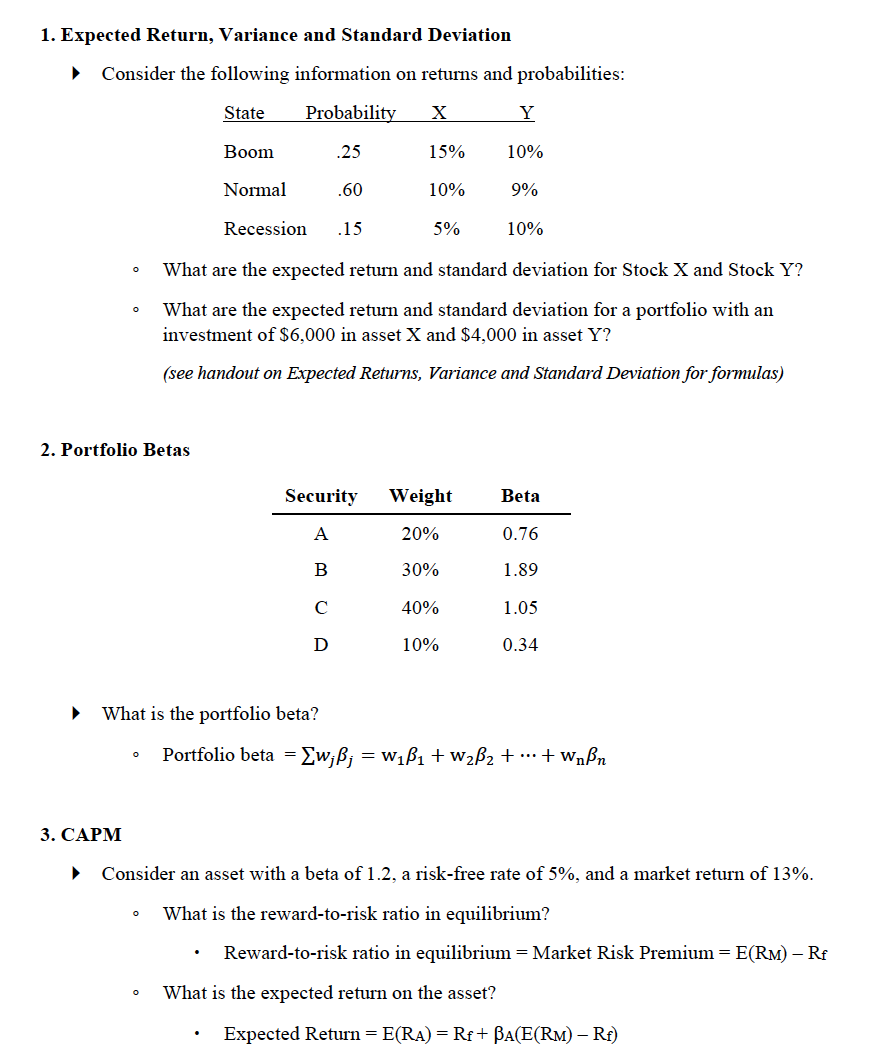

Question: 1. Expected Return, Variance and Standard Deviation Consider the following information on returns and probabilities: State Probability X Y Boom .25 15% 10% Normal .60

1. Expected Return, Variance and Standard Deviation Consider the following information on returns and probabilities: State Probability X Y Boom .25 15% 10% Normal .60 10% 9% Recession .15 5% 10% What are the expected return and standard deviation for Stock X and Stock Y? What are the expected return and standard deviation for a portfolio with an investment of $6,000 in asset X and $4,000 in asset Y? (see handout on Expected Returns, Variance and Standard Deviation for formulas) 2. Portfolio Betas Security Weight Beta A 20% 0.76 B 30% 1.89 40% 1.05 D 10% 0.34 What is the portfolio beta? Portfolio beta = Ew;; = wii + w2B2 + ... +wnBn 3. CAPM Consider an asset with a beta of 1.2, a risk-free rate of 5%, and a market return of 13%. What is the reward-to-risk ratio in equilibrium? Reward-to-risk ratio in equilibrium = Market Risk Premium=E(RM) - Rf What is the expected return on the asset? Expected Return = E(RA)=Rf+ BA(E(RM) - Rf)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts