Question: 1. Explain five competitive forces that together determine an industry's profit potential. 2. What is competitive strategy analysis? And explain two basic competitive strategies. 3.

1. Explain five competitive forces that together determine an industry's profit potential.

2. What is competitive strategy analysis? And explain two basic competitive strategies.

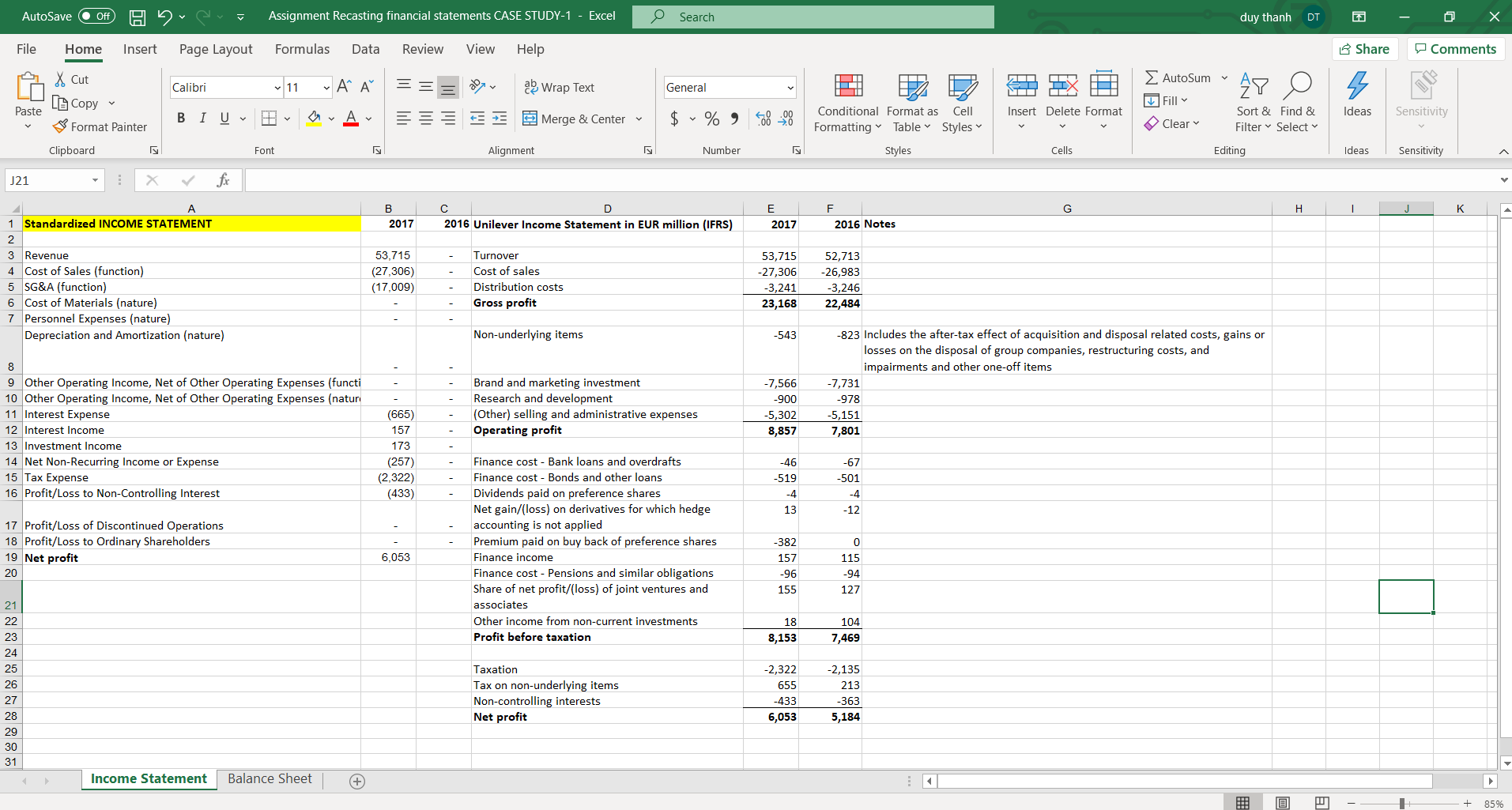

3. Prepare the standardized Income Statement and Balance Sheet for the Unilever using from the attached 2016 I/S and B/S information. .Assignment Recasting financial statements CASE STUDY-1.xlsx

AutoSave . Off) H Assignment Recasting financial statements CASE STUDY-1 - Excel Search duy thanh DT X File Home Insert Page Layout Formulas Data Review View Help Share Comments X Cut AutoSum Calibri 11 A" A ap Wrap Text General AY O [A Copy Fill Paste $ ~ % 9 68 28 Conditional Format as Cell Insert Delete Format Sort & Find & Ideas Sensitivity = = = E Merge & Center Format Painter BIUV FLAV Formatting > Table v Styles v Clear Filter ~ Select Clipboard Font Alignment Number Styles Cells Editing Ideas Sensitivity J21 X V fx B C D E F G H J K 1 Standardized INCOME STATEMENT 2017 2016 Unilever Income Statement in EUR million (IFRS) 2017 2016 Notes 3 Revenue 53,715 Turnover 53,715 52,713 4 Cost of Sales (function) (27,306 Cost of sales 27,306 26,983 5 SG&A (function) (17,009) Distribution costs -3,241 -3,246 6 Cost of Materials (nature) Gross profit 23,168 22,484 Personnel Expenses (nature) Depreciation and Amortization (nature) Non-underlying items -543 -823 Includes the after-tax effect of acquisition and disposal related costs, gains or losses on the disposal of group companies, restructuring costs, and 8 impairments and other one-off items 9 Other Operating Income, Net of Other Operating Expenses (functi Brand and marketing investment 7,566 -7,731 10 Other Operating Income, Net of Other Operating Expenses (natur Research and development -900 -978 11 Interest Expense (665) (Other) selling and administrative expenses 5,302 -5,151 12 Interest Income 157 Operating profit 8,857 7,801 13 Investment Income 173 14 Net Non-Recurring Income or Expense (257) Finance cost - Bank loans and overdrafts -46 -67 15 Tax Expense 2,322) Finance cost - Bonds and other loans 519 -501 16 Profit/Loss to Non-Controlling Interest (433) Dividends paid on preference shares -4 Net gain/(loss) on derivatives for which hedge 13 -12 17 Profit/Loss of Discontinued Operations accounting is not applied 18 Profit/Loss to Ordinary Shareholders Premium paid on buy back of preference shares -382 0 19 Net profit 6,053 Finance income 157 115 20 Finance cost - Pensions and similar obligations .96 -94 Share of net profit/(loss) of joint ventures and 155 127 21 associates 22 Other income from non-current investments 18 104 23 Profit before taxation 3,153 7,469 24 25 Taxation -2,322 -2,135 26 Tax on non-underlying items 655 213 27 Non-controlling interests 433 -363 28 Net profit 6,053 5,184 29 30 31 Income Statement Balance Sheet +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts