Question: 1 . Enter the basic payroll information for each employee in a payroll register. Record the employee s name, marital status, total and overtime hours,

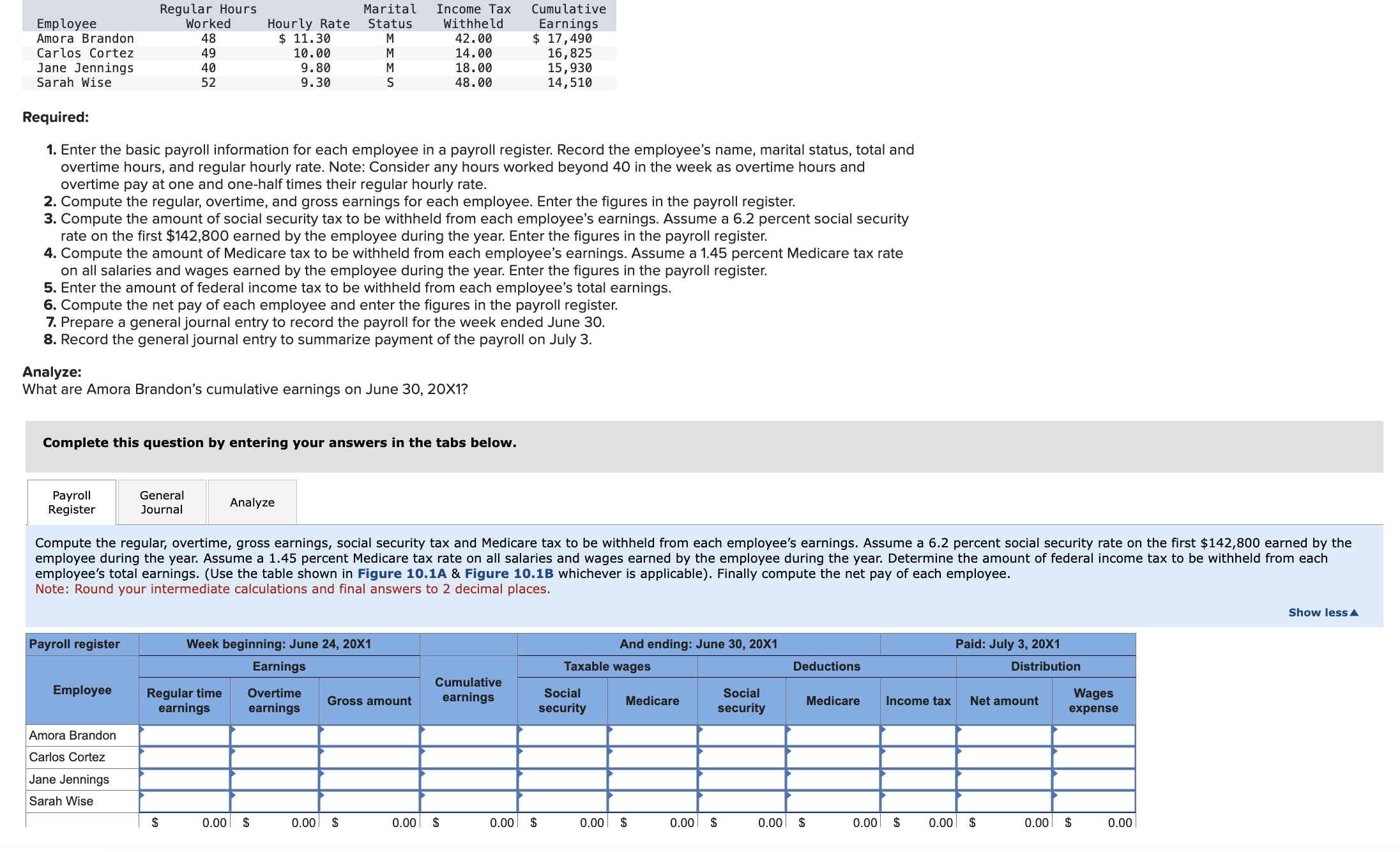

Enter the basic payroll information for each employee in a payroll register. Record the employees name, marital status, total and overtime hours, and regular hourly rate. Note: Consider any hours worked beyond in the week as overtime hours and overtime pay at one and onehalf times their regular hourly rate.

Compute the regular, overtime, and gross earnings for each employee. Enter the figures in the payroll register.

Compute the amount of social security tax to be withheld from each employees earnings. Assume a percent social security rate on the first $ earned by the employee during the year. Enter the figures in the payroll register.

Compute the amount of Medicare tax to be withheld from each employees earnings. Assume a percent Medicare tax rate on all salaries and wages earned by the employee during the year. Enter the figures in the payroll register.

Enter the amount of federal income tax to be withheld from each employees total earnings.

Compute the net pay of each employee and enter the figures in the payroll register.

Prepare a general journal entry to record the payroll for the week ended June

record the general journal entry to summarize payment of the payroll on July

Analyze:

Required:

Enter the basic payroll information for each employee in a payroll register. Record the employee's name, marital status, total and

overtime hours, and regular hourly rate. Note: Consider any hours worked beyond in the week as overtime hours and

overtime pay at one and onehalf times their regular hourly rate.

Compute the regular, overtime, and gross earnings for each employee. Enter the figures in the payroll register.

Compute the amount of social security tax to be withheld from each employee's earnings. Assume a percent social security

rate on the first $ earned by the employee during the year. Enter the figures in the payroll register.

Compute the amount of Medicare tax to be withheld from each employee's earnings. Assume a percent Medicare tax rate

on all salaries and wages earned by the employee during the year. Enter the figures in the payroll register.

Enter the amount of federal income tax to be withheld from each employee's total earnings.

Compute the net pay of each employee and enter the figures in the payroll register.

Prepare a general journal entry to record the payroll for the week ended June

Record the general journal entry to summarize payment of the payroll on July

Analyze:

What are Amora Brandon's cumulative earnings on June X

Complete this question by entering your answers in the tabs below.

Payroll

Register

employee's total earnings. Use the table shown in Figure A & Figure B whichever is applicable Finally compute the net pay of each employee.

Note: Round your intermediate calculations and final answers to decimal places.What are Amora Brandons cumulative earnings on June X

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock