Question: 1) Excel Template - Using the information provided above, prepare the following: Task #1 - T1 - Jeff Walchuck Task #2 - T1 - Jamie

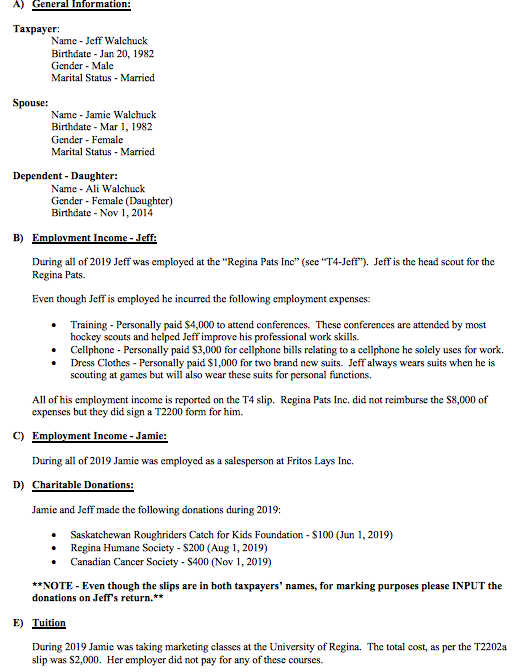

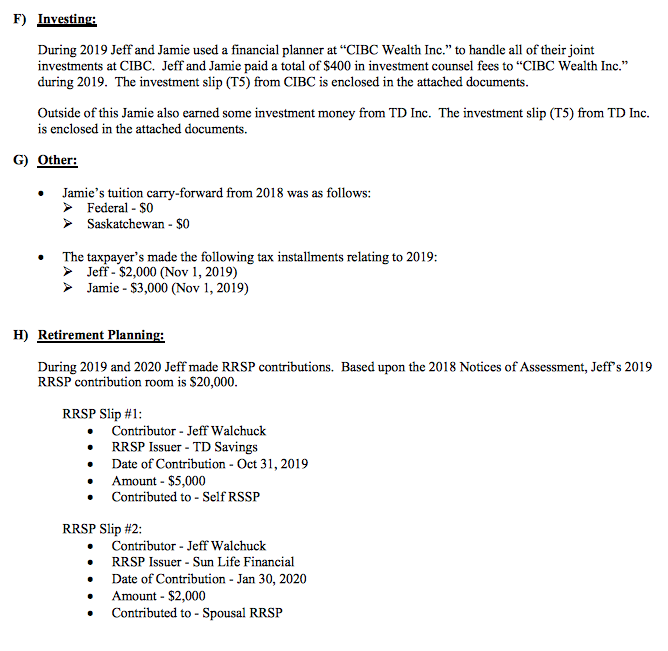

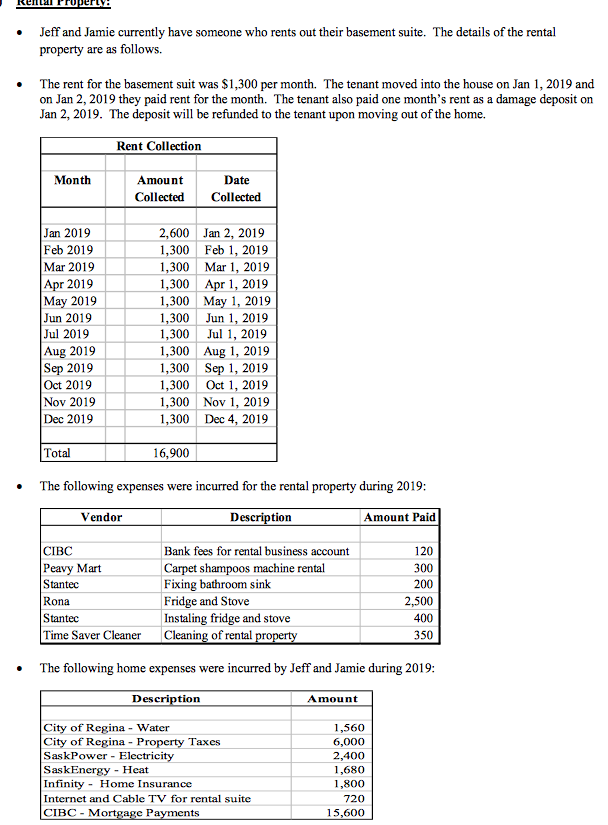

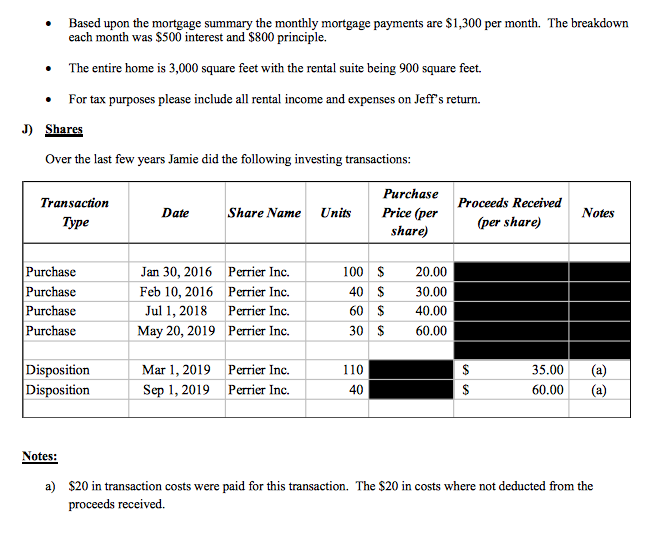

1) Excel Template - Using the information provided above, prepare the following: Task #1 - T1 - Jeff Walchuck Task #2 - T1 - Jamie Walchuck Task #3 - Support - Rental Income Task #4 - Support - Share Sale A) General Information: Taxpayer: Name - Jeff Walchuck Birthdate - Jan 20, 1982 Gender - Male Marital Status - Married Spouse: Name - Jamie Walchuck Birthdate - Mar 1, 1982 Gender - Female Marital Status - Married Dependent - Daughter: Name - Ali Walchuck Gender - Female (Daughter) Birthdate - Nov 1, 2014 B) Employment Income - Jeff: During all of 2019 Jeff was employed at the "Regina Pats Inc" (see "T4-Jeff"), Jeff is the head scout for the Regina Pats. Even though Jeff is employed he incurred the following employment expenses: Training - Personally paid $4,000 to attend conferences. These conferences are attended by most hockey scouts and helped Jeff improve his professional work skills. Cellphone - Personally paid $3,000 for cellphone bills relating to a cellphone he solely uses for work. Dress Clothes - Personally paid $1,000 for two brand new suits. Jeff always wears suits when he is scouting at games but will also wear these suits for personal functions. All of his employment income is reported on the T4 slip. Regina Pats Inc, did not reimburse the $8,000 of expenses but they did sign a T2200 form for him. C) Employment Income - Jamie: During all of 2019 Jamie was employed as a salesperson at Fritos Lays Inc. D) Charitable Donations: Jamie and Jeff made the following donations during 2019: Saskatchewan Roughriders Catch for Kids Foundation - $100 (Jun 1, 2019) Regina Humane Society - $200 (Aug 1, 2019) Canadian Cancer Society - $400 (Nov 1, 2019) **NOTE - Even though the slips are in both taxpayers' names, for marking purposes please INPUT the donations on Jeff's return.** E) Tuition During 2019 Jamic was taking marketing classes at the University of Regina. The total cost, as per the T2202a slip was $2,000. Her employer did not pay for any of these courses. F) Investing: During 2019 Jeff and Jamie used a financial planner at CIBC Wealth Inc." to handle all of their joint investments at CIBC. Jeff and Jamie paid a total of $400 in investment counsel fees to "CIBC Wealth Inc." during 2019. The investment slip (T5) from CIBC is enclosed in the attached documents. Outside of this Jamie also earned some investment money from TD Inc. The investment slip (T5) from TD Inc. is enclosed in the attached documents. G) Other: Jamie's tuition carry-forward from 2018 was as follows: > Federal - $0 Saskatchewan - $0 The taxpayer's made the following tax installments relating to 2019: Jeff - $2,000 (Nov 1, 2019) Jamie - $3,000 (Nov 1, 2019) H) Retirement Planning: During 2019 and 2020 Jeff made RRSP contributions. Based upon the 2018 Notices of Assessment, Jeff's 2019 RRSP contribution room is $20,000. RRSP Slip #1: Contributor - Jeff Walchuck RRSP Issuer - TD Savings Date of Contribution - Oct 31, 2019 Amount - $5,000 Contributed to - Self RSSP RRSP Slip #2: Contributor - Jeff Walchuck RRSP Issuer - Sun Life Financial Date of Contribution - Jan 30, 2020 Amount - $2,000 Contributed to - Spousal RRSP . Jeff and Jamie currently have someone who rents out their basement suite. The details of the rental property are as follows. The rent for the basement suit was $1,300 per month. The tenant moved into the house on Jan 1, 2019 and on Jan 2, 2019 they paid rent for the month. The tenant also paid one month's rent as a damage deposit on Jan 2, 2019. The deposit will be refunded to the tenant upon moving out of the home. Rent Collection Month Amount Collected Date Collected Jan 2019 Feb 2019 Mar 2019 Apr 2019 May 2019 Jun 2019 Jul 2019 Aug 2019 Sep 2019 Oct 2019 Nov 2019 Dec 2019 2,600 Jan 2, 2019 1,300 Feb 1, 2019 1,300 Mar 1, 2019 1,300 Apr 1, 2019 1,300 May 1, 2019 1,300 Jun 1, 2019 1,300 Jul 1, 2019 1,300 Aug 1, 2019 1,300 Sep 1, 2019 1,300 Oct 1, 2019 1,300 Nov 1, 2019 1,300 Dec 4, 2019 Total 16,900 The following expenses were incurred for the rental property during 2019: Vendor Description Amount Paid CIBC Peavy Mart Stantec Rona Stantec Time Saver Cleaner Bank fees for rental business account Carpet shampoos machine rental Fixing bathroom sink Fridge and Stove Instaling fridge and stove Cleaning of rental property 120 300 200 2,500 400 350 The following home expenses were incurred by Jeff and Jamie during 2019: Description Amount City of Regina - Water City of Regina - Property Taxes SaskPower - Electricity SaskEnergy - Heat Infinity - Home Insurance Internet and Cable TV for rental suite CIBC - Mortgage Payments 1,560 6,000 2,400 1,680 1,800 720 15,600 Based upon the mortgage summary the monthly mortgage payments are $1,300 per month. The breakdown each month was $500 interest and $800 principle. The entire home is 3,000 square feet with the rental suite being 900 square feet. For tax purposes please include all rental income and expenses on Jeff's return. J) Shares Over the last few years Jamie did the following investing transactions: Transaction Type Date Share Name Units Purchase Price (per share) Proceeds Received (per share) Notes Purchase Purchase Purchase Purchase Jan 30, 2016 Perrier Inc. Feb 10, 2016 Perrier Inc. Jul 1, 2018 Perrier Inc. May 20, 2019 Perrier Inc. 100 $ 40 $ 60 $ 30 $ 20.00 30.00 40.00 60.00 a Disposition Disposition Mar 1, 2019 Perrier Inc. Sep 1, 2019 Perrier Inc. 110 40 $ $ 35.00 60.00 (a) Notes: a) $20 in transaction costs were paid for this transaction. The $20 in costs where not deducted from the proceeds received 1) Excel Template - Using the information provided above, prepare the following: Task #1 - T1 - Jeff Walchuck Task #2 - T1 - Jamie Walchuck Task #3 - Support - Rental Income Task #4 - Support - Share Sale A) General Information: Taxpayer: Name - Jeff Walchuck Birthdate - Jan 20, 1982 Gender - Male Marital Status - Married Spouse: Name - Jamie Walchuck Birthdate - Mar 1, 1982 Gender - Female Marital Status - Married Dependent - Daughter: Name - Ali Walchuck Gender - Female (Daughter) Birthdate - Nov 1, 2014 B) Employment Income - Jeff: During all of 2019 Jeff was employed at the "Regina Pats Inc" (see "T4-Jeff"), Jeff is the head scout for the Regina Pats. Even though Jeff is employed he incurred the following employment expenses: Training - Personally paid $4,000 to attend conferences. These conferences are attended by most hockey scouts and helped Jeff improve his professional work skills. Cellphone - Personally paid $3,000 for cellphone bills relating to a cellphone he solely uses for work. Dress Clothes - Personally paid $1,000 for two brand new suits. Jeff always wears suits when he is scouting at games but will also wear these suits for personal functions. All of his employment income is reported on the T4 slip. Regina Pats Inc, did not reimburse the $8,000 of expenses but they did sign a T2200 form for him. C) Employment Income - Jamie: During all of 2019 Jamie was employed as a salesperson at Fritos Lays Inc. D) Charitable Donations: Jamie and Jeff made the following donations during 2019: Saskatchewan Roughriders Catch for Kids Foundation - $100 (Jun 1, 2019) Regina Humane Society - $200 (Aug 1, 2019) Canadian Cancer Society - $400 (Nov 1, 2019) **NOTE - Even though the slips are in both taxpayers' names, for marking purposes please INPUT the donations on Jeff's return.** E) Tuition During 2019 Jamic was taking marketing classes at the University of Regina. The total cost, as per the T2202a slip was $2,000. Her employer did not pay for any of these courses. F) Investing: During 2019 Jeff and Jamie used a financial planner at CIBC Wealth Inc." to handle all of their joint investments at CIBC. Jeff and Jamie paid a total of $400 in investment counsel fees to "CIBC Wealth Inc." during 2019. The investment slip (T5) from CIBC is enclosed in the attached documents. Outside of this Jamie also earned some investment money from TD Inc. The investment slip (T5) from TD Inc. is enclosed in the attached documents. G) Other: Jamie's tuition carry-forward from 2018 was as follows: > Federal - $0 Saskatchewan - $0 The taxpayer's made the following tax installments relating to 2019: Jeff - $2,000 (Nov 1, 2019) Jamie - $3,000 (Nov 1, 2019) H) Retirement Planning: During 2019 and 2020 Jeff made RRSP contributions. Based upon the 2018 Notices of Assessment, Jeff's 2019 RRSP contribution room is $20,000. RRSP Slip #1: Contributor - Jeff Walchuck RRSP Issuer - TD Savings Date of Contribution - Oct 31, 2019 Amount - $5,000 Contributed to - Self RSSP RRSP Slip #2: Contributor - Jeff Walchuck RRSP Issuer - Sun Life Financial Date of Contribution - Jan 30, 2020 Amount - $2,000 Contributed to - Spousal RRSP . Jeff and Jamie currently have someone who rents out their basement suite. The details of the rental property are as follows. The rent for the basement suit was $1,300 per month. The tenant moved into the house on Jan 1, 2019 and on Jan 2, 2019 they paid rent for the month. The tenant also paid one month's rent as a damage deposit on Jan 2, 2019. The deposit will be refunded to the tenant upon moving out of the home. Rent Collection Month Amount Collected Date Collected Jan 2019 Feb 2019 Mar 2019 Apr 2019 May 2019 Jun 2019 Jul 2019 Aug 2019 Sep 2019 Oct 2019 Nov 2019 Dec 2019 2,600 Jan 2, 2019 1,300 Feb 1, 2019 1,300 Mar 1, 2019 1,300 Apr 1, 2019 1,300 May 1, 2019 1,300 Jun 1, 2019 1,300 Jul 1, 2019 1,300 Aug 1, 2019 1,300 Sep 1, 2019 1,300 Oct 1, 2019 1,300 Nov 1, 2019 1,300 Dec 4, 2019 Total 16,900 The following expenses were incurred for the rental property during 2019: Vendor Description Amount Paid CIBC Peavy Mart Stantec Rona Stantec Time Saver Cleaner Bank fees for rental business account Carpet shampoos machine rental Fixing bathroom sink Fridge and Stove Instaling fridge and stove Cleaning of rental property 120 300 200 2,500 400 350 The following home expenses were incurred by Jeff and Jamie during 2019: Description Amount City of Regina - Water City of Regina - Property Taxes SaskPower - Electricity SaskEnergy - Heat Infinity - Home Insurance Internet and Cable TV for rental suite CIBC - Mortgage Payments 1,560 6,000 2,400 1,680 1,800 720 15,600 Based upon the mortgage summary the monthly mortgage payments are $1,300 per month. The breakdown each month was $500 interest and $800 principle. The entire home is 3,000 square feet with the rental suite being 900 square feet. For tax purposes please include all rental income and expenses on Jeff's return. J) Shares Over the last few years Jamie did the following investing transactions: Transaction Type Date Share Name Units Purchase Price (per share) Proceeds Received (per share) Notes Purchase Purchase Purchase Purchase Jan 30, 2016 Perrier Inc. Feb 10, 2016 Perrier Inc. Jul 1, 2018 Perrier Inc. May 20, 2019 Perrier Inc. 100 $ 40 $ 60 $ 30 $ 20.00 30.00 40.00 60.00 a Disposition Disposition Mar 1, 2019 Perrier Inc. Sep 1, 2019 Perrier Inc. 110 40 $ $ 35.00 60.00 (a) Notes: a) $20 in transaction costs were paid for this transaction. The $20 in costs where not deducted from the proceeds received

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts