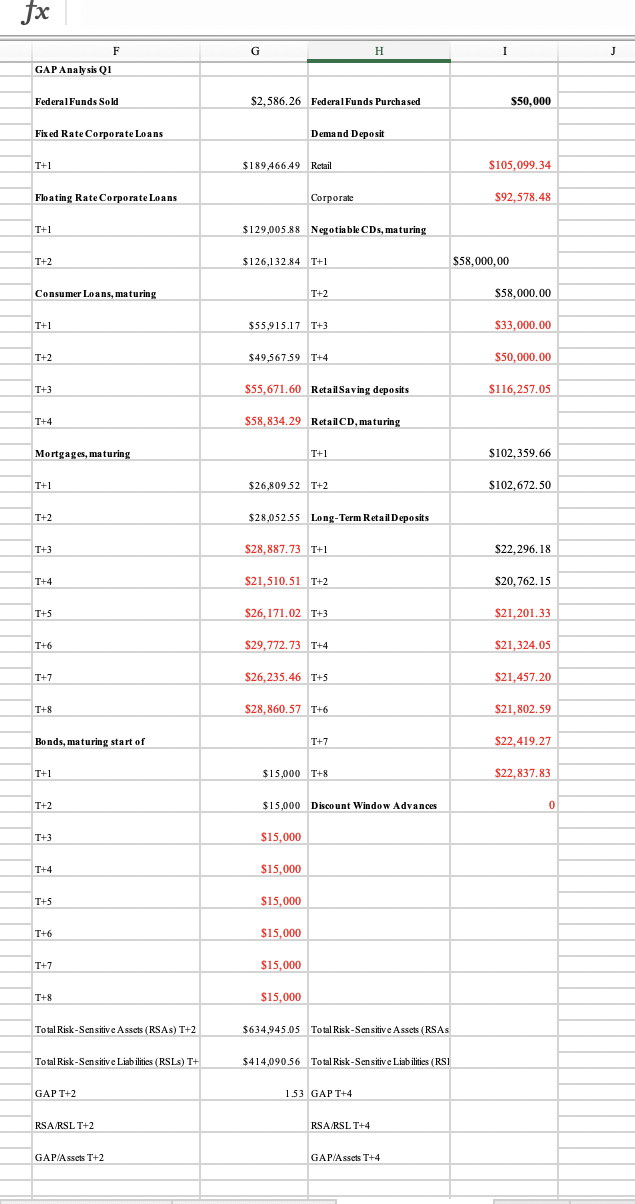

Question: 1. Estimate the twoquarter and fourquarter risksensitive assets (RSAs), risksensitive liabilities (RSLs), and the GAPs (in dollars). Unless otherwise instructed, do not include federal funds

| 1. Estimate the twoquarter and fourquarter risksensitive assets (RSAs), risksensitive liabilities (RSLs), and the GAPs (in dollars). Unless otherwise instructed, do not include federal funds sold or discount window advances in your estimation under the assumption it is a onetime event However, include federal funds purchased under the assumption that the bank is a net buyer of funds. |

fx G H I I J F GAP Analysis Q1 Federal Funds Sold $2,586.26 Federal Funds Purchased $50,000 Fixed Rate Corporate Loans Demand Deposit T+1 $189.466,49 Retail $105,099.34 Floating Rate Corporate Loans Corporate $92,578.48 T+1 $129,005.88 Negotiable CDs, maturing T+2 $126,132.84 T+1 $58,000,00 Consumer Loans, maturing T+2 $58,000.00 T+1 $55,915.17 T+3 $33,000.00 T+2 $49,567,59 T+4 $50,000.00 T+3 $ $55,671.60 Retail Saving deposits $ $116,257.05 T+4 $58,834.29 RetailCD, maturing Mortgages, maturing T+1 $102,359.66 T+1 $26,809.52 T+2 $102,672.50 T+2 2 $28,052.55 Long-Term Retail Deposits T+3 $28,887.73 T+1 $22,296.18 T+4 $21,510.51 T+2 $20,762.15 T+5 $26,171.02 T+3 $21,201.33 T+6 + $29,772.73 T+4 $21,324.05 T+7 T $26,235.46 T+5 $21,457.20 T+8 $28,860.57 T+6 $21,802.59 Bonds, maturing start of T+7 $22,419.27 T+1 +1 $15,000 T+8 $22,837.83 T+2 T $15,000 Discount Window Advances 0 T+3 $15,000 T+4 + $15,000 T+5 $15,000 T+6 $15,000 $ T+7 $15,000 T+8 $15,000 Total Risk-Sensitive Assets (RSAs) T+2 $634,945.05 Total Risk-Sensitive Assets (RSAs - Total Risk-Sensitive Liabilities (RSLs) T+ $414,090.56 Total Risk-Sensitive Liabilities (RSI GAP T+2 1.53 GAP T+4 RSA RSL T+2 RSA RSL T+4 GAP/Assets T+2 GAP/Assets T+4 fx G H I I J F GAP Analysis Q1 Federal Funds Sold $2,586.26 Federal Funds Purchased $50,000 Fixed Rate Corporate Loans Demand Deposit T+1 $189.466,49 Retail $105,099.34 Floating Rate Corporate Loans Corporate $92,578.48 T+1 $129,005.88 Negotiable CDs, maturing T+2 $126,132.84 T+1 $58,000,00 Consumer Loans, maturing T+2 $58,000.00 T+1 $55,915.17 T+3 $33,000.00 T+2 $49,567,59 T+4 $50,000.00 T+3 $ $55,671.60 Retail Saving deposits $ $116,257.05 T+4 $58,834.29 RetailCD, maturing Mortgages, maturing T+1 $102,359.66 T+1 $26,809.52 T+2 $102,672.50 T+2 2 $28,052.55 Long-Term Retail Deposits T+3 $28,887.73 T+1 $22,296.18 T+4 $21,510.51 T+2 $20,762.15 T+5 $26,171.02 T+3 $21,201.33 T+6 + $29,772.73 T+4 $21,324.05 T+7 T $26,235.46 T+5 $21,457.20 T+8 $28,860.57 T+6 $21,802.59 Bonds, maturing start of T+7 $22,419.27 T+1 +1 $15,000 T+8 $22,837.83 T+2 T $15,000 Discount Window Advances 0 T+3 $15,000 T+4 + $15,000 T+5 $15,000 T+6 $15,000 $ T+7 $15,000 T+8 $15,000 Total Risk-Sensitive Assets (RSAs) T+2 $634,945.05 Total Risk-Sensitive Assets (RSAs - Total Risk-Sensitive Liabilities (RSLs) T+ $414,090.56 Total Risk-Sensitive Liabilities (RSI GAP T+2 1.53 GAP T+4 RSA RSL T+2 RSA RSL T+4 GAP/Assets T+2 GAP/Assets T+4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts