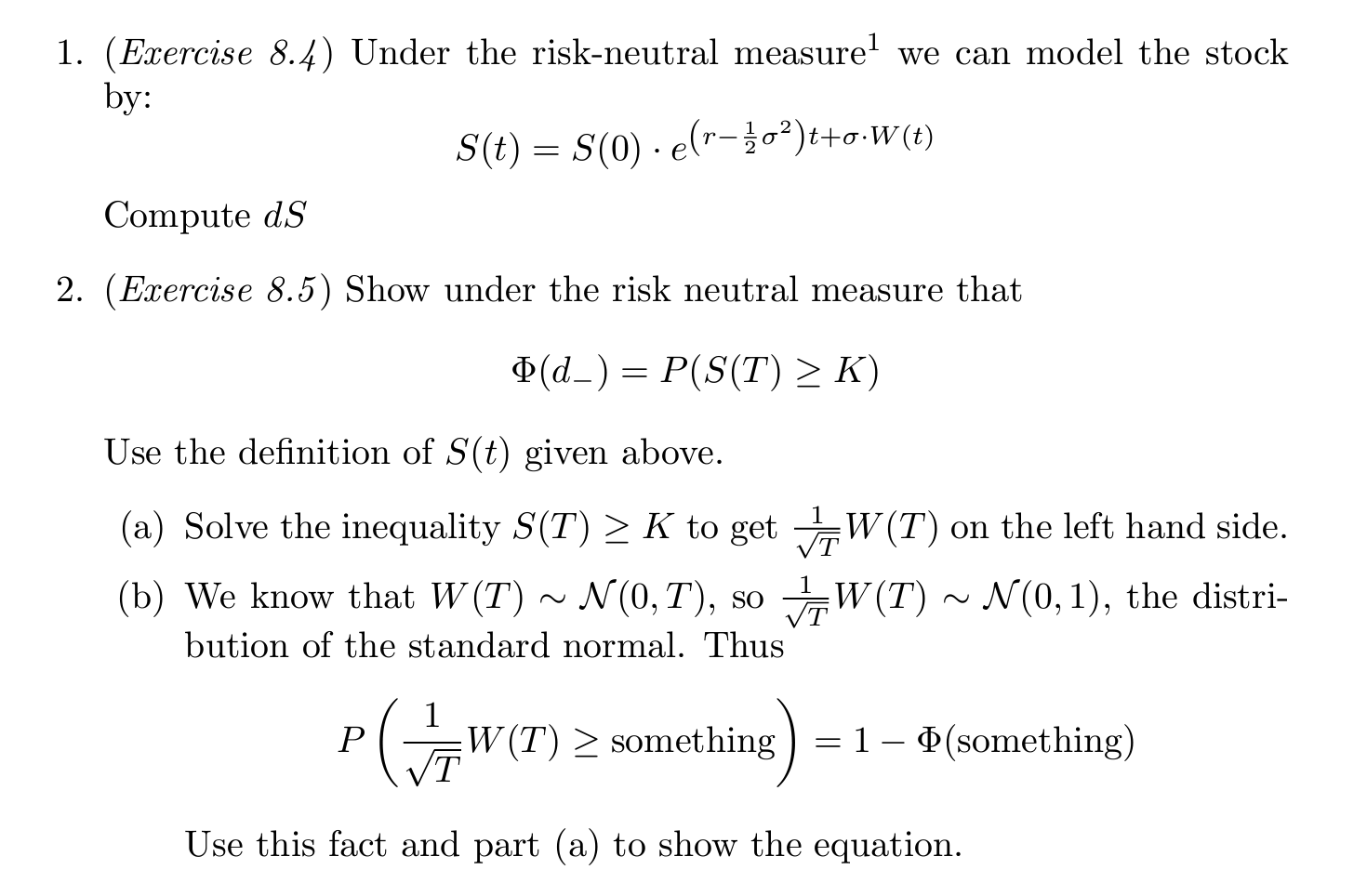

Question: 1. (Exercise 8.4) Under the risk-neutral measure we can model the stock by: S(t) = S(0) e(r20)t+oW(t) Compute dS 2. (Exercise 8.5) Show under

1. (Exercise 8.4) Under the risk-neutral measure we can model the stock by: S(t) = S(0) e(r20)t+oW(t) Compute dS 2. (Exercise 8.5) Show under the risk neutral measure that (d_) = P(S(T) K) Use the definition of S(t) given above. (a) Solve the inequality S(T) K to getW(T) W(T) on the left hand side. (b) We know that W(T) ~ N(0,T), so W(T) ~ N(0,1), the distri- bution of the standard normal. Thus 1 P ( W(T) something) = 1- (something) T Use this fact and part (a) to show the equation.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts