Question: 1 .Expected future revenues that differ among the alternatives under consideration are often referred to as: Alternative revenues. Preferential revenues. Relative revenues. Differential revenues. 2.

1 .Expected future revenues that differ among the alternatives under consideration are often referred to as:

Alternative revenues.

Preferential revenues.

Relative revenues.

Differential revenues.

2.

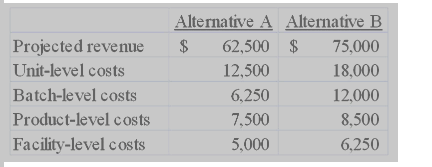

QRC Company is trying to decide which one of two alternatives it will accept. The costs and revenues associated with each alternative are listed below:  What is the differential revenue for this decision?

What is the differential revenue for this decision?

$25,000

$12,500

$62,500

$75,000

3.The benefits sacrificed when one alternative is chosen over another are referred to as:

Avoidable costs.

Opportunity costs.

Sacrificial costs.

Beneficial costs.

4.Select the correct statement about the master budget.

The master budget is a group of detailed budgets and schedules representing the company's operating and financial plans for the past accounting period.

The master budget usually includes operating budgets and capital budgets, and pro forma financial statements.

The budgeting process usually begins with preparing the strategic budgets.

Preparing the master budget begins with the cash budget.

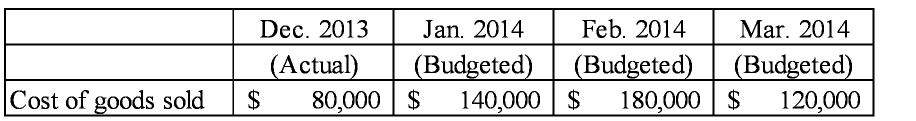

5 Payne Company provided the following information relevant to its inventory sales and purchases for December 2013 and the first quarter of 2014:

Desired ending inventory levels are 25% of the following month's projected cost of goods sold. The company purchases all inventory on account. January 2014 budgeted purchases are $150,000. The normal schedule for inventory payments is 60% payment in month of purchase and 40% payment in month following purchase. Budgeted cash payments for inventory in February 2014 would be:

$132,600.

$152,600.

$99,000.

$159,000.

6. Which of the following is not a benefit of budgeting?

Provides assurance that accounting records are in accordance with generally accepted accounting principles

Coordinates the activities of the company by integrating the plans of all departments

Requires managers to plan ahead and to formalize their objectives

Sets realistic standards that serve as benchmarks for evaluating performance

Projected revenue Unit-level costs Batch-level costs Product-level costs Facility-level costs Alternative A Alternative B $ 62,500 $ 75,000 12,500 18,000 6,250 12,000 7,500 8,500 5,000 6,250 Dec. 2013 Jan. 2014 Feb. 2014 Mar. 2014 (Actual) (Budgeted) (Budgeted) (Budgeted) 80,000 $ 140,000 $ 180,000 $ 120,000 Cost of goods sold $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts