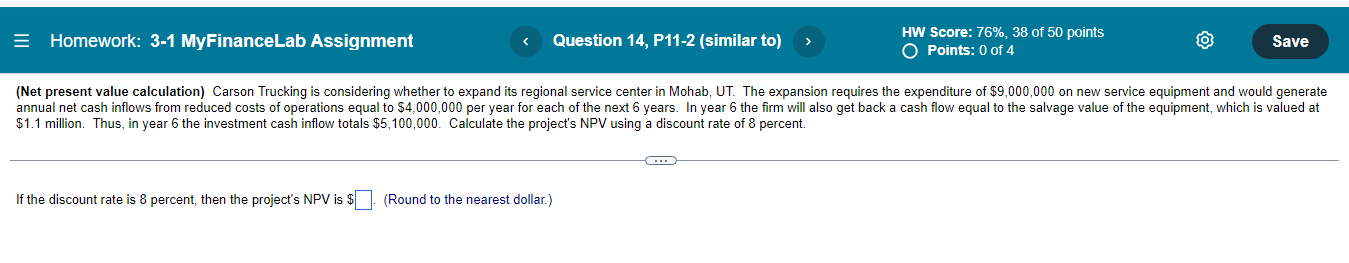

Question: 1) E Homework: 3-1 MyFinanceLab Assignment Question 14, P11-2 (similar to) W 5'7: 7- I worse palms C) Points: 0 of 4 [Net present value

1)

![value calculation] Carson Trucking is considering whether to expand its regional service](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/11/673c9a138adbd_851673c9a137c0e4.jpg)

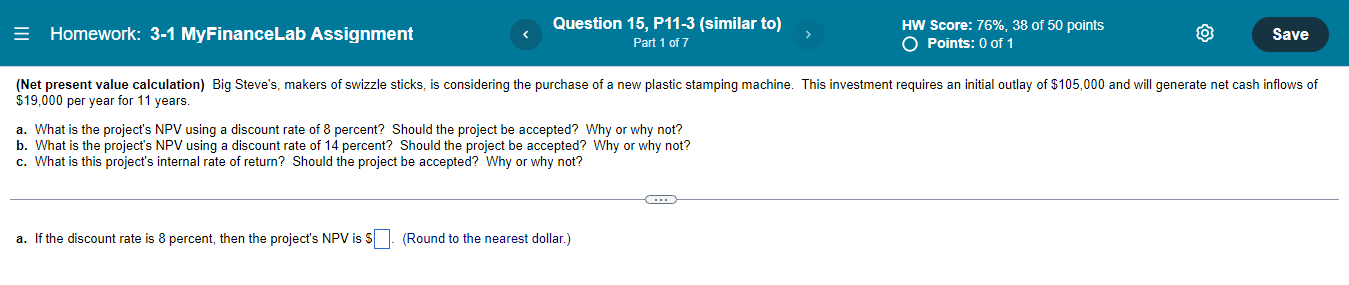

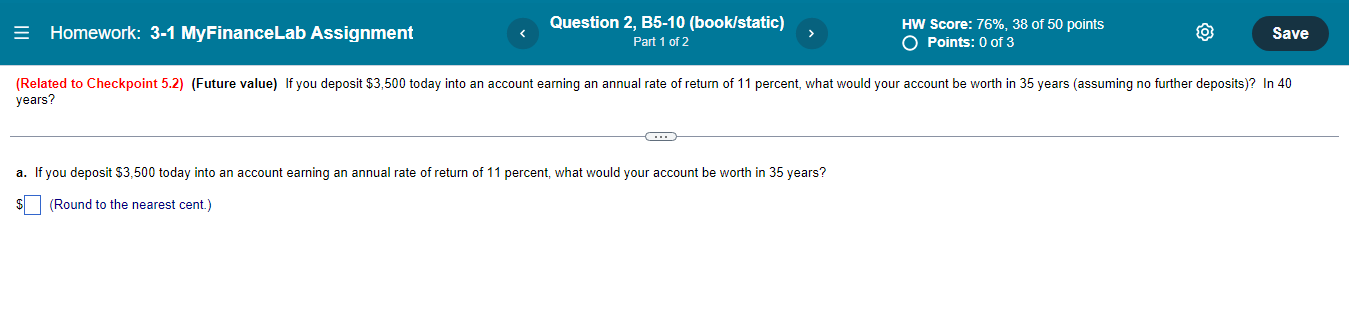

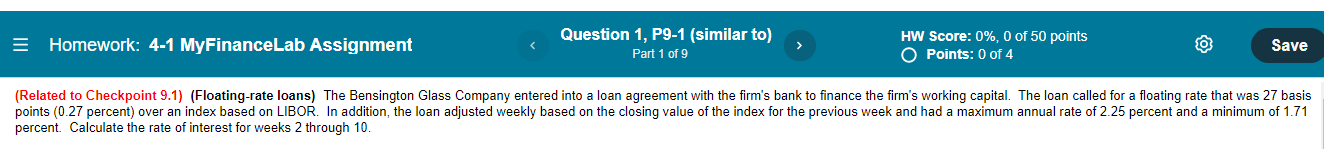

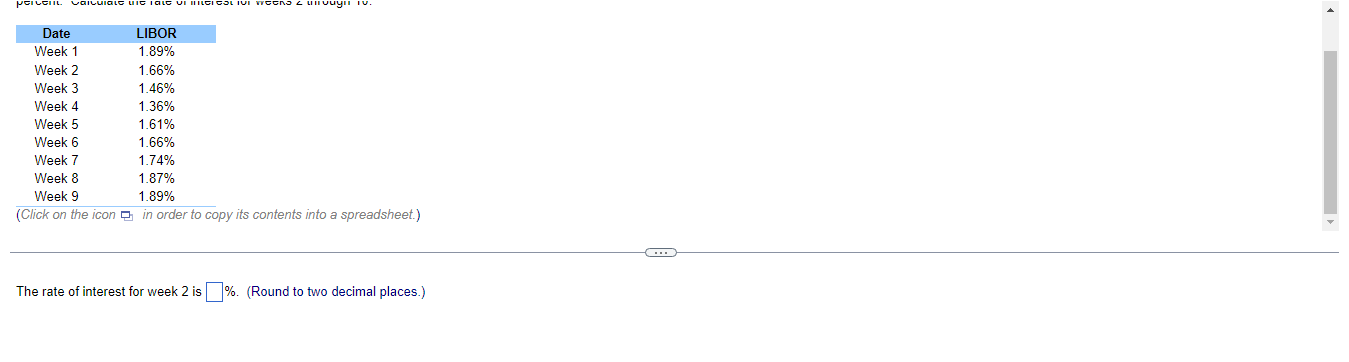

E Homework: 3-1 MyFinanceLab Assignment Question 14, P11-2 (similar to) \"W 5'7\"\": 7- I worse palms C) Points: 0 of 4 [Net present value calculation] Carson Trucking is considering whether to expand its regional service center in Mohab' UT. The expansion requir the expenditure of $9,000,000 on new service equipment and would generate annual net cash inows from reduced costs of operations equal to \"00000 per year for each of The next 6 years. In year 6 the rm will also get back a cash ow equal to the salvage value of The equipment' which is valued at $1.1 million. Thus' in year 5 the investment cash inow totals $5'100.000. Calculate the project's NPV using a discount rate of 3 percent. If the discount rate is 8 percent, then the project's NF'V is 5 (Round to the nearest dollar] Homework: 3-1 MyFinanceLab Assignment Question 15, P11-3 (similar to) HW Score: 76%, 38 of 50 points Part 1 of 7 Save O Points: 0 of 1 (Net present value calculation) Big Steve's, makers of swizzle sticks, is considering the purchase of a new plastic stamping machine. This investment requires an initial outlay of $105,000 and will generate net cash inflows of $19,000 per year for 11 years. a. What is the project's NPV using a discount rate of 8 percent? Should the project be accepted? Why or why not? b. What is the project's NPV using a discount rate of 14 percent? Should the project be accepted? Why or why not? c. What is this project's internal rate of return? Should the project be accepted? Why or why not? a. If the discount rate is 8 percent, then the project's NPV is $ . (Round to the nearest dollar.)HW Scare: 75%, 38 of 50 points 0 Points: Ugh-1 E Homework: 3-1 MyFinanceLab Assignment Question 1, P5-1 (similar to) (Related to Checkpoint 5.2] (Future value) To what amount will $5200 invested for 8 years at 11 percent compounded annually accumulate? $5200 invested for 8 years an percent compounded annually will accumulate to $ . {Round to the nearest cent.) E Homework: 3-1 MyFinanceLab Assignment Question 2, B5-10 (book/static) HW Score: 76%, 38 of 50 points Part 1 of 2 Save O Points: 0 of 3 (Related to Checkpoint 5.2) (Future value) If you deposit $3,500 today into an account earning an annual rate of return of 11 percent, what would your account be worth in 35 years (assuming no further deposits)? In 40 years? a. If you deposit $3,500 today into an account earning an annual rate of return of 11 percent, what would your account be worth in 35 years? $ (Round to the nearest cent.)Homework: 4-1 MyFinanceLab Assignment Question 1, P9-1 (similar to) HW Score: 0%, 0 of 50 points Save Part 1 of 9 O Points: 0 of 4 (Related to Checkpoint 9.1) (Floating-rate loans) The Bensington Glass Company entered into a loan agreement with the firm's bank to finance the firm's working capital. The loan called for a floating rate that was 27 basis points (0.27 percent) over an index based on LIBOR. In addition, the loan adjusted weekly based on the closing value of the index for the previous week and had a maximum annual rate of 2.25 percent and a minimum of 1.71 percent. Calculate the rate of interest for weeks 2 through 10.Date LIBOR Week 1 1.89% Week 2 1.66% Week 3 1.46% Week 4 1.36% Week 5 1.61% Week 6 1.66% Week 7 1.74% Week 8 1.87% Week 9 1.89% (Click on the icon [ in order to copy its contents into a spreadsheet.) The rate of interest for week 2 is |%. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts