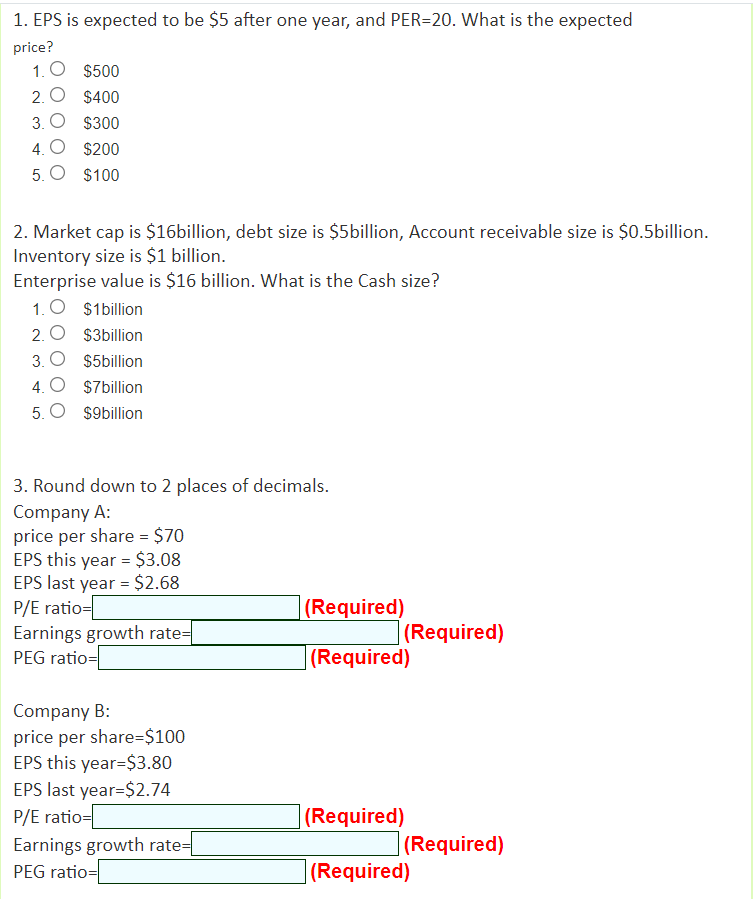

Question: 1. EPS is expected to be $5 after one year, and PER=20. What is the expected price? 1.0 $500 2.0 $400 3.0 $300 4. O

1. EPS is expected to be $5 after one year, and PER=20. What is the expected price? 1.0 $500 2.0 $400 3.0 $300 4. O $200 5. O $100 2. Market cap is $16 billion, debt size is $5billion, Account receivable size is $0.5billion. Inventory size is $1 billion. Enterprise value is $16 billion. What is the Cash size? 1.0 $1 billion 2.0 $3billion 3.0 $5billion 4. O $7billion 5. O $9billion 3. Round down to 2 places of decimals. Company A: price per share = $70 EPS this year = $3.08 EPS last year = $2.68 P/E ratio (Required) Earnings growth rate= (Required) PEG ratio=1 (Required) Company B: price per share=$100 EPS this year=$3.80 EPS last year=$2.74 P/E ratio Earnings growth rate= PEG ratio (Required) (Required) (Required)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts