Question: . . . . 1) Each scenario below lists a firm's options for borrowing directly in two different markets. The swap rate between these markets

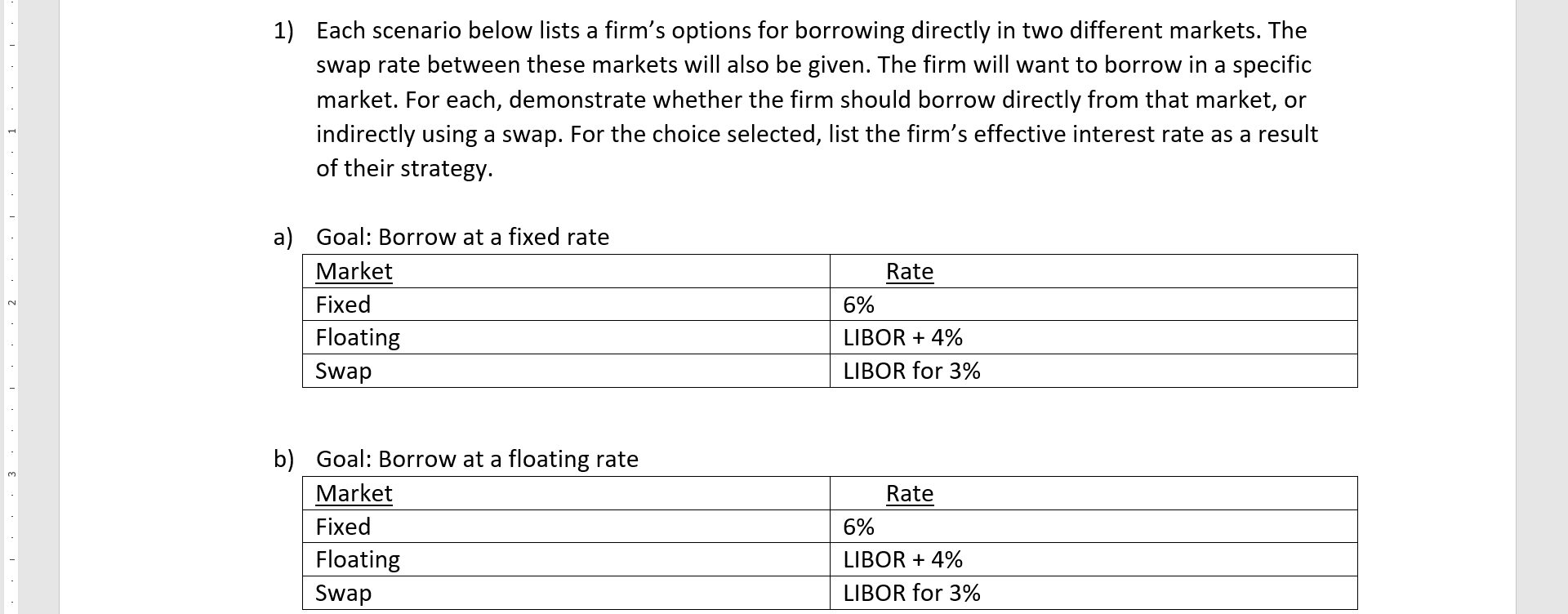

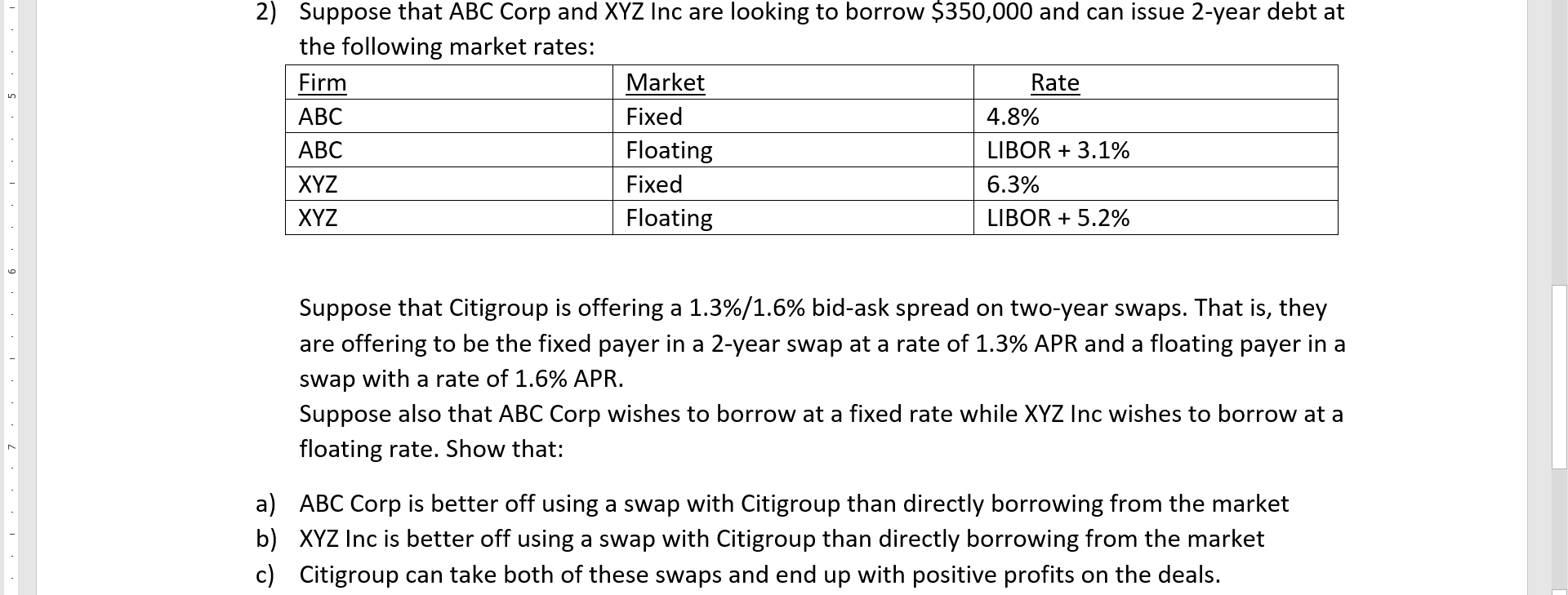

. . . . 1) Each scenario below lists a firm's options for borrowing directly in two different markets. The swap rate between these markets will also be given. The firm will want to borrow in a specific market. For each, demonstrate whether the firm should borrow directly from that market, or indirectly using a swap. For the choice selected, list the firm's effective interest rate as a result of their strategy. . 1 . . . . . . Rate . 2 a) Goal: Borrow at a fixed rate Market Fixed Floating Swap 6% . . LIBOR + 4% LIBOR for 3% . . . . 3 . Rate . b) Goal: Borrow at a floating rate Market Fixed Floating Swap 6% . . LIBOR + 4% LIBOR for 3% . . . . . 2) Suppose that ABC Corp and XYZ Inc are looking to borrow $350,000 and can issue 2-year debt at the following market rates: Firm Market Rate ABC Fixed 4.8% ABC Floating LIBOR + 3.1% XYZ Fixed 6.3% XYZ LIBOR + 5.2% . . . . Floating . . . . . . . Suppose that Citigroup is offering a 1.3%/1.6% bid-ask spread on two-year swaps. That is, they are offering to be the fixed payer in a 2-year swap at a rate of 1.3% APR and a floating payer in a swap with a rate of 1.6% APR. Suppose also that ABC Corp wishes to borrow at a fixed rate while XYZ Inc wishes to borrow at a floating rate. Show that: . . . . . . a) ABC Corp is better off using a swap with Citigroup than directly borrowing from the market b) XYZ Inc is better off using a swap with Citigroup than directly borrowing from the market c) Citigroup can take both of these swaps and end up with positive profits on the deals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts