Question: 1 . Evaluate and discuss the key features, differences, and disadvantages between MCOs, HMOs, PPOs, POSs, and ACOs with a comparative chart. 2 . Marjorie

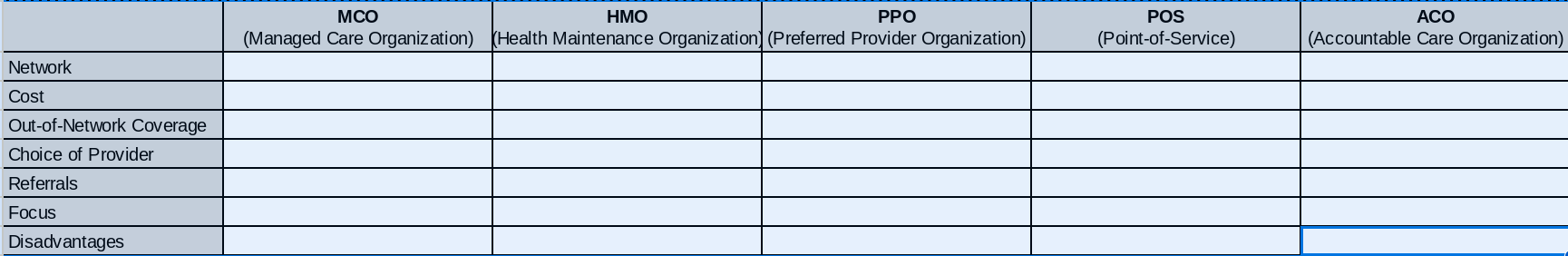

Evaluate and discuss the key features, differences, and disadvantages between MCOs, HMOs, PPOs, POSs, and ACOs with a comparative chart.

Marjorie has a Point of Service POS plan that has a yearly deductible of $ that is effective January of every coverage year. Marjories plan also requires her to pay of the charges each time she visits her primary care doctor until she reaches her outofpocket maximum. Marjorie is visiting her PCP next week. The contracted rate, as she is seeing an innetwork doctor, charges for her visit will be $ What will be Marjories out of pocket?

Ted has a Preferred Provider Option PPO plan that has a yearly deductible of $ that is effective January of every coverage year. Teds plan allows him to see innetwork and outof network doctors. If Ted sees an outofnetwork physician, his plan will cover of the charges after his deductible is met. If Ted sees an innetwork physician, his plan will cover of the charges after his deductible is met. Ted has been seeing his Primary Care Physician for over years and wants to continue treating with the same doctor. However, his PCP is outofnetwork. Ted has a visit coming up that will total $and his deductible is satisfied. What will Teds out of pocket be

Jonathan has a HMO plan that does not have a deductible. However, Jonathan has a copay for office visits, inpatient stays, diagnostic testing, and prescriptions. PCP office visits are $ Specialists are $ Diagnostic testing is $ and inpatient is $ per day. On Monday, Jonathan had an office visit with a specialist. The specialist referred Jonathon for diagnostic testing on Tuesday. The specialist received the results on Thursday and admitted Jonathan for emergency surgery on Friday. Jonathan was in the hospital for five days. What was Jonathans total out of pocket cost for this course of treatment?

Suzane has selected an Accountable Care Organization to be responsible for her care, Kaiser Permanente. Kaiser Permanente houses all physicians, lab services, specialty services, diagnostic care, and pharmacy services in one building. Suzane is charged a copay each time she sees a different physician, but does not have to pay for lab or diagnostic services. Suzane has decided that she wants to have plastic surgery and use a doctor that is not under Kaisers ACO umbrella. Does Suzanne have any options for coverage for any of her care?

Roseanne recently qualified for Medicare because she was diagnosed with ESRD. Roseanne is still working full time and still does have a private POS plan in place. Roseanne does have a deductible that must be met on her private plan. Roseanne has been undergoing dialysis and visits a Nephrologist weekly.

Which insurance would be primary? At what point does Medicare begin to pay? Does Roseanne still have to meet her deductible?

Bailey was admitted to the hospital with preterm labor and is covered by a Consumer Driven Health Plan. Bailey also has an HSA account where she has had pretaxed money taken by payroll deduction to fund this account. This account currently has $ that can be applied to health care costs. Baileys inpatient copay is $ per stay and her deductible is $ that she has not met yet. Bailey delivered and her and baby were discharged. Two weeks later Bailey returned to the hospital ER with the newborn not feeling well and the baby was readmitted. The newborn has been added to Baileys plan and the same deductible rules and copay apply. How much is Bailey out of pocket for this series of events with the application of monies in her HSA?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock